- Home

- Publications and statistics

- Publications

- The private non-financial sector increas...

The private non-financial sector increased its foreign asset position in 2020

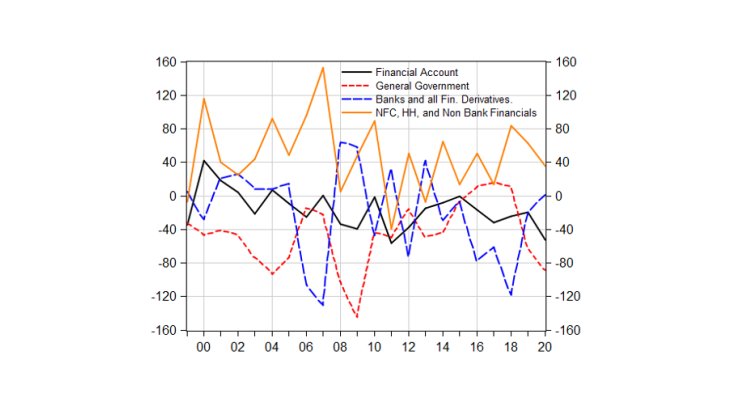

Post n°226. In 2020, the current account deficit of the balance of payments reached its highest level since 1982. It was financed by larger purchases of government securities by non-residents than in 2019, amounting to EUR 86 billion, which covered both the current account deficit and the increase in net private sector assets.

Source Banque de France

Note: in 2020, for non-financial corporations and households, foreign investment flows were EUR 40 billion higher than their liability flows. FD = financial derivatives.

The sectoral decomposition of the financial account distinguishes between monetary financial institutions (banks, including the central bank, that create money) and "other" agents including non-monetary financial institutions. The FDs of "others" are aggregated here at the MFI level. Insurance is in the "other" sectors. As the international insurance investment portfolio is held on behalf of households and NFCs, this sector grouping, which is in line with the balance of payments classification, is not problematic.

The standard presentation of the balance of payments financial account distinguishes between several functional categories such as direct investment (intra-group transactions excluding deposits, loans and borrowings of financial institutions), portfolio investment (purchases and sales of securities excluding intra-group operations), financial derivatives and other investments (deposits, loans and borrowings). Using another presentation, the resident institutional sector can be identified as the counterpart for the rest of the world. This post uses this second presentation (see also the note to Chart 1) rather than the usual breakdown by instruments.

Non-financial corporations (NFCs) and households increased their net foreign assets.

In 2020, the financial relations of NFCs and households with the rest of the world did not change substantially: their investments exceeded their net liabilities by almost EUR 40 billion, i.e. a slight decrease compared to 2019.

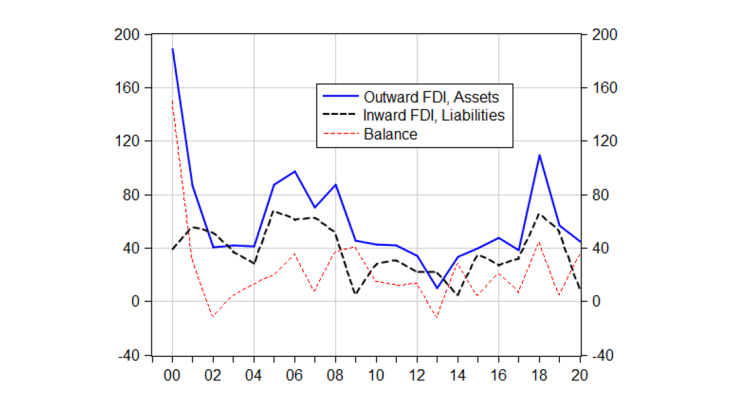

Traditionally, France, via NFCs in particular, invests more in foreign intra-group relations, which are a priori sustainable, than it receives in foreign direct investment (Chart 2, and fact sheet 3 of the 2019 annual balance of payments report). In 2020, French direct investment abroad remained strong (EUR 45 billion), due in particular to cash injections by large French multinationals into their foreign subsidiaries, presumably to help them weather the crisis in countries where government support for companies was less generous than in France. Inward foreign direct investment in France fell to EUR 9 billion, i.e. its lowest level since 2014, as companies adopted a wait-and-see attitude towards capital transactions in 2020. Direct investment transactions thus generated net capital outflows (increase in residents' net assets with the rest of the world) of EUR 35 billion in 2020, a level close to that of 2018 (EUR 44 billion), after EUR 5 billion in 2019.

Source: Banque de France.

Note: Direct investment by banks is not taken into account here

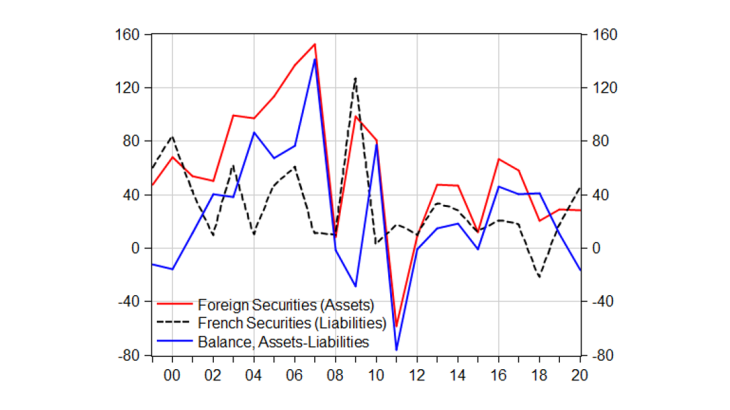

As regards market securities transactions (portfolio investment, Chart 3), NFCs and French households continued to invest in foreign securities in the amount of EUR 28 billion, i.e. unchanged from previous years. Their purchases of foreign private securities increased at the same rate as their disposals of foreign public securities, which explains the stability of the red line representing asset flows.

Non-residents also increased their net purchases of private debt securities by EUR 44 billion after EUR 18 billion in 2019, with the non-resident holding rate (measured by long-term securities) remaining stable at 57% at the end of 2020 (see Holdings of French securities).

Source: Banque de France

Note: foreign securities represent net purchases by French residents of securities from the rest of the world. French securities represent net purchases by non-residents of French securities issued by NFCs. French government securities are not included in this chart.

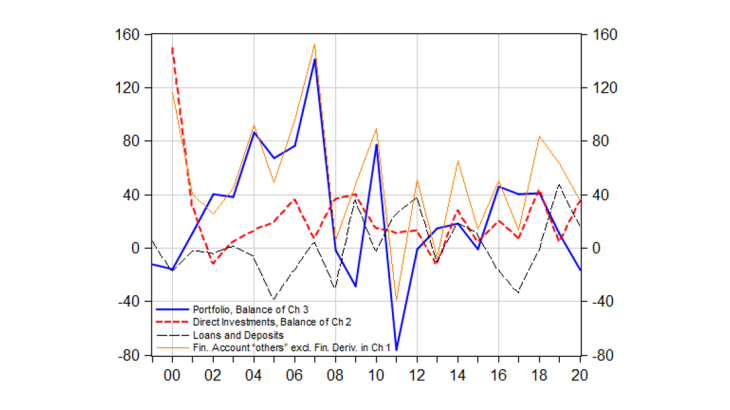

To obtain the line for the "other sectors", households, NFCs and the non-bank financial sector in Chart 1, which represents the net change in foreign assets, it is necessary to incorporate loans and deposits ("other investments" in the balance of payments classification) in addition to direct investment and portfolio investment. The sign of this series is positive when the borrowing of non-financial residents from foreign banks is lower than the flow of deposits of non-financial residents in non-resident banks (borrowing by non-monetary financial institutions is negligible).

Source: Banque de France

From 2019 to 2020, while remaining positive (capital exports), the balance of "other investments” decreased by around EUR 30 billion (from EUR 47 billion to EUR 16 billion, Chart 4) However, the decrease in the balance of other investments and the increase in purchases of French shares by non-residents (the majority of the black line representing "liabilities" in Chart 3) did not offset the increase in the net foreign assets of the French non-bank private sector and the current account balance, which has become more strongly negative Another sector therefore had to borrow heavily.

The general government sector increased its debt with the rest of the world

In 2020, against the backdrop of a sharp increase in net issuance, non-residents conducted significant net purchases of French government securities, totalling EUR 86 billion after EUR 56 billion in 2019. However, these purchases were less significant than during the 2008 financial crisis (red dotted line in Chart 1) Overall, non-resident holdings of government securities, excluding that held by the Banque de France, increased to 63% at the end of 2020 (see fact sheet 2 on page 20 of the annual balance of payments report). This contrasted with the period from 2016 to 2018 when residents, including the Banque de France, had purchased more French government securities from non-residents than the latter had acquired from residents, so that the net balance on French government debt was positive.

Conversely, while French residents excluding banks usually make net purchases of foreign government securities (notably via insurance entities and non-money market funds, which are in the "other" sectors of the balance of payments), 2020 was characterised by net sales of around EUR 20 billion.

The French banking system stopped borrowing from the rest of the world

In 2020, as in 2019, the French banking system (MFIs, including the Banque de France, and financial derivative transactions, whether initiated by banks or other financial institutions, blue line in Chart 1) virtually stopped borrowing from the rest of the world. In previous years, it ensured the financial closure of the other agents' transactions by increasing its debt. Both its net purchases and net issuance continued to rise, with the increase in the former exceeding that of the latter (19% versus 12%).

To sum up, the financing of the current account deficit and of the capital exports of the non-bank private sector was achieved by capital inflows from non-residents' purchases of government securities, since the French banking system did not incur any debt in 2020. Last year was marked by an exceptional widening of the fiscal deficit, while the non-financial private sector, households and NFCs, experienced a very strong increase in its financing capacity (see 2009 and 2020 crises: diverging external balance trajectories).

Updated on the 25th of July 2024