The rapid development of crypto-assets raises questions about their potential interactions with the economy. Stablecoins, a specific category of crypto-assets, are designed to minimize their fluctuations against a fiat currency, usually the US dollar. Since 2020, their market capitalization has soared by around $150 bn. The largest stablecoins available today hold reserve assets – short-term debt denominated in US dollars -- to maintain their peg. In this paper, we investigate how this pegging mechanism creates interconnections between the crypto-asset sphere and conventional financial markets. We study how changes in stablecoins’ issuers policies, regarding which assets are used as reserves, affect the markets for these assets. Specifically, we investigate whether the US commercial paper market was affected by the issuance of stablecoins when these securities were used as backing by stablecoins.

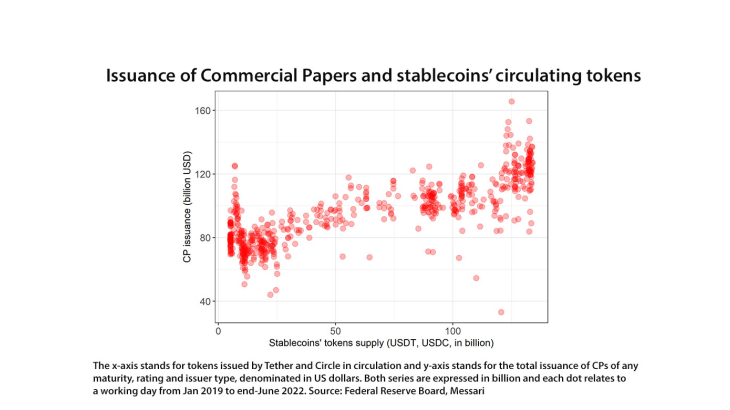

We first track the issuance of stablecoins on publicly available blockchain data and construct a dataset of daily change in the amount of stablecoin tokens in circulation, ie. tokens that need to be backed by reserve assets. We study the empirical link between stablecoin circulating tokens and the issuance of USD-denominated commercial paper (CP) by non-financial or financial corporates (Certificates of Deposits in the latter’s case). Through several empirical strategies, we show that stablecoins have caused more issuance of CP while there were used as reserve assets for stablecoins, both statistically and economically significant, confirming the correlation in the figure below. These results suggest that the issuers of CP, notably US companies and US financial institutions, react to the increasing demand for stablecoins by issuing more CP, with no impact on CP rates. Thus, the development of crypto-assets indirectly affects the financing of the real economy.

We confirm the causal interpretation of our results by exploiting the fact that reserve asset policies vary across stablecoins and over time. First, we find the relationship disappears when stablecoins stopped using CP as a reserve asset. Second, stablecoins not backed by US commercial paper did not affect the US market for CP. These results confirm that the relationship between stablecoins and CP market is effectively due to the purchase of CP by stablecoin issuers.

More generally, our paper highlights how markets react to the emergence of a new instrument with intended money-like properties and the subsequent increase in demand for reserve assets. Our results thus contribute to the ongoing debate on digital currencies and finance: the issuance of central bank digital currency (CBDC) as well as stablecoin regulation are likely to affect the demand for different categories of assets and hence the financing of the real economy even in normal times. The connection we document between the CP market and stablecoins might shift to other market segments, depending on stablecoin and CBDC developments.