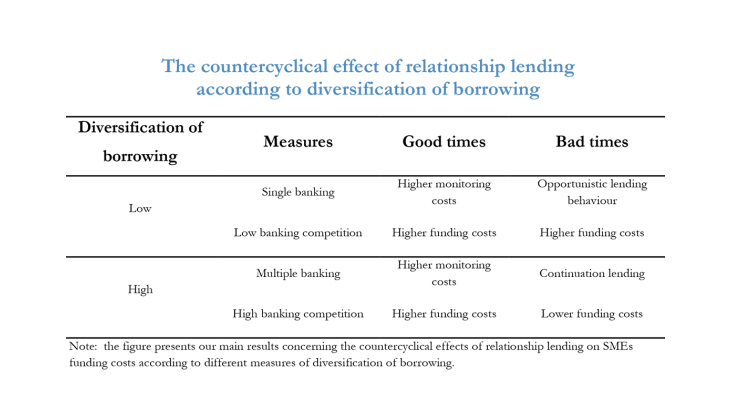

Among the ways that enable firms to overcome credit restrictions, relationship lending turns out to be one of the most salient. Through proprietary information and multiple interactions, closer and longer-lasting relationships not only mitigate small and medium-sized enterprises’ (SMEs) credit risk but also ensure the continuation of lending during crises. Yet, the effect of relationship lending on interest rates has always been unclear due to competition issues between external sources of finance. Indeed, the soft information acquired by relationship lenders during good times may give them an informational advantage that increases in relative terms during a financial crisis, when firms have no alternative funding options. Do relationship lending benefits depend on firms' ability to diversify their borrowing? Does multiple banking or local bank competition shield firms from opportunistic relationship lenders? If so, how do bank and firm heterogeneities influence interest rate setting?

To address these questions, we draw on measures of single banking and credit concentration and show that the beneficial effect of relationship lending on SME's funding costs depends on their ability to diversify their borrowing. Given that single-bank firms account for a substantial share of the firm population (for example, about 60 % of firms in the French Credit Register), focusing on their access to credit during the crisis is essential to our understanding of the economic recovery following the Great Recession.

In order to identify the effects of relationship lending on interest rates, we draw on five different databases encompassing 11,278 French SMEs over the period Q1 2006-Q4 2015. We first capture the protean nature of relationship lending both in terms of its length and its scope (i.e. the importance of the lending bank within the firm's outstanding amount of credit) and focus on the geographical distance between a lender and its borrower in our robustness analysis. All of these measures serve as proxies for the ability of lenders to accumulate information on borrowers.

As regards diversification of borrowing, we use two different measures. First, the single versus multiple banking indicator measures firms' ability to diversify their borrowing within their existing pool of lenders. Second, a Herfindahl Hirschman Index (HHI) on banks' deposits at the level of each French département captures firms' ability to diversify their lending within their local credit market.

To our knowledge, our paper is the first to provide evidence that the countercyclical effect of relationship lending depends on the SME's ability to diversify its borrowing within its pool of lenders. We find that the benefits of relationship lending vanish for SMEs with limited funding options. While relationship lenders "hold up" risky single-bank firms regardless of their position in the cycle, measures of diversification are associated with higher relationship lending benefits during crises. Interestingly, long-term credit and small, well-capitalized and non-trading-oriented banks drive the benefits of relationship lending. Finally, we find that large, trading-oriented and well- banks drive the opportunistic behaviour highlighted previously.