The vast majority of SMEs have kept their net bank debt under control

This post uses unpublished granular data collected from banks to assess the financial position of French SMEs at the end of March 2022. We use data on item-by-item loans granted by French banks to businesses. These data are taken from the AnaCredit database and an ad hoc database set up in 2020 by the Banque de France with several large French banks that volunteered to participate (representing around 57% of total outstanding business deposits). This database records, item by item, the deposits held by these banks' business customers. By cross-referencing these data (including for multi-banked companies), we can monitor quarterly changes in the bank debt and deposits of around 800,000 SMEs (including VSEs, i.e. companies that employ fewer than 250 people and have an annual turnover of less than EUR 50 million or total assets of less than EUR 43 million).

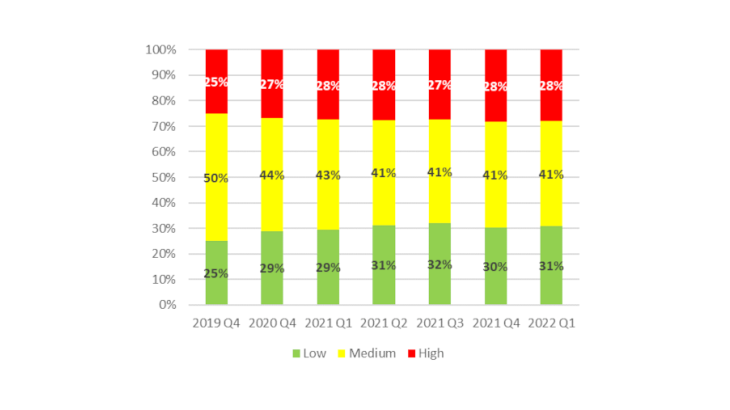

What do these individual data show us? Chart 1 shows changes in the distribution of SMEs by net bank debt, defined as the difference between their outstanding loans and bank deposits. SMEs are classified into three groups: in green, enterprises with "low" net bank debt, in yellow, enterprises with "medium" debt, and in red, enterprises with "high" debt. We assess whether debt is "high" or "low" based on pre-Covid benchmarks: net debt is considered "high" if it is above the 3rd quartile of the distribution at the end of 2019; it is considered "low" if it is below the 1st quartile of the distribution at the end of 2019; it is considered "medium" if it is between the 1st and 3rd quartile of the distribution at the end of 2019.

The health crisis was accompanied by a slight distortion in the distribution of SMEs' net bank debt, with both more firms with relatively low net bank debt and more firms with particularly high net debt. We observe that: (i) from a pre-Covid situation at the end of 2019, where by definition 25% of companies had "low" net bank debt, this percentage rose to 29% at the end of 2020, and 31% in March 2022; and, at the same time, (ii) the percentage of companies with "high" net debt rose from 25% at the end of 2019 to 27% at the end of 2020, and 28% in March 2022. However, the share of SMEs with very high net bank debt (95th percentile) increased very little, from 5% to 6% between December 2019 and March 2022. Overall, the distortion of the distribution of SMEs' net debt is relatively small, and it is more pronounced at lower levels of debt, which suggests that SMEs' net bank debt is under control.

The financial position of SMEs is robust in most sectors of activity

Across all sectors, less than half of SMEs (44%) increased their net bank debt between December 2019 and March 2022. Moreover, positions were fairly similar across sectors of activity: the share of SMEs that increased their bank debt fluctuated between 40% and 50%, with the main exception of the energy sector where only 25% of SMEs increased their net bank debt. For example, in the accommodation and food services sector, which was badly hit by the health crisis, firms' net debt increased only slightly more than the average. 55% of SMEs in this sector even reduced their net bank debt with the crisis. Public support measures for businesses (short-time working scheme, solidarity fund, etc.) no doubt help to explain this situation (see the final report of the Committee on the Monitoring and Evaluation of financial support measures for companies confronted with the Covid-19 pandemic, chaired by Benoît Cœuré, 2021. This also suggests that, for many companies, the use of state-guaranteed loans (SGLs) resulted in an increase in cash flow or a decrease in other loans.

Ultimately, French SMEs have upheld their repayment capacity

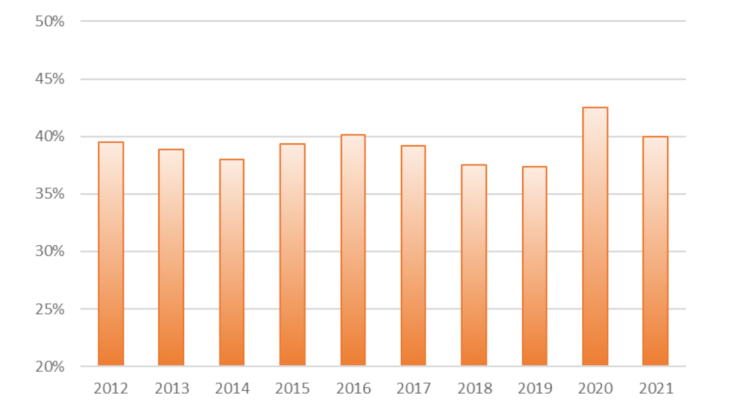

The debt and cash flow of companies are key factors for assessing their financial position, but they cannot in themselves provide a complete picture of a company's strengths and weaknesses. The Banque de France rating, which assesses a company's ability to meet its financial commitments over a three-year horizon, combines all aspects of financial analysis, supplementing the quantitative analysis with qualitative data collected during meetings with business leaders. The Banque de France rating is therefore a more comprehensive indicator than just net bank debt for determining whether the health crisis has impacted firms' repayment capacity.

Chart 2 shows changes in the share of the lowest-rated SMEs, i.e. between 5+ (fairly low capacity to meet commitments) and 9 (capacity seriously at risk), in the total number of legal entities that comprise the SMEs rated by the Banque de France. Despite a slight uptick to 42% at the end of 2020, this share returned to 40% at the end of 2021, i.e. close to the 2012-2019 average (39% with a standard deviation of 1.0 percentage point). Although the situation of the most fragile firms will require particular vigilance in the years to come, it is reasonable to conclude that the health crisis has not disrupted the repayment capacity of SMEs.