- Home

- Publications et statistiques

- Publications

- Monthly Business Survey – Start of Janua...

The Banque de France publishes a range of monthly and quarterly economic surveys that provide a snapshot of the French economy in the form of business climate indicators and short-term forecasts.

According to the business leaders surveyed (approximately 8,500 companies and establishments questioned between 20 December and 7 January), activity changed little in December in industry and construction, and continued to grow in market services. In January, business leaders expect activity to grow in industry and to a lesser extent in construction, while slowing down in market services. Overall, order books are deemed to be weak in all industrial sectors except aeronautics. They have also declined in construction.

Our uncertainty indicator based on comments from companies remains high in the three main sectors. Responses highlight the current political uncertainty over economic and tax policies.

According to business leaders in industry, selling prices continued to moderate, close to their pre-Covid rates, despite a slight rise in raw material prices. Recruitment difficulties decreased slightly in industry, market services and construction.

On the basis of the survey results, supplemented by other indicators, as was the case last month, we expect underlying growth to continue to trend slightly upwards in the fourth quarter. This would result in GDP remaining stable on the previous quarter, due to the negative counter effects of the Olympic and Paralympic games, estimated to be –0.2 percentage points of GDP.

1. In December, activity changed little in industry and construction, and continued to grow in market services

In December, activity changed little in industry, in line with business leaders’ expectations last month. It rose markedly in the agri-food sector, boosted by year-end sales and an increase in deliveries to the United States. Aeronautics also posted growth. Conversely, activity in the wearing appareltextiles- footwear, automotive and machinery and equipment sectors fell sharply. In this second group of sectors, business leaders specifically referred to end-of-year holidays and site closures that lasted longer than in previous years. Also in the automotive sector, the decline recorded this month specifically concerned manufacturers who occasionally reported supply difficulties for batteries. The wearing apparel-textiles-footwear sector is contending with sluggish demand, especially for luxury goods.

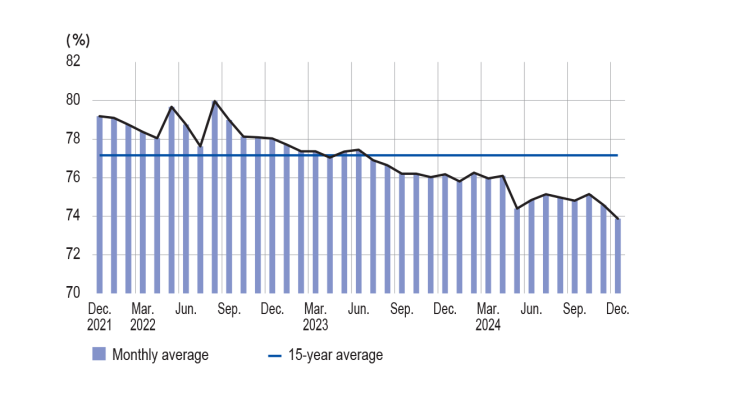

Capacity utilisation rate (en %)

The capacity utilisation rate (CUR) for industry as a whole fell further to 73.9% in December (after 74.6% in November). The indicator declined in most sub-sectors, including the wearing apparel-textiles-footwear (down 4 percentage points) and automotive sectors (down 3 percentage points). For 2024 as a whole, the CUR fell by 2.3 percentage points (after dropping by 1.9 percentage points in 2023), driven down by machinery and equipment, rubber and plastic products (down 6 percentage points), automotive products (down 5 percentage points), metal and metal products and computerelectronics- optical products (down 4 percentage points), and despite higher rates in the agri-food (up 2 percentage points) and aeronautics sectors (up 1 percentage point).

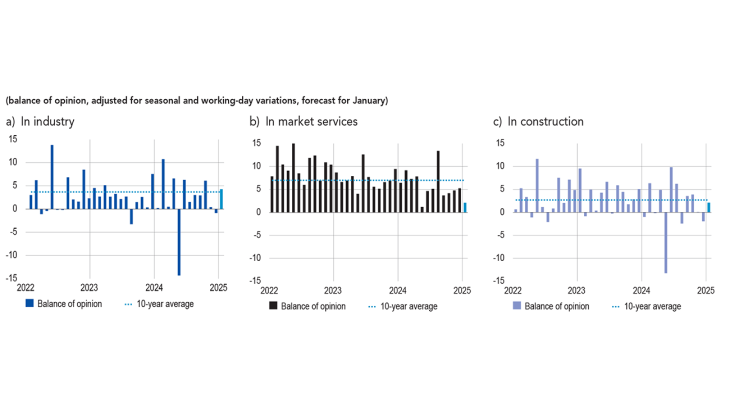

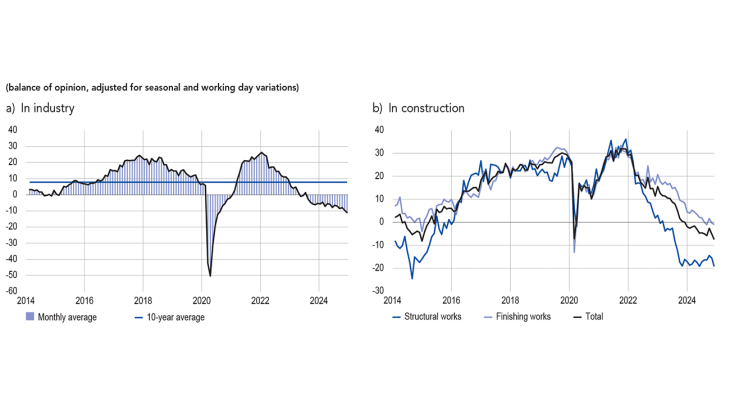

Balance of opinion on the outlook for activity (balance of opinion, adjusted for seasonal and working‑day variations, forecast for January)

over the past month) stood at 0 percentage points for December in industry. For January (light blue bar), business leaders in industry expect activity to increase by 4 percentage points.

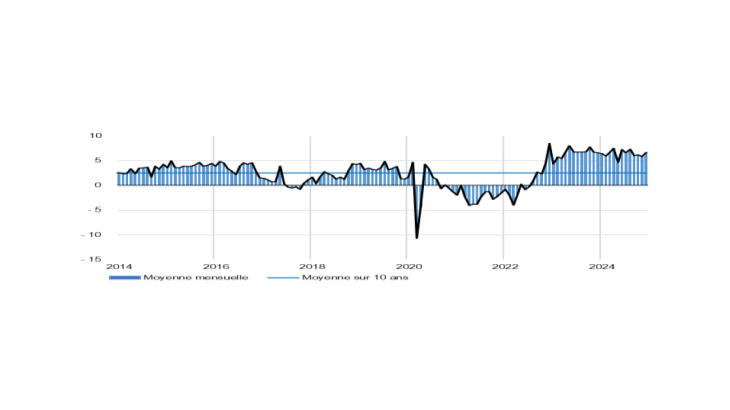

Inventories of finished goods increased slightly compared with November. They declined for computer-electronics-optical products and other industrial products (due to a strategy of running down inventories to ease cash flow), but rose in the automotive and agri-food sectors. In most sectors, inventories are above their long-term average, with the exception of wearing apparel-textiles-footwear, IT-electronics-optics and other industrial products.

In market services, activity grew slightly faster than in November, in line with what was forecast by business leaders last month. Activity grew in the accommodation and food services sector: business leaders reported good levels of activity driven by tourism, public holidays that fell conveniently (Christmas and New Year’s Day) and the reopening of Notre-Dame Cathedral in Paris. Transport-storage (a sector that includes delivery services, which benefited from Black Friday), rental, engineering activities and cleaning also recorded growth, however, activity declined in information services and vehicle repairs. Temporary work changed little this month, after three months of decline.

Inventories of finished goods in industry (balance of opinion, adjusted for seasonal and working day variations)

In construction, as was the case last month, there was little change in activity in December, in both structural and finishing work, whereas last month businesses were anticipating a significant downturn. Business leaders reported a slight upturn in the single-family home segment, but were generally pessimistic: the expected positive effect of lower interest rates appears to have been neutralized by the political uncertainty and lack of visibility concerning the budget for 2025.

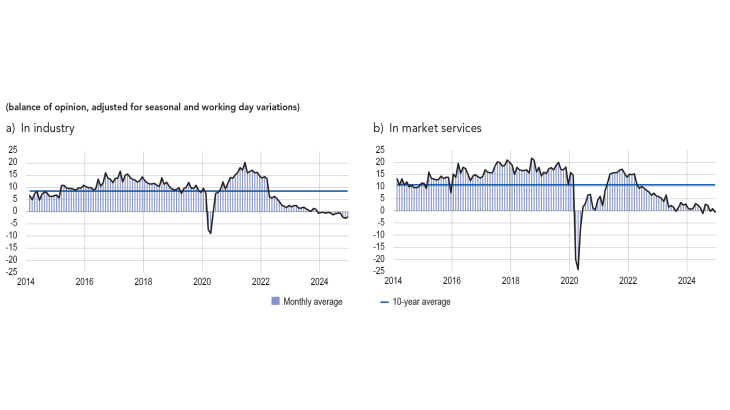

In December, the balance of opinion on cash positions remained unfavourable in industry. It deteriorated in electrical equipment, pharmaceuticals and wood/paper/printing. In all sectors, the balance of opinion is below its long-term average. In some industries, such as chemicals and aeronautics, business leaders identified longer payment times as a factor affecting their cash position.

In market services, the balance of opinion on cash positions changed little, although it varied widely across sub-sectors.

The cash position was deemed to be satisfactory in information services, engineering, publishing, leisure activities and personal services. However, it was considered weak in programming, management consultancy, advertising and cleaning.

The cash position was deemed to be satisfactory in information services, engineering, publishing, leisure activities and personal services. However, it was considered weak in programming, management consultancy, advertising and cleaning.

Cash position (balance of opinion, adjusted for seasonal and working day variations)

2. In January, business leaders expect activity to increase in industry and to a lesser extent in construction, but to slow down in market services

In January, business leaders in industry expect activity to recover to a level close to its long-term average. More specifically, this positive momentum should concern the chemicals, wearing apparel-textiles-footwear, rubber and plastic products, aeronautics and other transport sectors. However, activity is expected to decline in electrical equipment and wood/paper/printing.

After several months of growth, activity in market services is expected to slow down, especially in the transport-storage, accommodation and food services, rental and cleaning sectors.

Lastly, construction activity is expected to pick up slightly, driven by finishing works.

At the end of December, industrial order books deteriorated once again. With the exception of aeronautics, all sectors, continued to report weak order books. They are particularly weak in rubber and plastic products, machinery and equipment, wood/paper/printing, the automotive sector, and wearing apparel-textiles-footwear. Their levels continue to be deemed well below their long-term averages across all sectors.

In construction, assessments of order books deteriorated sharply this month. The downturn is especially marked in structural works, following a recovery observed since the beginning of 2024. Companies stressed the uncertainty surrounding the future of construction incentives such as zero-rate loans.

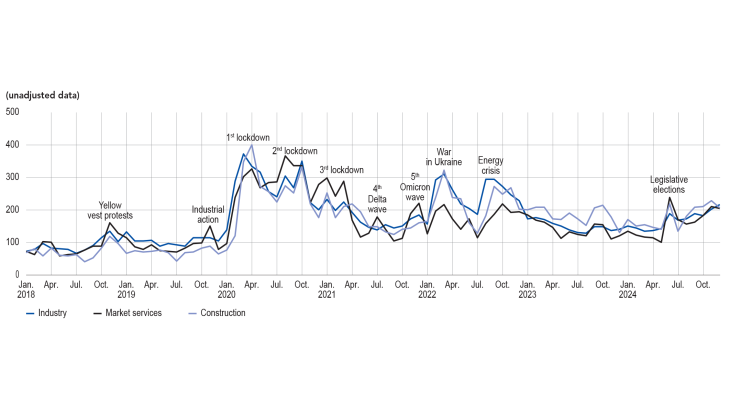

Our monthly uncertainty indicator, which is constructed from a textual analysis of comments by the respondent companies, remains high, close to the levels reported in November. Business leaders mainly highlighted the domestic political climate as a factor of uncertainty, particularly fiscal and tax policy.

Level of order books

(balance of opinion, adjusted for seasonal and working day variations)

Indicator of uncertainty in the comments section of the monthly business survey (mbs)(unadjusted data)

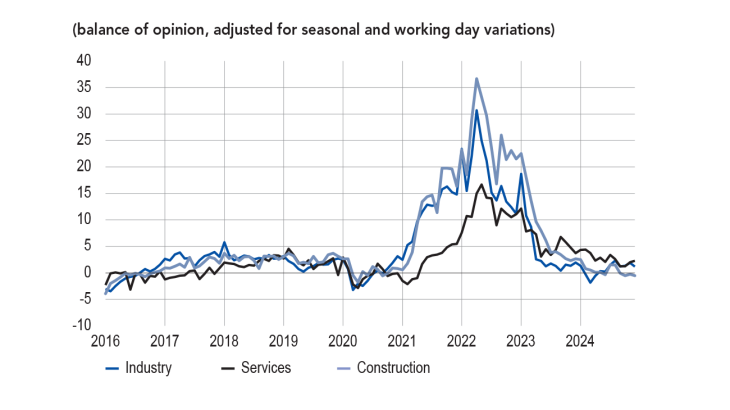

3. Selling prices continued to moderate, close to pre-Covid levels in industry and services, but lower in construction

In December, supply difficulties were generally stable compared to the previous month (10% of companies reported them, which was the same as in November). They remain relatively significant in transport, which is the most affected sector: aeronautics (44%) and the automotive industry (22%). Supply difficulties continued to be rare in the construction sector (2%).

In industry, business leaders report that raw materials prices have risen slightly. In their opinion, prices have risen significantly in the agri-food sector, and to a lesser extent in electrical equipment and aeronautics. The balance of opinion on finished goods1 deteriorated but remained slightly positive and close to its pre-Covid level.

More specifically, 4% of business leaders in industry reported that they had raised their selling prices in December, in line withv pre-Covid December figures and well below the same month in 2021 and 2022. Price increases were mainly concentrated in agri-food and pharmaceuticals (7%). Conversely, 4% of business leaders in industry reported cutting their selling prices, a higher proportion than in December during the pre-Covid period. Decreases in finished goods prices were mainly concentrated in chemicals (18%), the automotive industry (7%) and metal and metal products (6%).

In construction, 3% of business leaders reported increasing their quote prices, whereas 7% reported lowering them, which is a higher proportion than in the month of December in previous years. Moreover, the balance of opinion on price developments in this sector has been virtually zero for a number of months, driven down by structural works.

In services, the balance of opinion increased slightly, but remained comparable to pre-Covid levels. The proportion of companies reporting an increase in prices was 8%, well down on November figures for the last three years, but slightly higher than pre-Covid December figures. At the same time, the share of companies reporting a fall in their prices stood at 4%, on a par with figures reported in December of previous years. Price cuts were mainly concentrated in the rental sector.

As the start-of-year price revision period approaches, 18% of business leaders in industry were planning to raise their prices in January 2025, compared with 16% in January 2024. In market services, 17% of businesses were planning to raise their prices (compared with 21% in January 2024) as were 14% of construction businesses (14% in January 2024).

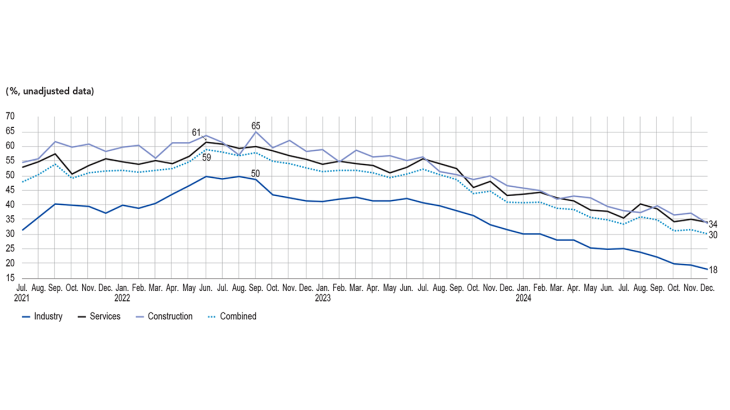

30% of business leaders reported recruitment difficulties in December, a drop of 1 percentage point on November. This proportion fell slightly in industry (18%, after 19% in November) and market services (34%; 35% in November), and more considerably in construction (34%, after 37%).

Change in finished goods prices by major sector (balance of opinion, adjusted for seasonal and working day variations)

Share of businesses reporting recruitment difficulties (%, unadjusted data)

4. Our estimates suggest that GDP will remain stable in the fourth quarter, with underlying growth in activity of around 0.2%, offset by the negative counter effects of the Olympic and Paralympic games.

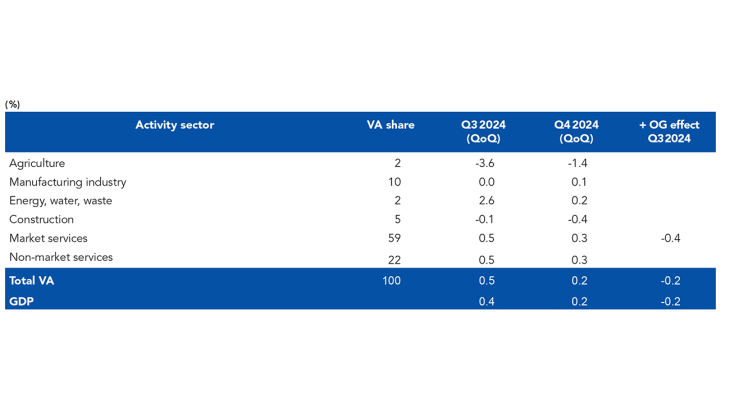

Based on the results of the Banque de France monthly business survey (MBS), rounded out by other available data (INSEE production indices and surveys and high-frequency data), we estimate that GDP should remain stable in the fourth quarter of 2024. This forecast, unchanged from last month, is attributable to underlying growth of around 0.2%, offset by the negative counter effects of the Olympic and Paralympic Games estimated at –0.2 percentage points of GDP.

Excluding the counter effects of the Olympic Games, value added in market services is set to grow this quarter, albeit at a more moderate pace than in the previous quarter. Value added in the energy and manufacturing sectors is expected to grow slightly. Lastly, construction is expected to decline as it is still being dragged down by new builds.

Quarterly changes in gdp and value added in france (en %)

Sources : INSEE data for the third quarter of 2024, Banque de France forecast for the fourth quarter of 2024.

1 The balance of opinion is the difference between the proportion of business leaders reporting increases or decreases, weighted by the intensity of the variation (with three possible grades in the monthly business survey: low, normal and high). A business leader indicating a “high” increase in prices will, all other things being equal, influence the balance of opinion more than a business leader indicating a “low” increase.

Download the full publication

Updated on the 24th of January 2025