- Home

- Publications et statistiques

- Publications

- Original sin in EMEs: less currency risk...

Original sin in EMEs: less currency risk but more capital flow volatility

Post No. 370. EMEs have succeeded in overcoming original sin and the resulting currency risk, transferring currency risk to international investors. As international investors are more sensitive to changes in global financial volatility, EMEs now face greater volatility in the ownership of their foreign debt, leading to an original sin redux.

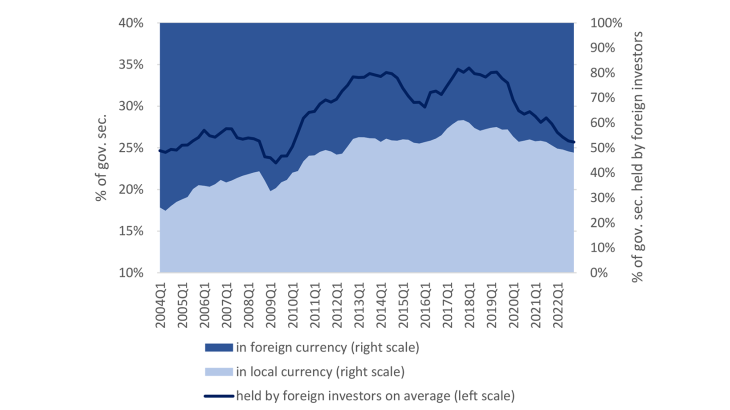

Chart 1: EME government securities held by foreign investors and currency breakdown

Note: Central government securities of 13 EMEs. Data are adjusted for valuation changes. At the end of 2022, foreign investors held on average 26% of an EME’s government securities (left-hand scale). Within government securities held by foreign investors, the proportion of debt held in local currency, on average for an EME, increased from 26% in the first quarter of 2004 to 48% in the fourth quarter of 2022 (right-hand scale).

As Eichengreen and Hausmann (1999) first pointed out, the term “original sin” refers to a country's inability to borrow abroad in its own currency. This stems from the reluctance of foreign investors to hold sovereign debt in local currency, due to perceived currency risk and domestic economic instability. It implies that the domestic government bears a currency risk due to currency mismatch between its foreign currency debt and its domestic investment, generally in domestic currency. Although long associated with EMEs, original sin has been overcome recently by many emerging countries. The share of EME government securities held by foreign investors reached a peak in 2018 with 35% held by foreign investors on average for an EME, while decreasing since then to 26% at the end of 2022 (Chart 1). This dynamic goes hand in hand with an increase in the share of government securities denominated in local currency within total government securities held by foreign investors since 2004. Several factors can explain this improvement in original sin, including sound macroeconomic management, better institutions and economic fundamentals, and financial deepening.

Heterogeneity within EMEs contrasts with the overcoming of original sin

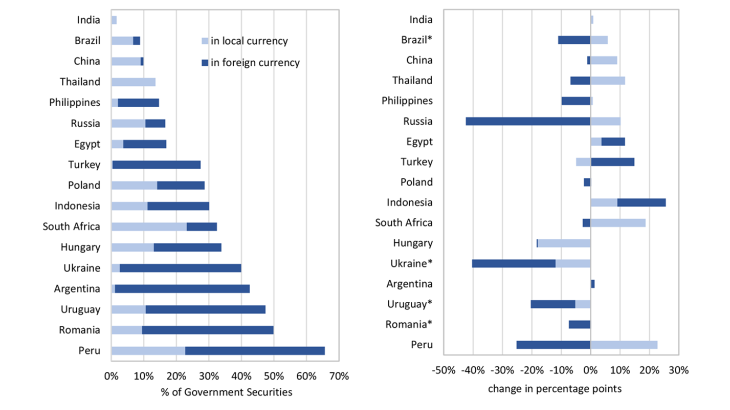

However, overcoming original sin has not been homogeneous among EMEs. While the largest and most developed EMEs, including India, Brazil, China, Russia, Thailand and South Africa, have broadly succeeded, other countries are far from having escaped from the constraint of issuing in foreign currencies when it comes to sovereign debt held by foreign investors (Chart 2, panel A). The most vulnerable cases are Argentina, Uruguay, Peru, Romania, Ukraine and Turkey, where the debt held by foreign investors was both significant and massively denominated in foreign currency at the end of 2022. Although most of its debt is held domestically, Egypt is also identified as a country suffering from original sin, with 70% of its debt held by foreign investors denominated in foreign currencies.

Chart 2: EME government securities held by foreign investors, by country (% of total outstanding of EME government securities in local and foreign currency - at end of 2022, and changes since 2004 )

Note: Central government securities of 17 EMEs. Data are adjusted for valuation changes.

*Changes since 2004 except for Brazil (2005), Ukraine (2006), Romania (2008) and Uruguay (2008)

Changes have also occurred over the past 20 years among EMEs (Chart 2, panel B). For Egypt, Turkey and Indonesia, the increase in the share of sovereign debt held by foreign investors stems from the rise in foreign currency-denominated debt, which translates into an increase in original sin. Except for these three countries, most of EMEs reduced their dependence on foreign currencies for the debt held by foreign investors. China, Thailand, and South Africa have increased their share of debt held by foreign investors but reduced their dependence on foreign currencies for this category of debt. Finally, Brazil, Russia, Ukraine, Uruguay and Romania have reduced both their share of debt held by foreign investors and their dependence on foreign currencies for this category of debt, thus overcoming part of their original sin.

An original sin redux

The end of original sin – as historically defined – means that international investors are now bearing more currency risk and a greater currency mismatch. This currency risk borne by foreign investors increases the volatility of capital flows, leading to “original sin redux” (Carstens et Shin (2019), Onen et al. (2023)).

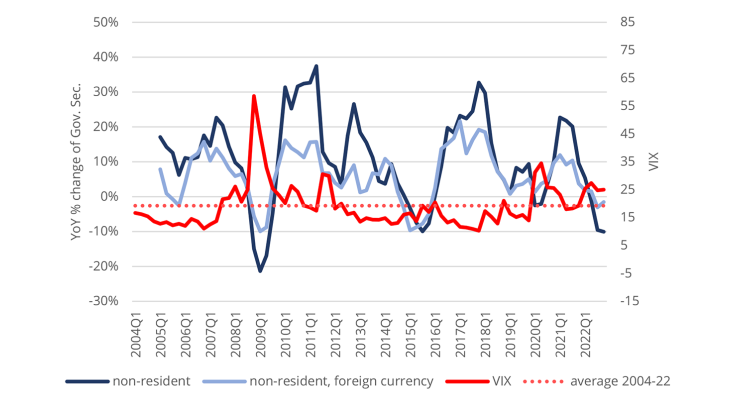

This original sin redux can be associated with changes in the global financial cycle. Chart 3 illustrates the evolution of central government securities held by foreign investors and the level of global financial risk expressed by global financial volatility (i.e. the VIX indicator). It shows that volumes of central government securities held by foreign investors tend to fall when global financial risk exceeds its average level over the period, reflecting the home bias in foreign investors' perception of risk (i.e. the retrenchment of foreign investment during episodes of global financial stress). This has been particularly true during the global financial crisis of 2008-09, the euro area sovereign debt crisis in late 2011, the run-up to the Brexit vote in 2015, the Covid-19 crisis in 2020 and since the US monetary policy normalisation of 2022.

Chart 3: EME government securities and global financial volatility

Note: Central government securities of 13 EMEs, data are adjusted for valuation changes.

government securities held by foreign investors and the level of global financial risk is weaker when central government securities are denominated in foreign currencies than when they are denominated in local currency. Since foreign investors holding central government securities in foreign currencies do not bear currency risk, they are less sensitive to changes in global financial risk and more inclined to maintain their exposure to EMEs in the event of global financial tensions.

The original sin redux in the current global financial conditions

Volatility of capital flows and abrupt capital outflows can be observed when global financial conditions tighten. This was the case when the US monetary policy started its normalisation in 2022. Foreign investors that held EME debt in local currency registered losses stemming both from the increase in sovereign spreads and the depreciation of the EME’s currency that occurs when these spreads widen.

Valuation losses linked to currency movements are amplified when international investors' portfolios are made up of longer-dated bonds. Currency risk is coupled with duration risk (Bertaut et al. (2023)).For these investors - mainly mutual funds - the incentive to disengage from EMEs plays a major role in EME outflows, accentuating the risk of an original sin redux.

The recent phase of "high for long" trajectory of interest rates in core economies revived the debate on original sin and the vulnerability of EMEs to foreign financial shocks. While intervention in the foreign exchange market and broadening the domestic investor base can help reduce this vulnerability, they do not eliminate it (Hofmann et al. (2022)). As 10 out of the 17 EMEs countries listed in Chart 2 have a significant reliance on foreign investors (foreign investors hold more than 20% of their government securities), they are still exposed to potential abrupt capital outflows, especially if securities are denominated in local currency with long-term maturity.

Download the full publication

Updated on the 25th of October 2024