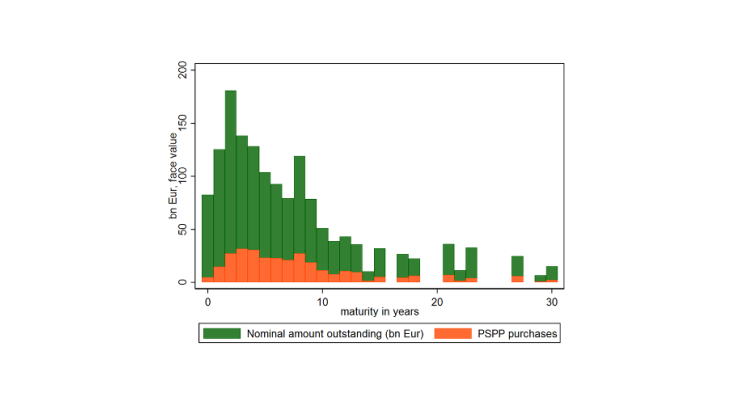

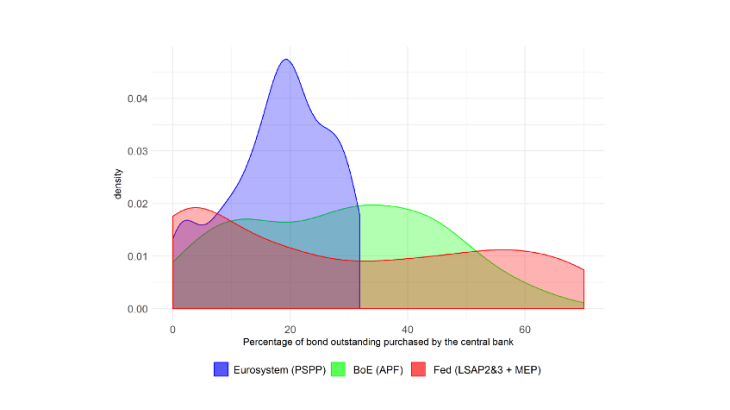

Note: The distributions provide the breakdown of the share of eligible securities held by the central bank. For the Eurosystem, this distribution is concentrated around 20% and delimited to the right by the 33% rule. PSPP purchases in France, Germany, Italy and Spain, end-March 2018.

The execution of Eurosystem purchases aims to minimise price distortions...

The negotiation and execution of transactions take into account liquidity and also ad hoc demand from market participants for certain specific bonds (such as bonds delivered on underlying futures contracts, securities subject to strong demand on the securities lending market, etc.). Furthermore, the transactions are spread over the day and over the curve. Lastly, monetary policy portfolio managers will not intervene in certain segments of the yield curve around primary issues.

... complemented by a securities lending facility intended to support market liquidity

When a central bank purchases securities, it withdraws them from the market, thereby making them more scarce and – in the absence of perfect substitutes – more expensive to buy and to borrow. In order to reduce potential distortions resulting from this scarcity, the Federal Reserve and the Bank of England introduced the solution of lending back part of the securities to market participants, which can thus make temporary use of them to deliver a futures contract or cover a short-selling position.

The securities lending facility put in place by the Eurosystem therefore allows counterparties to borrow securities held under the PSPP against another, less valuable security or, in certain countries like France, against cash collateral. When tensions appear in the money markets, as has become common at quarter or year-end, the Eurosystem's facilities have acted as a tool to support market liquidity. For example, the Banque de France provides a daily securities lending auction scheme, making the entirety of its PSPP portfolio available for borrowing to the market.

A recent Banque de France working paper (Arrata, Nguyen, Rahmouni-Rousseau and Vari, 2018) shows that the introduction of the securities lending facility by the Eurosystem coincided with improved repo market conditions since 2017, and was accompanied by a normalisation of the sometimes very high cost of borrowing certain securities of the more financially sound euro area countries. This facility also seems to have contributed to limiting tensions at year-end on the securities lending market.

Market neutrality and the effectiveness of securities purchases

Although market neutrality is intended to minimise unintended price distortions that could undermine the functioning of the markets, this does not mean that QE has no impact on prices. The central bank's extraction of duration risk from the market is a major transmission channel: in this mechanism, rates vary depending on the total amount of risk borne by private investors and the compensation they demand to take on that risk.

At the end of 2017, the Eurosystem had absorbed 20% of the sovereign debt market duration risk in the euro area and enabled almost all investors to reduce their exposure to risk. This contributes to an accommodative monetary policy after the conclusion of the net purchases, as a proportion of this duration risk is absorbed in the central bank's balance sheet.

Finally, part of the effect of asset purchase programmes stems from the signal sent by the central bank on its long-term commitment to maintaining its accommodative stance. This signal also mobilises other instruments, such as communication on future interest rate paths (forward guidance).