The resurgence of inflation in the euro area, spurred by the post-COVID crisis recovery and tensions in oil and natural gas markets following the war in Ukraine, has coincided with a significant increase in inflation differentials between member countries, reaching unprecedented levels and all-time highs.

Inflation divergence has drawn attention of policymakers since it can challenge the effectiveness of monetary policy. Adjusting nominal interest rates based on a single inflation target might result in an excessively accommodative monetary policy for nations experiencing notably higher inflation than the euro area average. Conversely, countries with inflation considerably below the average may encounter unwarranted tightening policy pressures.

Accurately assessing the risk of inflation dispersion is thus of deep relevance for policymakers. A key consideration is to determine whether inflation differentials are temporary or have the potential to persist over an extended period. Simultaneously, gaining insights into the drivers of inflation disparities provides valuable perspectives for predicting their future evolution and evaluating the risks associated with sustained divergences. Moreover, in the context of a monetary union, where countries share the same nominal interest rate, a high dispersion of inflation rates translates into a high dispersion of real interest rates between member countries. In this context, the risk of inflation dispersion may also be informative of the risk of financial fragmentation in the euro area, which may impair the transmission of monetary policy. However, the lack of reliable and available tools for analyzing these risks makes investigation on this important issue very limited. Indeed, current available measures of inflation dispersion typically rely on realized inflation, and thus, by construction, do not contain any forward-looking information about expected inflation dispersion at medium and long-term horizons.

In order to properly build a measure of expected inflation dispersion among euro area countries, one needs to take a probabilistic forecasting approach by considering not only cross-country differences in point forecasts of inflation, but also cross-country differences in density forecasts since they bring additional information, namely differentials in uncertainty and tail risks. This is what we intend to do in this paper. More specifically, our dispersion measure reflects the dissimilarity, i.e., the distance, between the full predictive inflation distributions of euro area member countries. Therefore, it captures how "far'' apart inflation levels are expected to be between euro area members for a given horizon.

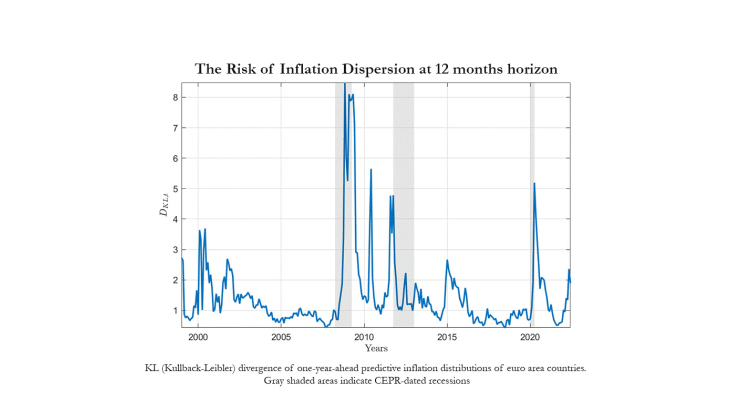

We provide evidence that the risk of inflation differentials shows a strong countercyclical pattern, which has tendency to rapidly increase during economic downturns (see Figure). Our counterfactual analyses show that the rising risk of dispersion appears to be mainly associated with a deterioration in financial conditions. By contrast, a robust anchoring of inflation expectations tends to mitigate this risk. Finally, we demonstrate that our measure has predictive power for future euro area inflation realizations as well as for variations in the monetary authority's interest rate.

Keywords: Inflation Dispersion, Kullback-Leibler, Euro area, Quantile Regression, Phillips Curve

JEL classification: D80, E31, E58, F45, G12