A central bank is independent if the fiscal authority does not stand in the way of its objectives, foremost among them being price stability. In workhorse macroeconomic models, a necessary condition for equilibrium, the “intertemporal budget constraint of the government”, imposes strong restrictions on jointly feasible fiscal and monetary policies. In particular, the central bank is independent only if the fiscal authority can commit to a Ricardian policy, ensuring that the budget constraint holds for all paths of the price level.

This paper extends these workhorse models in two directions. We first posit that the public sector has a unique ability to supply liquidity vehicles to the economy, thereby generating resources above and beyond fiscal surpluses. This may relax the interdependence between fiscal and monetary policies that derives from a standard intertemporal budget constraint. Second, rather than assuming that fiscal and monetary authorities indefinitely commit to policy rules, we endow both authorities with objectives and instruments, and study the subgame-perfect outcome from their strategic interactions. Put simply, we offer a formal game-theoretic analysis of Wallace's ``game of chicken''.

One purpose of these extensions is to assess central-bank independence in the current context. Several observers (e.g., Blanchard, 2019) argue that the US government should reap the benefits from interest rates below growth rates by issuing more debt at zero fiscal and inflationary costs. Current attempts of the US executive branch at influencing monetary policy are apparently not perceived by markets as pure noise (Bianchi et al., 2019). Overall, relative to a view of the world in which central-bank independence is warranted by a Ricardian fiscal policy given the intertemporal budget constraint of the government, the current context suggests on the one hand that this budget constraint may be ``soft'', but that fiscal policy, on the other hand, is far from Ricardian. What is the net implication for central-bank independence?

Our analysis generates the following insights. First, we offer a general formulation of the condition under which public liquidity supply makes the monetary arithmetic “pleasant”, in the sense that it relaxes fiscal and monetary interdependence and thus significantly expands the set of jointly feasible policies.

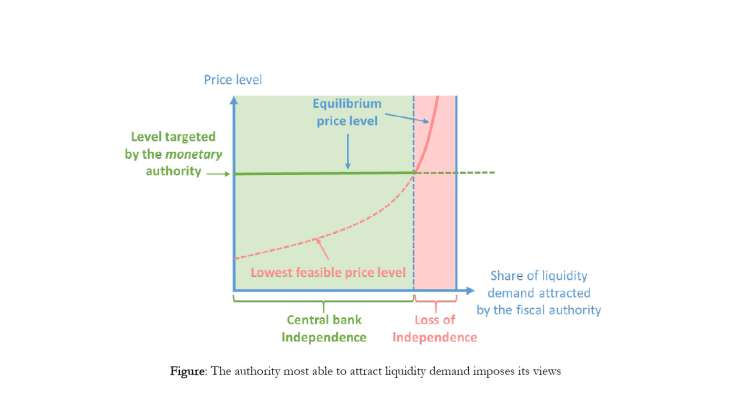

One could conclude from this latter remark that demand for public liquidity reinforces central-bank independence. The predictions from our strategic analysis are however gloomier. We find that the degree of “pleasantness” of the economy, broadly defined as the wiggle room between fiscal and monetary policies, is actually not the essential determinant of central-bank independence when both authorities are strategic. It is rather the ability of the central bank to mop up private liquidity before the fiscal authority does so with the issuance of debt that warrants its independence. We find indeed that the authority that is the fastest at meeting private liquidity demand can force the other to chicken out. There is fiscal consolidation and a stable price level if the monetary authority preempts liquidity demand whereas there is fiscal expansion and inflation in case the fiscal authority does so.

Our explicit strategic approach offers useful insights into the question that Sargent and Wallace (1981) raise in conclusion of their unpleasant arithmetic: “The question is, Which authority moves first, the monetary authority or the fiscal authority? In other words, Who imposes discipline on whom?” We contend that the authority who moves first in this sense is the one that preempts private demand for liquidity. If the fiscal authority is the primary issuer of the public liabilities sold to the private sector, it de facto controls future price levels. If the monetary authority by contrast is this primary issuer, then fiscal paths cannot dictate the price level.

Despite the current prevalence of low interest rates relative to growth, and even if this prevalence implies that issuing government debt comes at no fiscal cost, our analysis therefore implies that capping the ratio of outstanding government debt to GDP remains a requirement for central-bank independence and price stability. The quantitative value of such a cap depends on the intensity of the private demand for public liquidity relative to growth.