- Home

- Publications et statistiques

- Publications

- What conclusions can be drawn from the i...

What conclusions can be drawn from the implementation of the two-tier system?

Post n°208. The two-tier system, which has been in place for over a year in the euro area, exempts part of banks' excess reserve holdings with the central bank from negative remuneration. This system aims to support the bank-based transmission of monetary policy. It has not unduly influenced money market rates.

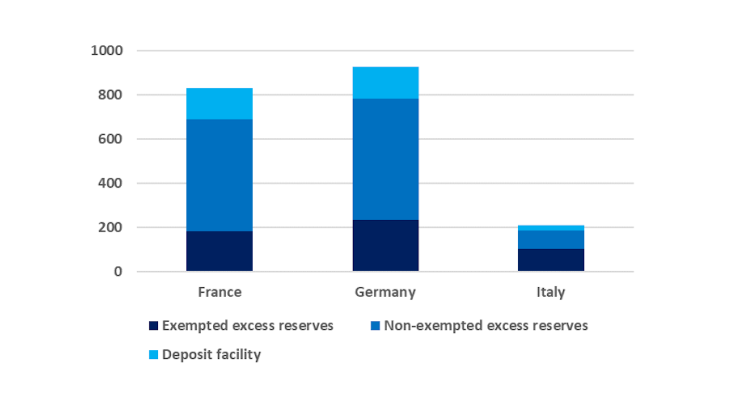

Source: Banque de France, European Central Bank

Note: Out of EUR 874 billion of excess liquidity in France, EUR 181 billion is exempt from negative remuneration (average for the 4 November 2020 - 1 December 2020 period).

On 30 October 2019, the ECB introduced the two-tier system for remunerating excess reserve holdings. By exempting from negative rates part of commercial banks’ excess reserves, the two-tier system aims to support the bank-based transmission of monetary policy. Similar systems had already been implemented by other central banks using negative interest rates (Japan, Switzerland, Nordic countries).

The two-tier system aims to mitigate the potentially adverse effects of negative rates on the transmission of monetary policy

Banks in the euro area are required to deposit excess liquidity in their accounts with the central bank. The minimum reserve requirements, calculated by institution, are based on bank customers’ short-term deposits. Reserves are remunerated at an interest rate which is one of the key rates of the central bank, and which influences the rates at which banks lend and borrow liquidity between each other on the money market. In normal times, this system enables the central bank to control banks' demand for liquidity and to smooth changes in money market rates. However, in the current situation and in the context of the asset purchase policy, the banking system mechanically has an overall amount of reserves in excess of the minimum reserve requirement. Unlike minimum reserves, which are remunerated at 0%, this excess liquidity is remunerated at the deposit facility rate, which is currently negative (-0.5% since September 2019), thus entailing a cost for the banks.

Banks as a whole cannot reduce this cost by lending their excess liquidity, as its overall amount is determined by the actions of central bank: the behaviour of individual banks can only influence the distribution of excess liquidity. Since negative rates do not affect all banks' funds (notably retail customer deposits), this cost could affect the profitability of the banking system, and therefore ultimately the cost or volume of credit. This two-tier system therefore aims to support the bank-based transmission of monetary policy.

It exempts part of banks' excess reserve holdings with the central bank from negative remuneration. This exempted tier is defined as a multiple of the minimum reserve requirement and has been set at six. It is remunerated at the same rate as the banks' minimum reserves, currently 0%. The two-tier system is therefore based on two parameters: a multiplier that determines the maximum exemption level from negative rates, currently set at six, and a rate of remuneration, set at 0%. The Board of Governors stated that these two parameters could change depending on the macroeconomic situation.

In practice, two questions arise: to what extent is this system used by commercial banks? And what are the effects of this measure on the money market, in particular on interest rates? We can reply to these questions using data published by the European Central Bank and the Banque de France.

The two-tier system is fully used by commercial banks

At present, approximately EUR 855 billion of commercial banks’ excess liquidity is exempted from negative remuneration in the euro area (average for the 4 November 2020 -1 December 2020 period). EUR 2.497 trillion remains subject to a negative rate of -0.5%. Excess liquidity holdings exempt from negative rates are concentrated in the largest euro area countries: Germany (EUR 236 billion), France (181) and Italy (104) (Chart 1).

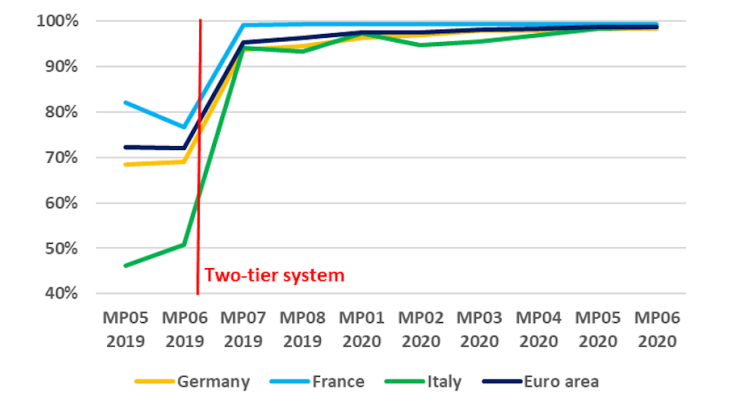

Banks adjusted their deposits with the central bank as soon as this system was implemented. Those with unused exemptions borrowed, at negative rates, from other financial players with excess liquidity holdings, either on the unsecured interbank market or on the repo market. Transfers between banks within the same group also took place. In the period prior to the implementation of the two-tier system (from 18 September 2019 to 29 October 2019), only 72% of the liquidity eligible for exemption under this system would have been exempted, whereas in the first period of application (from 30 October 2019 to 17 December 2019), 95% of the liquidity eligible for exemption was actually exempted (Chart 2). This redistribution of liquidity took place in all countries, particularly in those countries whose banks had the greatest liquidity needs, which puts into perspective the fact that a certain degree of money market fragmentation between euro area jurisdictions was observed. Currently, around 99% of liquidity eligible for exemption is actually exempted. The two-tier system, which is used to its full potential by commercial banks, therefore makes it possible to mitigate the potentially adverse effects of negative interest rates on banking intermediation and to enhance the transmission of monetary policy.

Source: BdF, ECB

Note: The periods considered are the reserve maintenance periods. The calendar for these periods is available on the ECB website.

The two-tier system has had a limited impact on money market rates

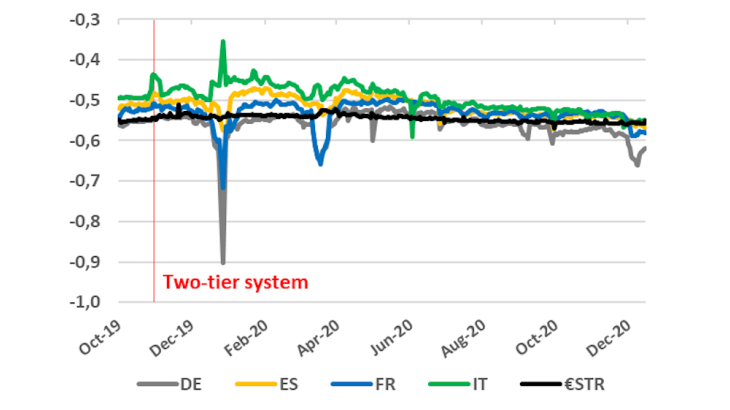

The two-tier system has not led to a sustained rise in money market rates. If the multiplier had been incorrectly set, it could have exerted upward pressure on these rates, which would have run counter to the accommodative monetary policy stance. Indeed, as excess reserves exempt from negative interest rates were no longer traded on the money market, the system could have resulted in a relative scarcity of liquidity, and hence in a rise in interest rates. However, it was set at a level making enough liquidity non-exempt from negative rates to leave the average interest rates on transactions unchanged, both in the unsecured market (unsecured loans) and in the secured market (cash loans against a security as collateral or repos, Chart 3). Only a slight increase in the Italian repo rate was observed during the first few weeks following the implementation of the system, but it has since been absorbed. Rates have therefore stayed low, in line with the monetary policy stance in the euro area.

Source: BdF, ECB

Note: Overnight rate, weighted by the volume of transactions. The rates on secured transactions are broken down according to the origin of the government bond used as collateral for the loan. Latest date 15 December 2020

The system has led to a redistribution of bank liquidity between euro area countries. The distribution of excess liquidity is structurally uneven across countries. Following implementation of the two-tier system, some banks borrowed from other financial entities in order to benefit as much as possible from the exemption. Flows between countries have thus been observed, with a decrease in the share of excess liquidity in countries with a high concentration of liquidity, and an increase in others. Overall, the two-tier system has led to a more equal distribution of liquidity within the euro area, while supporting the transmission of monetary policy.

Updated on the 25th of July 2024