- Home

- Publications et statistiques

- Publications

- The share of inheritance in aggregate we...

Post n°96. The share of inheritance in aggregate wealth has varied significantly over time. Indeed, it depends on economic and demographic conditions that are not constant. The share was very high during the 19th century and until the First World War. After an abrupt decline, it is now rising in several countries.

Assessing the relative importance of inheritance in aggregate wealth is complex

This complexity lies at the heart of one of the most famous disagreements between economists, which saw Franco Modigliani estimate the share of inherited wealth in the United States at 20-30% while Laurence J. Kotlikoff and Lawrence H. Summers argued that it was 80%. The difference is particularly confusing given that all three economists were using the same data. This point is crucial and warrants consideration to try to transcend this divide.

This blog is based on Alvaredo, Garbinti and Piketty (2017) and presents a historical perspective for the evolutions in the share of inherited wealth in the United States, France and several other European countries. The terms “inherited wealth” and “inheritance” used in this blog refer to both wealth bequeathed at death and also inter vivos transfers. The data and methods presented are quite far removed from the “ideal world with perfect data” that one might hope for.

In order to calculate the share of inheritance in aggregate wealth, the value of the inherited wealth must be reassessed to take account of changes in value between the moment it was received and the moment it was measured. Modigliani only uses the consumer price index to account for inflation. This choice is problematic as inherited capital generates income, such as returns on investments or rent, for example, which accumulates and adds to the amount initially received. Kotlikoff and Summers on the other hand, recognise the returns on inherited capital but do not consider the fact that part of the inheritance may be consumed. Where this is the case, it is erroneous to attribute returns to the part that has been consumed and that therefore no longer exists.

The estimates produced in this blog necessitate the use of assumptions and are, by nature, fragile. They are mainly based on a formula developed by Piketty, Postel-Vinay and Rosenthal (2014), which is preferable to those applied by Modigliani and Kotlikoff-Summers as it splits the population between those who save and those who consume their inherited wealth, and is thus more satisfactory. Furthermore, this formula has the advantage of not depending on ad hoc assumptions for the remeasurement of inherited assets, which would act as a determinant on the evolution of the inheritance share over time.

After the First World War, the share of inherited wealth became higher in the United States than in Europe

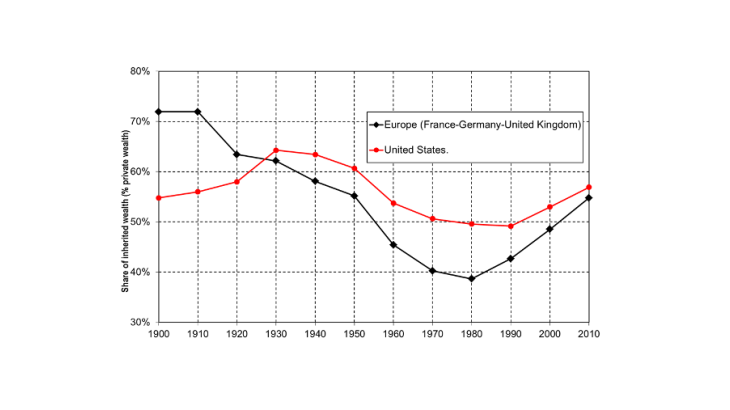

At the beginning of the 20th century, the inheritance share in European countries (France, Germany and the United Kingdom) accounted for over 70% of aggregate net wealth (see Chart 1). It was lower in the United States, with a level of less than 60%. This probably reflects a “New World” effect, which could be due to the fact that in general migrants arrived with a limited amount of inherited wealth and had to build up savings on their own. However, while the inheritance share collapsed in Europe at the beginning of the First World War, it increased in the United States. The shocks caused by the Great Depression in the 1930s and the Second World War certainly led to a downturn but its effects were much less pronounced than in European countries.

In Europe, the share of inherited wealth dropped to its lowest level in the 1970s and 1980s, at a little less than 40%, while it stood at around 50% in the United States. During the entire post-war period, the share of inherited wealth remained higher in the United States than in European countries. Moreover, other estimates find that this share has been rising more rapidly over the recent period in the United States.

A “U-shaped” pattern in France and Germany

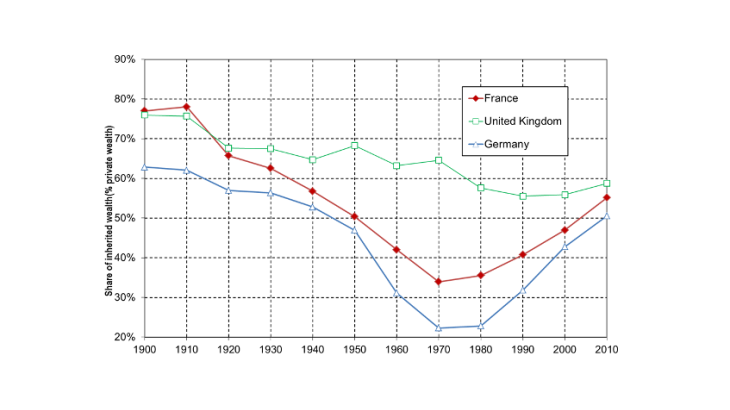

Over the course of the 20th century, the trends in inheritance shares in France and Germany have been very similar, although the share appears to be higher in France. In Germany, it reached a particularly low level in the 1970s and 1980s (see Chart 2) due to (i) extremely low inheritance and intra vivos gift flows in the immediate post-war period and (ii) high savings rates that encouraged wealth accumulation. These two dynamics (wealth transmission and savings behaviour) have a significant impact on the relative importance of inherited wealth in national wealth. The increase in the inheritance share that followed the 1970-80 low was more pronounced in Germany than in France to the extent that the levels observed for the two countries in the 2010s were similar.

However, not all countries in Europe have followed the same evolution. In the United Kingdom, the inheritance share never falls below the levels in France and Germany (where it appears to be systematically lower). Here again, savings behaviours play an important role: over the recent period, the substantial inheritance share in the United Kingdom can certainly be explained by low savings rates.

Recent studies (Ohlsson, Roine and Waldenström, 2018) suggest that Sweden could have a similar profile to France. The main difference is that the recent increase observed in France is clearly less pronounced in Sweden, probably as a result of an increase in Swedish savings rates.

The importance of a historical perspective

The historical perspective presented in this blog underlines the extent to which an analysis of inheritance share that focuses on one single year is inadequate given the substantial variations over time. A possible explanation for these substantial variations could be that the economies are rarely in their “steady state” and that the inheritance share never attains its long-run value. Another explanation could be that different possible steady-state values exist. Indeed, the inheritance share depends on numerous economic and demographic parameters (mortality rates, motives for saving and transmission, etc.), which can vary. Economic growth also plays an important role as lower growth rates lead to higher inheritance shares. This effect can also be reinforced by the fact that the importance of the wealth of decedents relative to the wealth of the living depends on economic growth and demographic parameters such as life expectancy.

This historical perspective highlights the rise in the share of inherited wealth during recent decades. However, even if the methods and data used here are more satisfactory than those employed previously, they are still imperfect and many limitations remain. This implies a degree of uncertainty with regard to both the levels and the trends observed. Improving data quality and access is vital to obtaining a deeper understanding of the link between inherited wealth and inequalities.

Updated on the 25th of July 2024