Post n° 349. The nominal wage increases negotiated in 2023 at industry and firm levels have remained strong, the earlier rises in prices and the Smic (national minimum wage) having been passed on with a lag. The first agreements signed for 2024 point to a moderation in negotiated increases, which should nevertheless remain on average above inflation, given the sharp fall in the latter.

Monitoring wage trends in real time is a key issue for monetary policy insofar as wage trends are one of the determinants of inflation in the medium term. In France, as in many other European countries, wage growth is largely determined by collective bargaining at firm and industry levels (Gornicka et al. 2024). Since most wage agreements in France are signed between October and April, an analysis of agreements at the start of the year therefore provides a reliable initial assessment of future wage trends for the year. This blog post presents an initial snapshot of negotiated wage increases for 2024, based on information contained in 117 industry-level agreements signed for 2024 (covering 6 million employees, i.e. around a third of employees covered by a private sector collective agreement) and around 1,500 firm-level agreements (covering over 600,000 employees of all market sectors (industry, construction, services, etc.)).

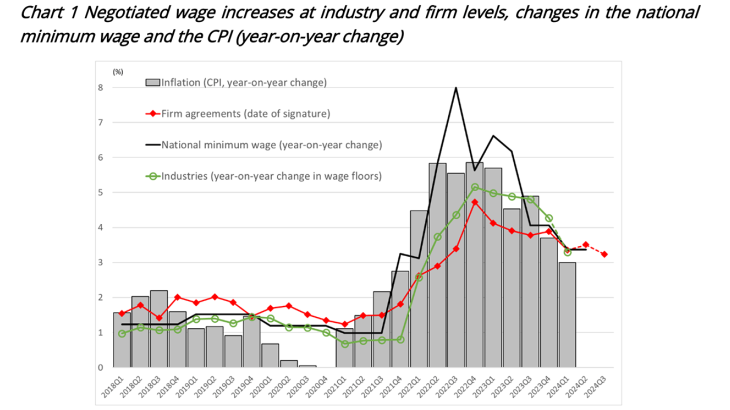

In 2023, industries continued to pass on fairly rapidly to negotiated wages the price rises that had appeared in 2022: the average annual increase in industry-level wage floors peaked at the end of 2022 and then remained at a level close to 5% in 2023, compared with a 4.9% rise in consumer prices (CPI). In companies, the annual increases set out in the compulsory annual negotiations agreement (négociation annuelle obligatoire – NAO) also peaked at the end of 2022 and averaged 4% in 2023 (Chart 1). However, the decline in inflation since the start of 2023 has led to a moderation in negotiated wage increases, which is expected to continue in 2024. In agreements signed at firm and industry level for 2024, year-on-year negotiated wage increases stand at just under 3.5% on average, while inflation is expected to be close to 2% year-on-year by the end of 2024, according to the latest Banque de France projections.

In 2024, increases in industry-level minimum wages are expected to ease as growth in the national minimum wage slows, while outpacing the rise in consumer prices

At industry level, the first agreements signed for 2024 provide for lower nominal wage floor increases than in 2023. According to our provisional estimate, the average increase in industry-level wage floors should be 3.3% in the first quarter of 2024, compared with 5% in the first quarter of 2023 (Chart 1).

In 2023, increases were driven in particular by the successive upward revisions of the national minimum wage in August 2022, then in January and May 2023 (+6.2% year-on- year at the start of 2023). In addition, the fact that a number of industries brought their pay scale into line with the national minimum wage raised the frequency of agreements and contributed to speeding up the spread of the national minimum wage and inflation to industry-level wage floors (Baudry et al. 2023). In 2024, the sharper drop in inflation and the less pronounced rise in the national minimum wage (raised by +1.13% at 1st January 2024, i.e. +3.4% year-on-year) account for the moderate wage increases negotiated in industry-level agreements.

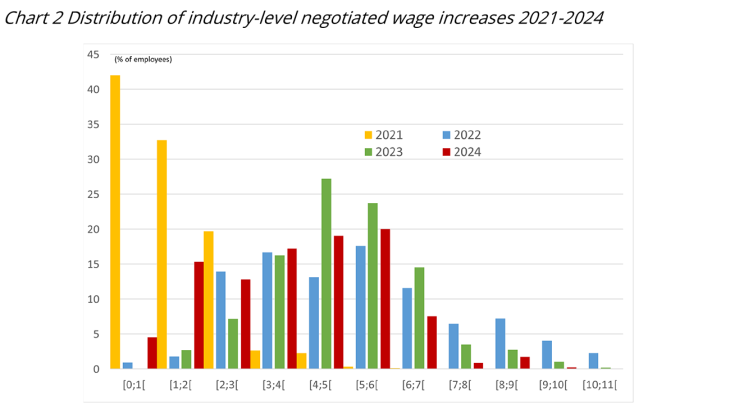

As in 2023, the wage increases negotiated for 2024 also vary considerably across sectors (Chart 2). Some agreements provide for increases of 5% or more for 2024. This is the case, for example, in road transport and prevention-security, notably in order to deal with recruitment difficulties and to maintain their pay scales above the national minimum wage, while the share of employees paid close to the national minimum wage reached a high at the beginning of 2023 (Dares 2023). In most other industries, wage increases of between 2% and 4% were agreed on.

Note: wage increases are calculated on a year-on-year basis at the end of the year, except for 2024 where the calculation is on a year-on-year basis at the end of the 2nd quarter.

At this stage, between the beginning of 2022 and 2024, the average increase in industry-level wage floors was 10.3%, i.e. a rate close to the cumulative rise in prices over the same period (10.5%). However, fairly significant differences can be observed across industries. A quarter of industries raised their wage floors by over 12% between 2022 and 2024, in particular those industries that sharply raised their wages in line with the upward revisions of the national minimum wage (hotels-cafés-restaurants, road transport, cleaning services, hairdressers, etc.). A quarter of industries increased their wage floors by less than 9%, notably those where agreements were less frequent over the period (for example, technical consultancies) and where an agreement is still under discussion for 2024. These differing trends may have contributed to the narrowing of the distribution of wage floors as a whole (Rapport Smic 2023).

Firm-level agreements provide for average wage increases of 3.4% in 2024

For companies with trade union representation, which are often the largest, wages are one of the issues that must be covered by a compulsory annual negotiations agreement (NAO). In most companies, these agreements are signed at the end of the year for the following year, or at the very beginning of the year.

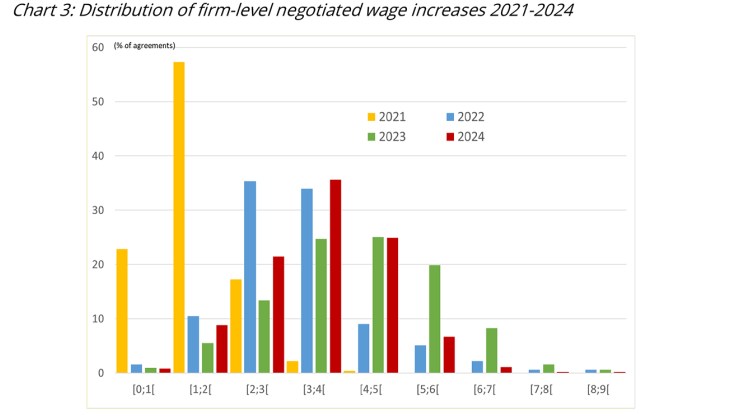

An analysis of the content of around 1,500 agreements signed for 2024 shows that the average wage increase contained in the NAOs is 3.4%, i.e. an annual growth rate close to that of industry-level wage floors or the minimum wage. By comparison, the increases negotiated at the beginning of 2023 were higher, a little above 4% (Baudry et al. 2023). Thus, 80% of the companies for which we have data on the 2023 and 2024 NAO agreements (around 420 companies in total) signed a lower increase in 2024 than that signed in 2023, with an average differential of -0.8 percentage points. Overall, the pace of NAO increases is therefore slower in 2024, even though these increases remain at historically high levels and above expected inflation in 2024.

In addition, the wage increases negotiated in 2024 vary slightly less from one company to another than in 2023. Less than 10% of 2024 agreements provide for increases of 5% or more, while close to half of agreements provide for increases of between 3% and 4% for 2024 (Chart 3). As in 2023, the increases are slightly higher in industry than in services (except transport)

Note: wage increases are calculated as the cumulative total of negotiated wage increases taking effect in a given year.

Lastly, at the end of 2023, the share of NAO agreements that mention the payment of a value-sharing bonus (“prime de partage de la valeur”) was lower than at the end of 2022 (less than 30% at the end of 2023 compared with around 40% at the end of 2022). The average amounts provided for in the agreements at the end of 2023 were nevertheless fairly close to those provided for at the end of 2022 (a little less than EUR 900) (Urssaf 2024).

Business leaders expect base wages to rise by 3% over the next 12 months

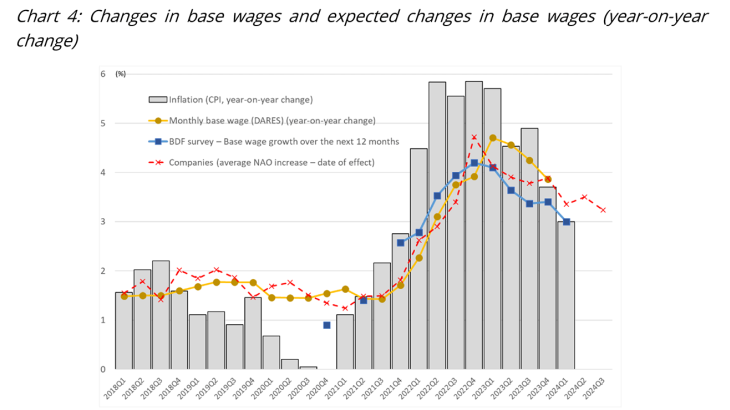

As a result of increases in the national minimum wage and industry and company wage agreements, base wages (excluding bonuses and overtime) have risen sharply in recent quarters: the year-on-year increase in base wages peaked in the first quarter of 2023 at 4.7% in early 2023, then fell back to 3.9% at the end of 2023 (Chart 4).

The wage agreements signed for 2024 suggest that base wage growth should continue to decline this year, while significantly outpacing inflation. Every quarter, a Banque de France survey asks 1,700 business leaders about their expectations for inflation and base wage growth. On average, in the first quarter of 2024, business leaders expect base wages to rise by 3% over the next 12 months (compared with 4.1% at the beginning of 2022), which suggests that the contraction observed in the agreements signed at the beginning of the year should continue.

All of these results support the scenario whereby the pace of wage growth contributes to the gradual return of inflation towards 2% by the end of 2024

Download the PDF version of the publication

Updated on the 25th of July 2024