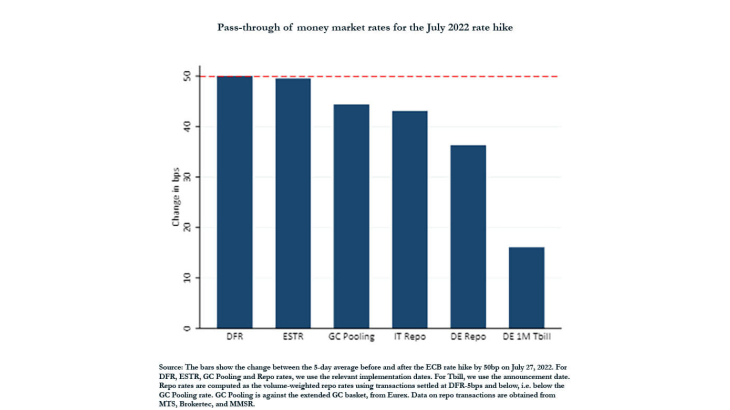

On July 27, 2022 the Eurosystem increased its policy rates by 50bp to 0%, the first hike since 2011. The pass-through of this rate hike to money markets, however, was imperfect. While unsecured market (ESTR) rates increased one-for-one with the change in policy rates, the response of the repo market---in which transactions are generally collateralized by sovereign bonds---was sluggish. For example, repo rates increased only by 35 bps for transactions secured by German collateral.

In this paper, we show that the source of this imperfect pass-through to money market rates is the safe asset scarcity that was partly the result of the Eurosystem's Quantitative Easing. We measure safe asset scarcity using a bond’s ``specialness premium'', the spread between a bond’s repo rate and the risk-free rate, capturing the price market participants are willing to pay to borrow that specific bond. Using transaction-by-transaction data for the four largest Euro area countries, we show that repo transactions backed by the scarcest bonds traded at the highest specialness premia and experienced the lowest pass-through around the ECB interest rate hikes of 2022.

We trace the source of a bond's specialness to the Eurosystem’s asset purchase programs: the fraction of a bond's amount outstanding held by the central bank precisely and persistently predicts that bond's specialness and the extent to which a change in policy rate is passed-through to its repo rate. Sluggish response of repo rates is not only important for money markets, the first step of monetary policy transmission. We show that specialness premia affect bond prices and investors’ funding costs. First, we find that a lack of pass-through on the repo market, which corresponds to an increased specialness premium, is reflected in bond prices: As specialness premium constitutes an additional ``dividend'' for investors holding scarce bonds, the prices of bonds that are scarce decrease less around rate hikes. Second, we consider banks’ portfolio holdings and show that banks funding costs display a significant heterogeneity in their increase surrounding rate hikes. We show further that funding costs increased heterogeneously across countries and investors types, based on the composition of their bond portfolio.

Rates hikes offer an experiment to understand how repo rates, specialness, and risk-free rates interact and what frictions cause repo rates to diverge from risk-free rates. We show the heterogeneity in pass-through is linked to the composition of bonds' holders and their participation to the repo market: bonds with the weakest pass-through are held by investors whose supply elasticity to changes in repo rates is lower. One case in point is the Eurosystem itself, as the amount of bonds it lends back to the market through its securities lending is capped and highly inelastic. On the opposite side of the spectrum, rates of repo transaction secured by bonds held by banks react more promptly to change in risk-free rate, as banks borrow more against the bonds they hold, receive the specialness premium, and place the proceed at higher risk-free rates.

Our paper is the first to document the tension between interest rate policy and the size of central banks' balance sheets. The decision of engaging in conventional monetary policy tightening separately from---before---Quantitative Tightening leads to a higher dispersion of repo rates and yields. Our analysis has clear policy implications: while hiking interest rates, a central bank can increase the market's access to its safe assets holdings to better transmit monetary policy. In other words, our analyses support synchronizing interest rate hikes with the reduction of a central bank's footprint as a bond holder. Securities lending facilities are an ideal complement through the tightening process.