Admittedly, to date, the bulk of Chinese investment has been made outside the EU (i.e. Asia, Africa and the former CIS). Within the EU, investment has been concentrated in Eastern European countries (Czech Republic, Hungary, Croatia) or the Southern European countries that have experienced financial difficulties in recent years (Portugal, Italy, Greece).

The establishment in 2011 of the "16 +1 format" group bringing together China and 16 Central and Eastern European countries to promote greater cooperation constitutes an additional risk of division among Europeans (see ”Dubrovnik Guidelines”). This group operates alongside the annual EU-China summit with no institutional coordination in place.

The new G20 principles may limit the risks associated with China's unilateral approach

China's unilateral approach has already shown its risks for the countries in which it invests. Some infrastructure projects have proved to be poorly adapted to the needs of the recipient countries. They have sometimes been disproportionately large and not always efficient, as well as being a source of financial vulnerability. This is the case, for example, of Sri Lanka, which, having been unable to repay the loans taken out for the development of the port of Hambantota, had to hand over its management for a period of 99 years to China. According to the Center for Global Development, other countries could soon find themselves in a similar situation of unsustainable debt.

In fact, some infrastructure projects carried out under the NSR initiative have resulted in the disclosure of "hidden" debts due to the lack of a comprehensive recording of off-balance sheet commitments as a result of complex financial schemes.

Faced with these possible abuses, the various international bodies have defined common rules aimed at ensuring the sustainability of states' debt and the viability of investment projects. This is notably the case for the operational guidelines defined by the G20 in 2017, which should make it possible to ensure more rigorous and equitable financing, as recalled in particular at the recent Paris forum on 7 May 2019. At the last summit in Fukuoka, the G20 agreed on the establishment of new principles aiming to improve the quality of infrastructure investment while seeking to prevent the risk of the excessive indebtedness associated with this type of project and ensure its good governance.

Recently, the Chinese Ministry of Finance has appeared to be moving towards greater transparency regarding the financing granted to the NSR project by developing a framework for analysing the debt sustainability of countries which is more in line with international standards but whose implementation is yet to be confirmed

Need to integrate sustainable development and social inclusion objectives

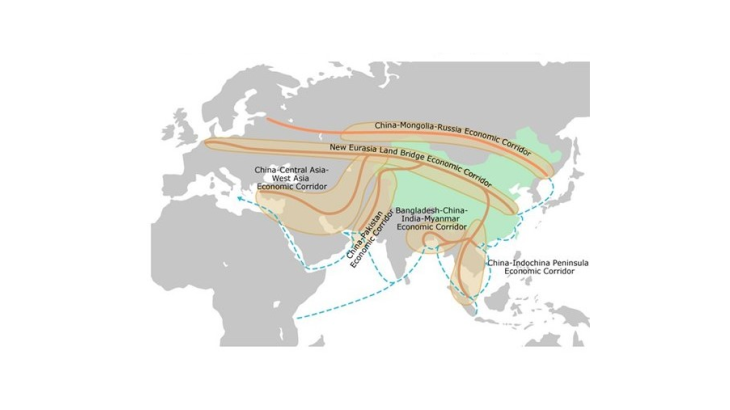

The NSR project aims to generate an increase in trade flows of goods, particularly between Asia and Europe. This trade is now almost exclusively carried out by sea, with an increasing ecological cost, according to a World Bank's analysis.

Against a backdrop of the growing awareness of climate change issues, the G20 reiterated the need for infrastructure projects to be consistent with national strategies to ensure their energy transition, in line with the 2030 agenda on sustainable development. Thus, infrastructure projects must internalise environmental factors. The use of green financing instruments is encouraged, in line with the work undertaken by the Network for Greening the Financial System (NFGS) in particular.

The G20 also introduced new standards to address corporate social responsibility issues in infrastructure investment, as well as those related to good governance, the fight against corruption and transparency in public procurement.

Moving from the unilateral method followed by China to a veritable dialogue with Europe

The lack of a dialogue specifically devoted to this subject between the Chinese authorities and the Commission raises a problem of efficiency and governance, on the one hand regarding the necessary coordination of Chinese investments with those of the Trans-European transport network (TEN-T) and, on the other hand, regarding the risk of investments that are not in line with European priorities.

In its relations with China, the EU is seeking to conclude an investment agreement under the “EU-China 2020 Strategic Agenda for Cooperation“, but these negotiations have made little progress since 2013.

It is essential for Europeans to be able to speak with one voice in order to better defend their interests vis-à-vis a project that must not solely serve the strategic aims of our Chinese partner. This matter will require the full attention of the new European Commission.