According to a ground-breaking survey, Reunion Islanders are more attached to using cash than their counterparts in mainland France

IEDOM (the French overseas departments’ note-issuing bank) is conducting a ground-breaking survey on the means of payment used among a representative sample of individuals aged 18 and over living in French overseas departments (excluding Mayotte). The survey was first conducted on Reunion Island in 2022 and continued in Martinique, Guadeloupe and French Guiana in 2023. It builds on the European SPACE survey (Study on the Payment Attitudes of Consumers in the Euro area).

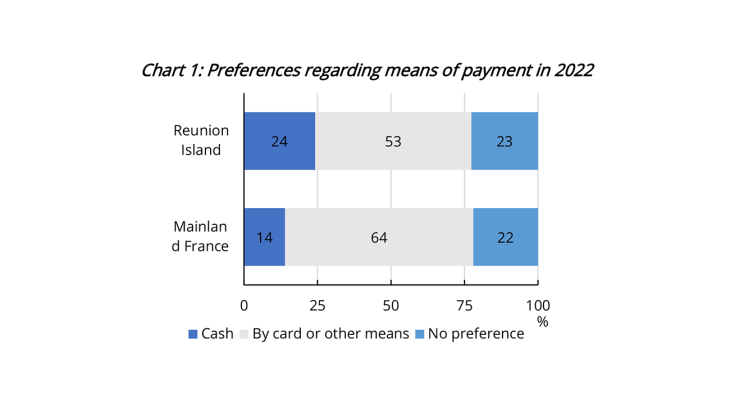

Initial findings reveal a stronger preference for cash among Reunion Islanders. A quarter of those surveyed stated a preference for cash (notes and coins) when paying for purchases at the point of sale, compared with 14% in mainland France in 2022. Conversely, the proportion of Reunion Islanders who prefer to use bankcards is lower than in mainland France (53% versus 64%, respectively) (Chart 1).

This preference is based on the recognised qualities of banknotes and coins. Cash is appreciated for its practicality (speed and ease of use) by over half of those Reunion Islanders who state that they prefer it. Four out of 10 people surveyed also believe they have a clearer overview of their expenditure when using cash. Cash is accepted in more situations (for 20% of respondents) and guarantees the anonymous nature of transactions (for 17% of those surveyed).

Reunion Islanders also value cash for its accessibility. 87% of those surveyed consider access to an Automated teller machine (ATM) or bank counter to be easy or very easy, a level of satisfaction that is very close to that encountered at national level and throughout the euro area (i.e. 92% and 89%, respectively). ATMs are the main source of cash for people: 55% of Reunion Islanders say they get their cash from an ATM, however, this proportion is much higher in mainland France (78%). In Reunion Island, cash comes from a wider range of sources, including withdrawals at bank branches (16% of banknotes held in Reunion Island, compared with 9% in mainland France), or from cash kept at home (16% locally, compared with 3% in mainland France). Hoarding, consisting of accumulating cash at home or in safes, appears to be more pronounced on the island.

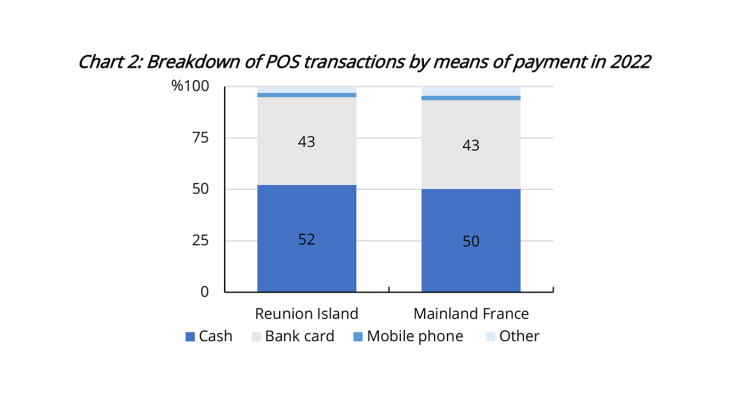

But there is comparable use of bankcards for in-store payments

Based on this preference for cash, we might also expect a higher proportion of cash in transactions, however, the SPACE-R survey covers this point for the first time: for everyday POS transactions, people from Reunion Island and mainland France actually have similar payment habits. 52% of payments by Reunion Islanders for everyday POS transactions are made in cash, a proportion that is now similar (50%) to that of people living in mainland France (Perrain and Gobalraja, 2023a) (Chart 2). Card payments rank second (and first in terms of value), accounting for 43% of transactions, the same as in France (excluding the overseas departments). Mobile payment apps account for 2% of transactions while other means of payment (cheques, credit transfers, meal vouchers, other, etc.) are used for 3% of purchases on Reunion Island, compared with 2% and just under 5% respectively, in mainland France (excluding the overseas departments).

Moreover, 4% of Reunion Islanders claim to own crypto assets, compared with 3% in mainland France and an average of 4% in euro area countries (ECB, 2022). 40% of those holding crypto assets use them as a means of payment, a similar proportion to that in mainland France (37%).