The Harmonised Index of Consumer Prices (HICP) acts as the reference for the monetary policy inflation target for the euro area (ECB, 2021). However, this measure can be disrupted by significant movements in certain components of the index. These disruptions, which are often exogenous and short lived, are not necessarily an indication of a shift in price formation mechanisms that would justify a monetary policy intervention to stabilise prices. For example, in 2020 21, changes in the price of oil first pushed the year on year rate of the headline index below 0%, before an upturn in the oil price triggered a sharp increase in consumer price inflation. In order to avoid overreacting, central banks analyse developments in so called “core inflation” indices in parallel with the HICP.

1 HICP excluding energy and food remains sensitive to price disruptions, which can complicate its economic interpretation

Core inflation is taken to be the rate of inflation that would occur in the absence of exogenous disruptions unrelated to the economic cycle (Eckstein, 1981). In other words, it serves to map the fundamental inflationary trend of the economy, excluding short term disturbances. The concept of core inflation is simple to understand. However, the technical aspects of its calculation are not universally agreed and several approaches exist.

HICP excluding energy and food is constructed through the fixed exclusion of certain categories of goods

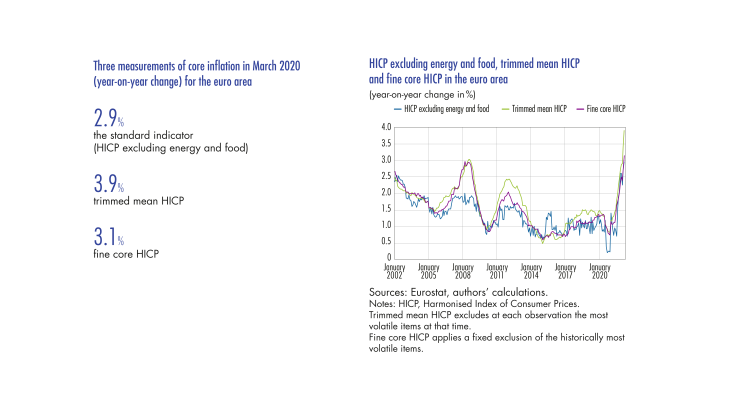

The core inflation index usually applied in the euro area is defined as the inflation of a consumption basket made up of HICP products excluding energy and food (two categories of goods that are mainly imported and for which the prices are fixed on global markets and are volatile). The goods and services that remain in the core index account for around 70% of the total weighting of the index as a whole. The advantage of this definition is that the index is technically simple to construct and easy to analyse as it excludes two entire categories of consumption items that relate to primary sector production and that are held to be subject to international price fluctuations.

HICP excluding energy and food remains sensitive, however, to one off phenomena that are unrelated to the underlying trends in inflation

Core HICP is easy to construct. However, the flipside of its simplicity is that certain items kept in the index’s basket are still sensitive to one off phenomena that are unrelated to the underlying trends in inflation.