Measuring the pass-through of commodity prices to inflation: a complex exercise

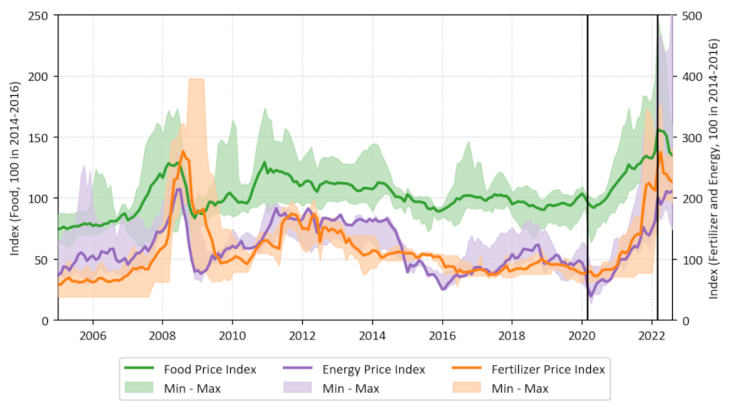

Various studies have tried to measure the pass-through of food and energy commodity prices to consumer price indices (including Bekkers et al., 2017 and Gelos and Ustyugova, 2017). The results generally find a pass-through of between 5% and 15%. However, these pass-throughs are likely to be underestimated, as they are based on aggregate commodity price indices that use a weighting scheme that is representative at the global level, and hence do not reflect local realities. More recently, Okou et al., 2022 have found an almost complete pass-through of certain world staple food prices to the prices observed in local markets in Sub-Saharan Africa. However, this type of approach does not capture potential indirect effects on the prices of other consumer goods (e.g. processed food). Lastly, existing studies generally do not take into account shocks to fertilizer prices, which can have a longer-term impact on local production.

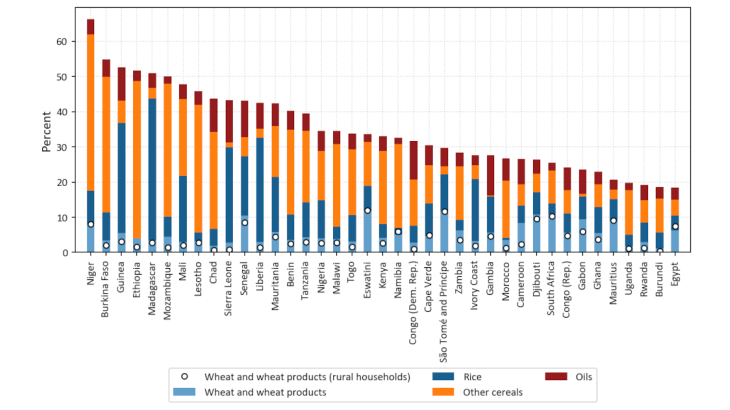

In an article in the Rapport annuel des coopérations monétaires Afrique-France 2021, we estimate, country by country, the pass-through of global commodity prices to consumer prices in Africa, incorporating simultaneously 17 commodities grouped into five categories (cereals, vegetable oils, sugar, energy, fertilizer).

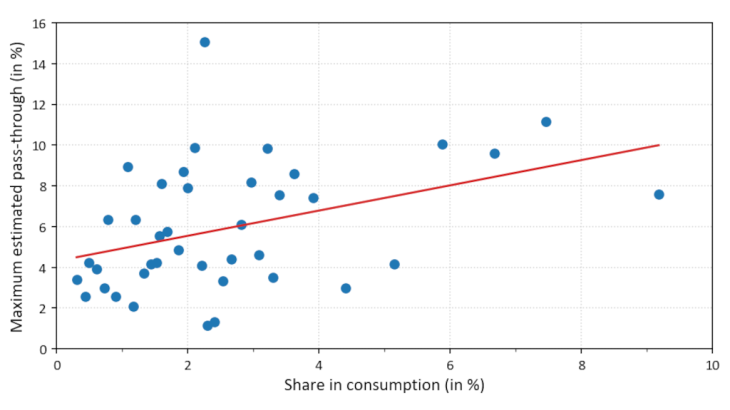

The use of disaggregated price indices allows us to better capture the heterogeneity of global price variations, as well as cross-correlations between commodity categories and between goods within categories. Using these indices in estimated country-by-country regressions also allows us to better capture the heterogeneity of consumption baskets’ compositions across African countries. The impacts are estimated net of exchange rate effects, natural disasters, civil conflicts and interest rate changes. However, they do not take into account the measures implemented to mitigate price rises (subsidies, price caps, etc.), or the relatively strong prevalence of self-sufficiency across the continent.

A strong and lasting pass-through of commodity prices to consumer prices

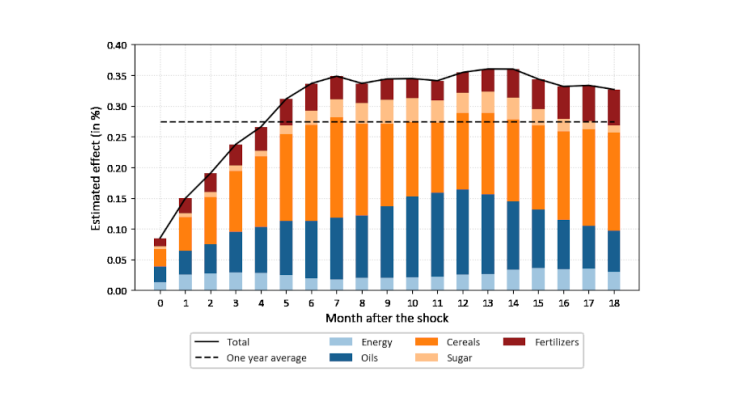

Chart 1 shows, for Africa as a whole, the cumulative impact on consumer prices of a simultaneous 1% rise in the world prices of 17 commodities, with the results aggregated by category (using GDP at purchasing power parity in 2021). Only positive impacts that exceed the 10% significance threshold are taken into account.

Such a 1% rise leads, across Africa, to a rapid and lasting increase in consumer prices of about 0.3% on average, corresponding to a pass-through of 30%. The pass-through to domestic prices increases in the seven months following the shock and then reaches a plateau. Adding the negative or non-significant coefficients, the pass-through would reach 20% to 25%.

Cereal and vegetable oil prices have the largest impact, with average pass-throughs of 11% and 9%, respectively, over one year. These two categories account for more than two-thirds of the total impact over the period. Rises in energy commodity prices have a limited effect on consumer prices, with an average pass-through of 2% over one year. This might be attributable to the high prevalence of fuel subsidies across the continent. The impact of a rise in fertilizer prices is moderate over one year (3% on average), but then increases towards the end of the horizon, reaching 6% after 18 months. This illustrates the impact that higher fertilizer prices can have on subsequent harvests.

The results show significant cross-country disparities, with a pass-through of close to 10% for Maghreb economies and South Africa, and of over 45% in many countries, including Chad, Burundi, Kenya and several island economies.