1. Companies: economic agents sensitive to rising interest rates

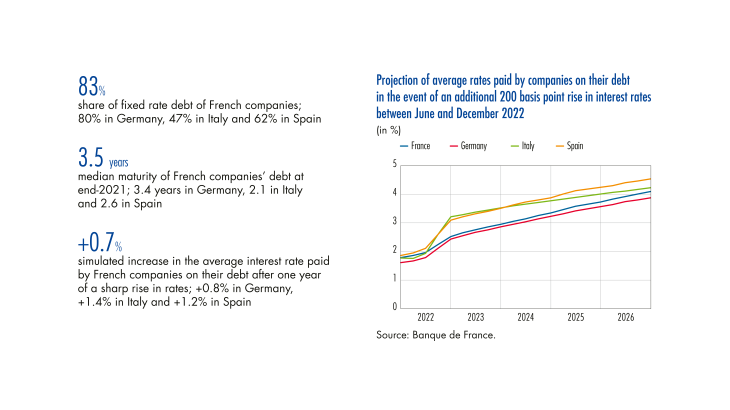

A rise in interest rates such as the one that began in 2022 weighs on the accounts of economic agents with structural financing needs, in particular the State and companies. Precisely measuring the weight of this rise, which could affect the stability of the financial system, depends not only on the total volume of debt contracted, but also on its structure (maturity, breakdown between fixed and variable rates) and its speed of renewal.

This article uses detailed contract-by-contract data gathered by the Eurosystem to reconstruct the aggregate debt structure of non-financial corporations (NFCs, hereafter referred to as “companies”) resident in the four largest European economies as at 31 December 2021. Thanks to these data, it is possible to project the increase in the cost of this debt over several years according to the evolution of interest rates.

The exploitation of these data shows that the rise in market interest rates between January and June 2022 will affect Italian and Spanish companies more rapidly than French and German companies. If this rise were to increase by +2% between June and December 2022, the average interest rates on corporate debt in these four countries would continue to rise gradually by 2026. They would reach +2.3% in France and Germany, and even +2.5% in Italy and +2.7% in Spain, compared to January 2022. These differences in behaviour stem from differences between long-term and mainly fixed rate debt structures (French and German companies), the cost of which reacts slowly to changes in rates, and more variable rate debt structures (Italian and Spanish companies), which have a more rapid impact on cost. More specifically, the survey covers the following types of outstanding debt:

• bank loans extended to companies by euro area banks, as reported by banks in the AnaCredit database, as long as their exposure to the debtor exceeds EUR 25,000;

• debt securities issued by these companies, as documented in the Centralised Securities Database (CSDB) if they are issued or held in the euro area.

With this information, it is possible to project the evolution of these interest-bearing liabilities under simple assumptions of debt renewal, and then to calculate the corresponding average rate according to scenarios of future evolution of borrowing rates.

[to read more, please download the article]