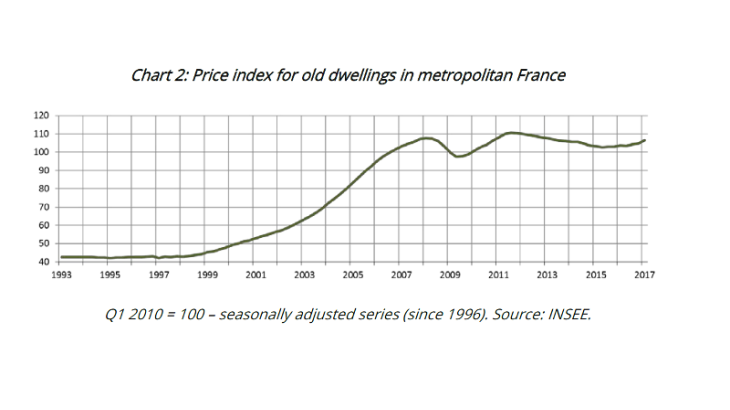

Has this trend had an impact on corporate activity and competitiveness? This post draws from a recent study by Fougère, Lecat, and Ray (2017), which analyses the relationship between local real estate prices and French corporate investment behaviour since the mid-1990s.

Positive collateral channel, negative profit channel

Several articles document a causal relationship between the market values of real estate assets held by firms and their level of corporate investment (Gan, 2007 or Chaney et al., 2012). In a context of credit markets characterised by the fact that the creditor is unable to perfectly control the behaviour of the entrepreneur, an increase in the market value of the asset that can be pledged as collateral with a creditor, and therefore seized in the event of default, facilitates lending, and consequently investment. As real estate assets are mainly used as collateral with financial institutions (Beck et al., 2008), this collateral channel is responsible for a mechanism that positively links real estate prices to investment of non-financial corporations.

The second channel, which has the opposite effect, is that firms' real estate holdings are a factor of production whose cost impacts corporate profit levels. If the debt capacity of firms is also determined by this profit, an increase in real estate prices has an ambiguous effect on investment capacity.

The relative strength of the collateral channel and the profit channel depends on the volume of the firm's ex ante real estate holdings. Faced with an increase in real estate prices, firms with significant real estate holdings benefit from the collateral effect without suffering the negative impact to their profit levels that would result from rising costs; conversely, firms with fewer holdings are confronted with a sharper decline in their profit levels without benefiting from a significant collateral effect.

The price effect depends on the volume of real estate holdings

On the basis of firm-level data, we can study the effect of real estate prices on investment behaviour using a double difference estimate. These estimations highlight the differentiated effect of local real estate price levels on investment according to the volume of real estate holdings, normalised by total net assets.

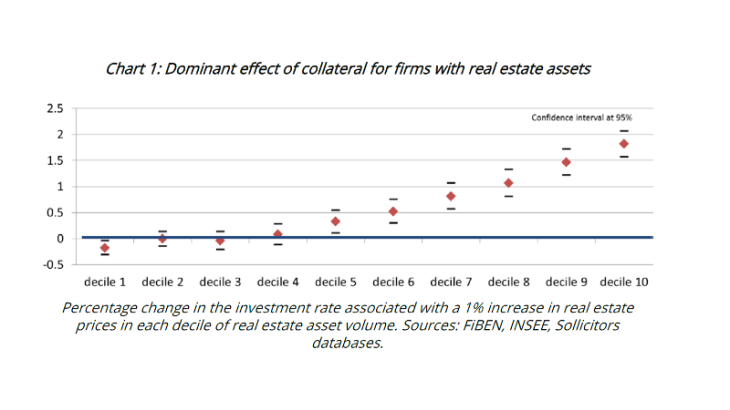

The distinct real estate price effect according to the firm's position in the sectoral distribution of volumes of real estate holdings can be very clearly seen in the results of our estimation. Chart 1 summarises the estimation results by showing the elasticity of the median firm's investment rate to the real estate prices for each decile of the distribution. A firm in the first decile of this distribution reduces its investment rate by 0.5 percentage points when prices rise by 10%, while a firm in the last decile increases its investment rate by 3.2 percentage points following an identical price rise.

Based on these elasticities and median investment rates in these two deciles, a 10% annual increase in real estate prices over a ten-year period, i.e. a scenario close to that observed in France in the 2000s, leads to an increase of almost 34% in the total volume of productive capital at the end of the period compared with a stable price scenario for a firm in the last decile. However, the volume of productive capital drops 4% compared with the stable price scenario for a firm in the first decile.

Price rises benefit more established firms

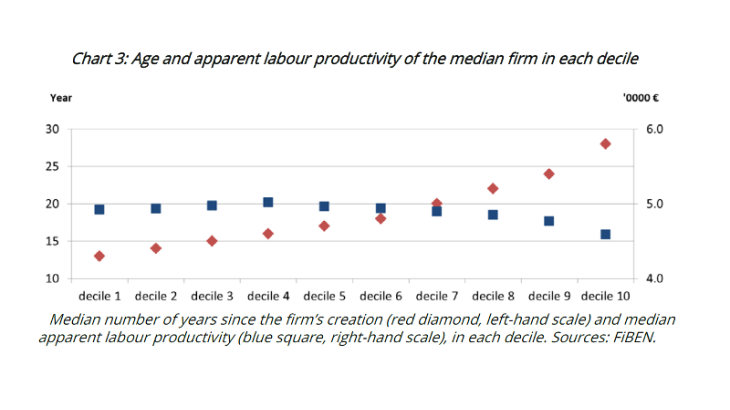

The link between real estate prices and the allocation of capital between firms can be analysed in the light of the heterogeneous effects documented in this study. The firms that benefit from an increase in real estate prices are those that have significant ex ante real estate holdings. However, the median firm belonging to the last deciles is older and less productive than the median firm in the first deciles (see Chart 3). This suggests a negative relationship between real estate price dynamics and productivity dynamics.