Post No.353. Despite the fears that were expressed when they were launched, public-guaranteed loans (PGLs) did not prompt banks to increase their risk-taking. By mechanically reducing the weighting of risks, the partial public guarantee made it possible to continue financing businesses while maintaining their standards for screening new loans.

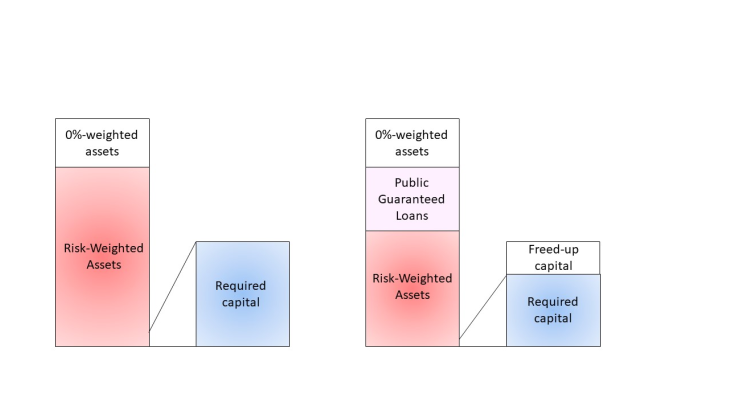

Chart 1: Release of capital following the issuance of public-guaranteed loans

Source: ACPR

PGLs benefited banks through two main channels

In response to the Covid-19 pandemic and the negative effects of lockdowns on economic activity, the French government implemented a EUR 300 billion guarantee scheme to support bank financing for businesses and avoid the risk of a credit crunch. French banks had two main economic reasons for participating in this scheme:

- Firstly, they could use PGLs to prop up their risky borrowers, which could have defaulted during the pandemic, in order to avoid the deterioration of their assets ("risk-taking channel").

- Secondly, banks could benefit from a reduction in their regulatory capital requirements, as PGLs carried a zero risk weighting ("risk-weighted asset channel"). This enabled them to support lending to the economy without increasing their risk, which was covered by a public guarantee.

This mechanism is illustrated in Chart 1. This is a standard credit enhancement mechanism whereby the borrower benefits from the same credit rating as that of its guarantor, in this case the state. Thus, on the part of the loan guaranteed by the state (ranging from 70% to 90% of the total amount of the loan), the company benefits from a credit risk weighting equal to that of the French state, i.e. a zero risk weighting, since it is the state that will repay the guaranteed part of the loan in the event of a default by the company. In other words, PGLs are considered to be very low-risk loans according to banking regulations and therefore do not require banks to raise additional capital.

A large-scale partial guarantee scheme

The aim of PGLs was clear: to prevent solvent companies with cash flow problems from defaulting, in order to reduce the impact of lockdowns on GDP while encouraging banks to continue lending to these companies. Between 23 March 2020 and 30 June 2022, more than EUR 140 billion in PGLs were granted, representing just over 10% of total outstanding loans to businesses. The state guaranteed between 70% and 90% of the outstanding loan, depending on the size of the beneficiary. With a maximum maturity of 6 years and an interest rate of 0.25% in the first year and between 1% and 2.5% in subsequent years, PGLs represented up to 3 months' turnover in 2019 or 2 years' payroll for innovative companies. This scheme, which was negotiated with the European Commission, has many features in common with other neighbouring countries (Jiménez et al., 2022, Altavilla et al., 2021). However, France differs from other countries in that, on the one hand, the amounts granted were substantial (two to three times higher than in Italy or Germany) and, on the other, there was no 100% guarantee, unlike that provided by the German, Italian and Spanish governments.

Risk-taking stabilised for banks thanks to PGLs

The main concern regarding the implementation of public guarantees is their potential impact on banks' risk-taking and financial stability (Schepens et al., 2020). Indeed, the presence of a public guarantee scheme socialises losses of up to 90% of the amounts borrowed, which can considerably alter the perception of risk and encourage lending to riskier borrowers. This mechanism is likely to be even more pronounced for banks that were in a weakened position prior to the COVID-19 crisis, i.e. those with a riskier credit portfolio that would not have had sufficient capital to absorb the potential losses resulting from the halt in activity (Holmstrom and Tirole, 1997).

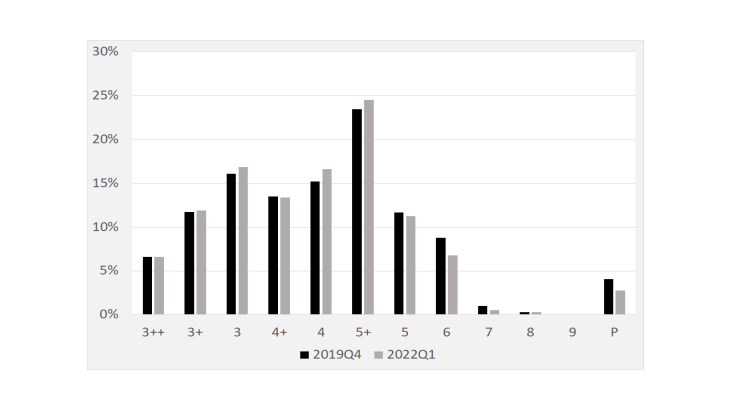

Using granular data from the AnaCredit database, which records all new loans to businesses and their characteristics between spring 2020 and spring 2022, Nicolas et al., (2023) studied the effects of the introduction of PGLs on banks' risk-taking. More specifically, using a panel data analysis, the authors can identify the characteristics of the banks, firms and loans that are associated with higher PGL amounts. The results suggest that the partial public guarantee encouraged banks to lend according to their usual risk criteria while maintaining their standards for screening new loans, meaning that the most liquid, solvent and profitable companies obtained higher amounts of PGLs. In other words, PGLs did not structurally change the risk profile of outstanding loans granted by French banks. Chart 2 shows the changes in the distribution of risk in the credit portfolio of French banks before and after the pandemic. Companies' risk measures are calculated based on the Banque de France rating for December 2019, to exclude the impact of PGLs and other support measures on the rating itself. The scale used in the chart is the previous rating scale in place in 2019, where 3++ is the best rating, 9 the worst, and P indicates a company in default.

Chart 2: Changes in the 2019 company rating in banks' credit portfolios before and after the pandemic

The most capital-constrained banks made greater use of PGLs

The empirical study also shows that, all other things being equal, the most capital-constrained banks before the pandemic, i.e. those most likely to reduce credit supply during the crisis, lent higher amounts of PGLs.

For example, for two PGLs granted to two companies with the same risk profile, banks with a capital adequacy ratio one percentage point lower than the average lent 8% higher amounts of PGLs. Given that the average amount of a PGL is EUR 442,000, the less capitalised banks granted an average of EUR 40,000 more to businesses.

However, unlike the "risk-taking channel" hypothesis, which suggests that PGLs could have encouraged the riskiest banks to lend to the weakest firms, we show that the most capital-constrained banks before the crisis granted lower amounts of PGLs to risky companies and higher amounts to healthy companies. The introduction of PGLs therefore played its expected counter-cyclical role by limiting the risk of a tightening of lending standards.

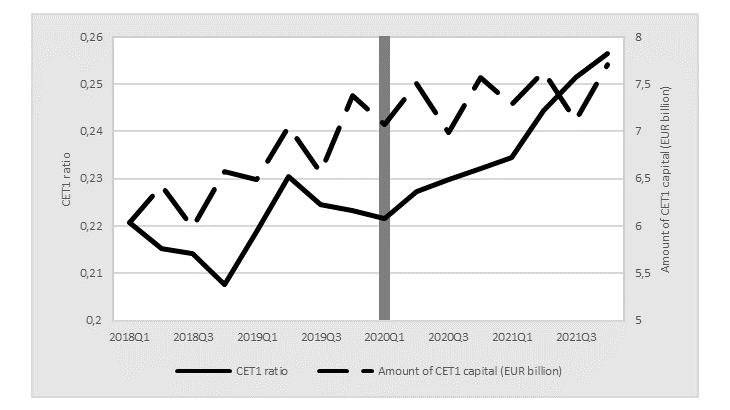

Indeed the most capital-constrained banks benefited from a mechanical increase in their regulatory capital ratio (solvency ratio or Common Equity Tier 1 ratio) due to the reduced risk weighting of their assets (denominator of the ratio) linked to the public guarantee, without increasing their regulatory capital (numerator of the ratio). This effect was favourable for the economy because the regulatory constraints on the share of PGLs were eased, making it possible to support lending to the economy during the recovery phase and thus avoid a credit crunch without increasing the risk for the banking sector.

All in all, thanks to PGLs, French banks managed to significantly increase their solvency ratios. Chart 3 shows that the average CET1 ratio of French banking groups has risen steadily since the introduction of PGLs in the first quarter of 2020, while the amount of CET1 capital remained relatively stable over the period.

Chart 3: Changes in the CET1 ratio of French banking groups

Download the PDF version of the publication

Updated on the 25th of July 2024