1. SDRs were created to supplement the official reserves of IMF Member States

IMF general allocations: lending money without conditionality

Since the amendment to its Articles of Agreement in 1969, the International Monetary Fund (IMF) has issued an international foreign exchange reserve asset, known as the Special Drawing Right (SDR), to meet liquidity needs and supplement the official reserves of Member States facing balance of payments crises. The SDR is not a currency, but an asset that holders can exchange for foreign currency if necessary. The allocation of SDRs creates a debt of Member States vis à vis the IMF.

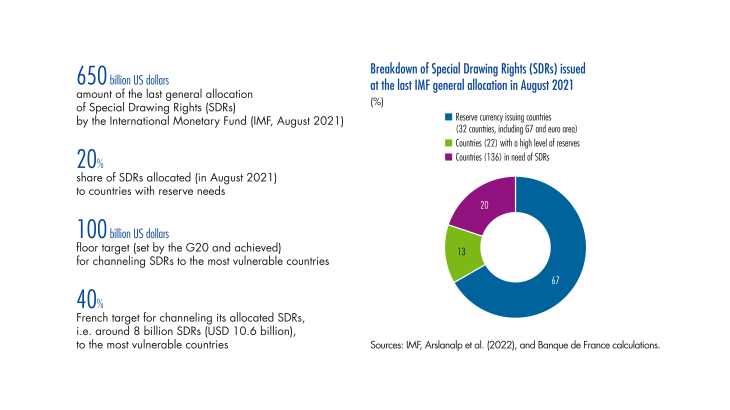

The IMF can therefore decide to allocate new SDRs to Member States. Of the four general allocations made since its creation, the latest (August 2021) is the largest ever: 456 billion SDRs, which corresponds to USD 650 billion. Previous allocations amounted to 9.3 billion SDRs in 1969, 12.1 in 1979 and 161.2 in 2009. General SDR allocations have several advantages for Member States:

• Allocations are not subject to any ex ante or ex post conditionality for Member States. This is a major difference from IMF financial assistance facilities, which are subject to strong conditionality (implementation of economic and financial structural adjustment programmes) or at least ex ante qualification criteria (linked to external debt sustainability and ability to repay the IMF);

• Allocated SDRs do not generate any costs for Member States if they are not converted, and costs remain moderate if they are used (see Box 1 below);

• Finally, the use of allocated SDRs is at the discretion of Member States:

‒ A State may keep the SDRs received as an additional reserve, which makes it possible to improve market access (for example by reducing borrowing costs) and ease external financing constraints. Thus, in practice, the central bank may commonly keep the SDRs by extending a loan to the Member State in local currency in return;

‒ A Member State may also use the SDRs allocated to it to repay any debts it owes to the IMF;

‒ A Member State may also exchange SDRs for freely usable currencies (US dollar, euro, pound sterling, yen, yuan) in order to adjust the composition of its international reserves, repay external debts other than those linked to the IMF, or finance additional budget expenditure.

For example, in an ex post assessment report of the 2021 allocation, published at the end of August 2023, the IMF uses data from the SDR Tracker, which tracks 142 of the 190 Member States, to determine how the allocated SDRs were used.

[To read more, please download the article]