1 Household debt has followed a different path in each major euro area country since 2014

A macroeconomic context conducive to heterogeneous developments in wealth and debt across countries

Between 2014 and 2017, the gradual recovery in economic activity following the sovereign debt crisis in the euro area gradually spread to all countries in the bloc. Over this period, falling interest rates tended to push up house prices (see Chart 1).

Moreover, real estate is by far the largest component of household wealth. In 2017, the share of real assets – mostly property – in household wealth stood at around 81% in the euro area, 80% in France, 79% in Germany and 87% in Italy. House price dynamics therefore inevitably and largely determine the household wealth dynamics (Arrondel and Coffinet, 2019).

Over the period 2003‑2017, property prices in the euro area, France, Germany and Italy showed contrasting trends. They rose from 2003 to 2008 in France and Italy, but not in Germany. Since 2008, they have steadily increased in Germany. In France, they have displayed more uneven developments, with a decrease in 2009, an increase between 2009 and 2011, then a slow decline, and finally an upswing from 2015 onwards. In Italy, they also declined in 2009, but then stabilized up to 2011, before falling at the end of the period (see Chart 1).

At the end of the period (2016‑17), household financing costs in the euro area reached their lowest level. Since the 2008 crisis, average mortgage interest rates in the three main euro area economies have fallen sharply, from just over 5% in 2008 to less than 2% in 2017 (see Chart 2). Since 2012, mortgage rates in Italy have been higher than in the other two countries.

Household mortgage debt dynamics differ across countries

In this context, the aggregate debt of Italian households appears relatively stable over the 2010‑17 period. Conversely, German household debt has increased, in line with the house price dynamics. The rise in French household debt, which was even more sustained, therefore appears unusual, insofar as it is only weakly correlated with house price trends over the same 2010‑17 period (see Chart 3).

2 The debt of households residing in France displays specific dynamics

Stability of debt and primary residence ownership…

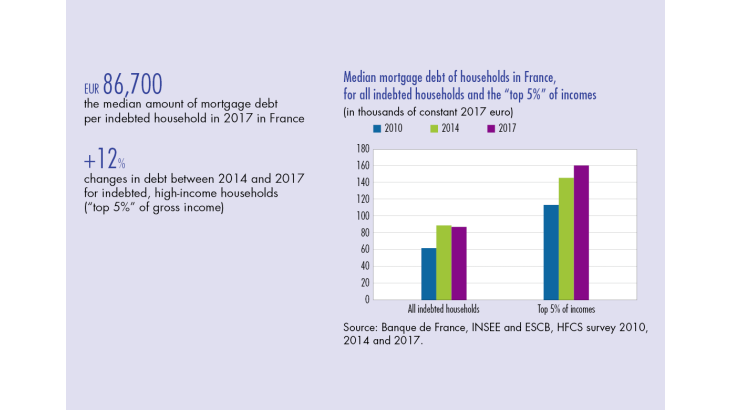

Since 2014, the percentage of indebted households (all types of debt) in Germany and France has remained stable at around 45% and 46% respectively…

[to read more, download the article]