- Home

- Publications et statistiques

- Publications

- Monthly Business Survey – Start of Janua...

The Banque de France publishes a range of monthly and quarterly economic surveys that provide a snapshot of the French economy in the form of business climate indicators and short-term forecasts.

According to the business leaders surveyed (approximately 8,500 companies and establishments questioned between 20 December 2023 and 5 January 2024), activity expanded in December in industry, market services and construction finishing works, while stabilising in construction structural works. In January, business leaders expect further growth in industry and services, albeit at a slower pace, and a deterioration in construction activities. Order books continued to contract in the construction sector. They expanded slightly in industry but levels are still deemed low, with the notable exception of the aeronautics sector.

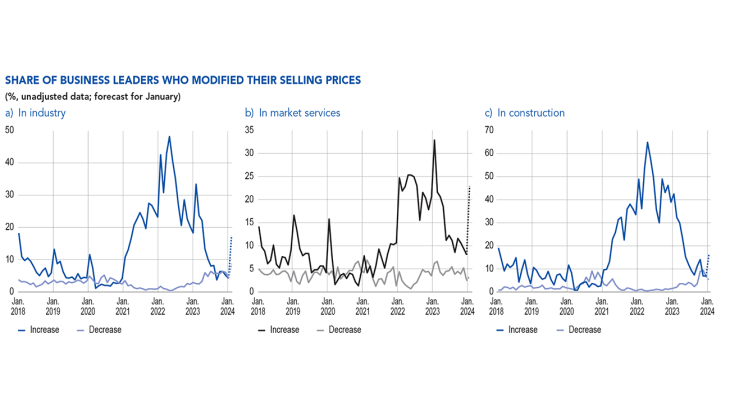

Price moderation continued. According to business leaders in industry, raw material prices stabilised while prices of finished goods showed little improvement. In December, the share of businesses increasing their prices continued to decline in industry and market services and stabilised in construction.

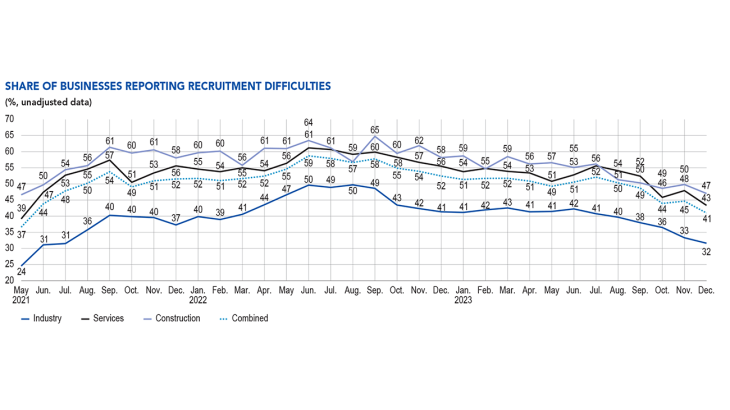

There was a perceptible downturn in recruitment difficulties, which affected 41% of the businesses surveyed compared with 45% in November.

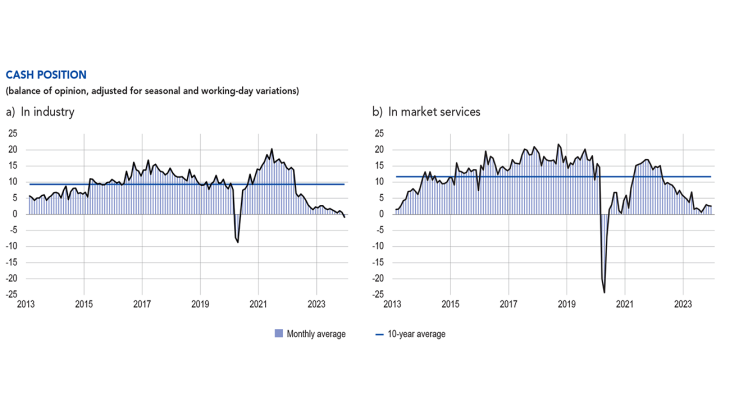

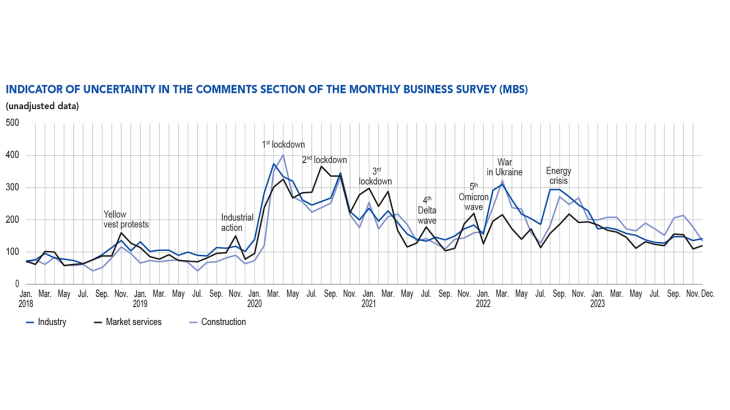

The uncertainty indicator returned to close to its pre‑Covid level in all major sectors. Cash positions deteriorated further in the industrial sector and stabilised in services. Business leaders felt that they were degraded in numerous sectors of activity.

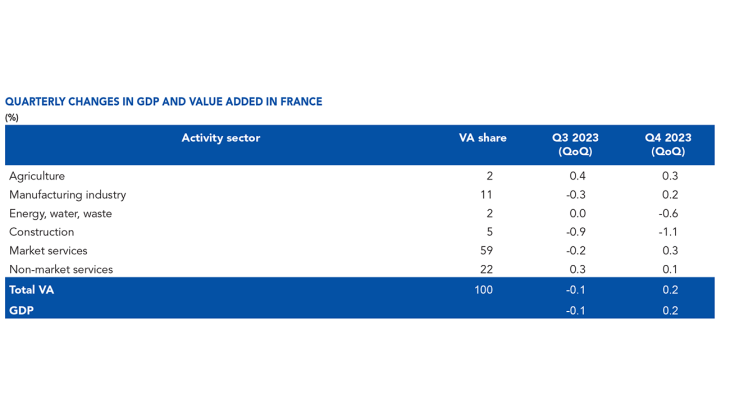

Based on the survey results as well as other indicators, fourth‑quarter GDP growth is expected to be a little higher than the 0.1% forecast in the previous month and should be closer to 0.2% (after a contraction of 0.1% in the third quarter). This was driven by market services and, to a lesser extent, manufacturing.

1. In December, activity continued to expand in industry, market services and construction finishing works

In December, activity rose sharply in industry, even though business leaders had expected a slowdown the previous month. This positive “surprise” concerned all sectors except aeronautics, whose good results were in line with expectations. It was particularly significant in chemicals, pharmaceuticals, the automotive industry and metal and metal products manufacturing. Activity declined in rubber and plastic products and wearing apparel, textiles and footwear, but at a slower pace than business leaders had expected the previous month.

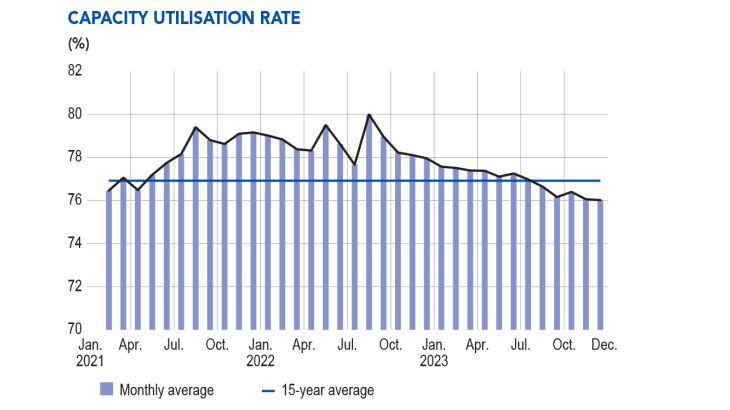

The capacity utilisation rate (CUR) remained constant at 76%. However, this is the lowest level recorded for three years and is significantly below its 15‑year average of 76.9%. CUR improved in the aeronautics and metal and metal products manufacturing sectors (up 1 percentage point) but fell back 1 percentage point in rubber and plastic products and wearing apparel, textiles and footwear.

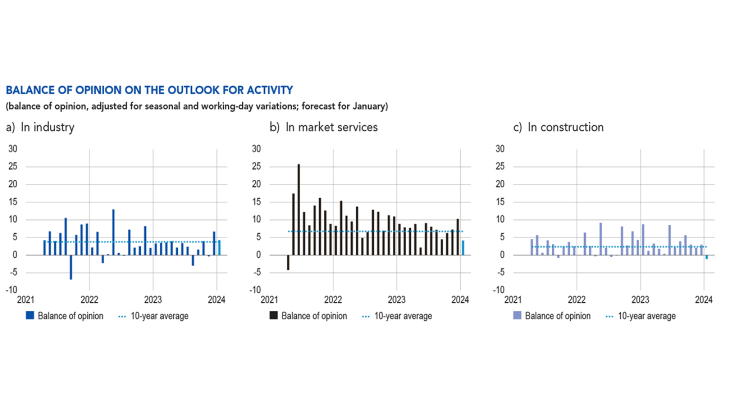

past month) stood at +7 percentage points in December in industry. For January (light blue bar), business leaders in industry are expecting a slowdown in activity to +4 percentage points.

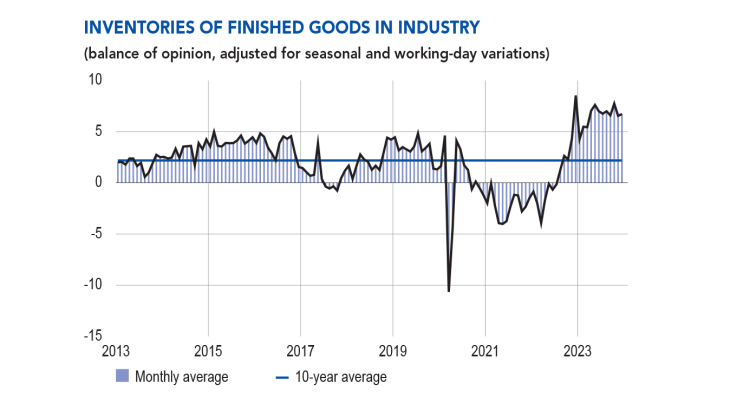

As deliveries were more dynamic in December, less production had to be stocked than in previous months: inventories of finished goods thus remained stable in December. Nonetheless, levels continue to be deemed high and above their long‑term average in all sectors except the machinery and equipment industries, wearing apparel, textiles and footwear and aeronautics.

Activity continued to expand in market services, and at a higher pace than business leaders had expected the previous month. This increase in activity mainly concerned accommodation and food services and rental and repair of motor vehicles in the consumer services sector and, in the business services sector, temporary work, which was notably boosted by rising demand in the agri‑food, transportation and storage and large general retail sectors.

In the construction sector, activity continued to expand in the finishing works sector and stabilised in structural works.

The balance of opinion on cash positions deteriorated further in industry. It was felt that cash positions were satisfactory in aeronautics and pharmaceuticals but were particularly weak in wood, paper and printing, wearing apparel, textiles and footwear, and rubber and plastic products. In December, cash positions remained stable in market services; were deemed satisfactory in publishing, architectural and engineering activities and temporary work; and were considered very weak in the motor vehicle repair, advertising and market research sectors.

2. In January, business leaders expect activity to expand at a slower pace in industry and services, and to contract in construction

Business leaders in industry expect activity to continue to expand in January, but at a slower pace and with a certain variability across sectors. For example, sharper growth is expected in aeronautics and agri‑foods but in the wood, paper and printing, rubber and plastic products, and machinery and equipment industries, activity is expected to contract slightly.

In services, activity is expected to slow down. In consumer services, business leaders expect buoyant activity in accommodation and food services, motor vehicle rental and publishing. In business services, leaders also expect sustained growth in activity in management consultancy, technical services and information services. Activity is expected to decline, however, in temporary work and personal services.

Lastly, construction activity is expected to stabilise in the finishing works sector and to contract sharply in structural works.

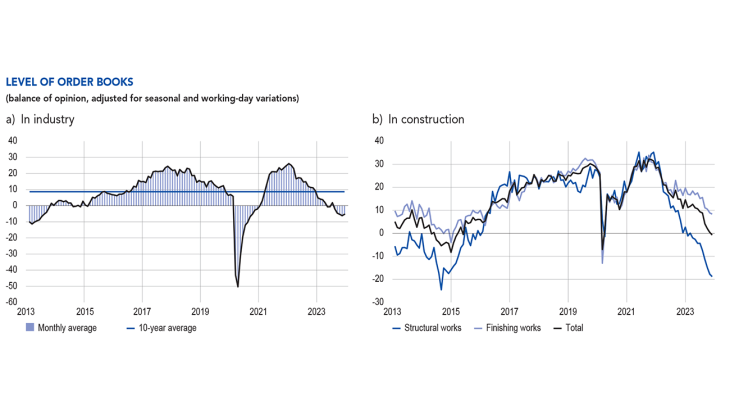

The balance of opinion on industry order books stopped deteriorating in December. Most sectors are benefiting from this trend; and most noticeably the aeronautics sector, where order books, which were already robust, expanded significantly. In the rest of the industrial sector, order book levels were deemed low.

In construction, order book levels continued to deteriorate, reaching their lowest levels since September 2014 in structural works, and falling again in finishing works and thus widening the gap with its long‑term average.

Our monthly uncertainty indicator, which is constructed from a textual analysis of comments by surveyed companies, is once again at levels that are consistent across construction, services and industry, and is slightly above the pre‑Covid levels.

3. Price moderation continued

In December, supply difficulties were unchanged in industry (14% of businesses reported difficulties, as in November) and improved in construction (7%, after 10% the previous month).

Business leaders in industry reported that raw material prices were stabilising, while prices of finished goods showed little improvement.

At a more detailed level, 5% of business leaders in industry reported that they had raised their selling prices in December. This is unchanged from November but below the 19% reported in December 2022. Moreover, 4% of business leaders in industry reported lowering their selling prices in December, compared with 3% in December 2022. Decreases in finished goods prices were most common in chemicals (9%), wood‑paper‑printing (9%), agri‑foods (7%) and electrical equipment (7%); in all these sectors, the share of businesses that lowered their prices was higher than those that raised them.

In construction, 7% of businesses raised their prices in December (compared with 39% in December 2022), while 6% lowered them.

In services, 8% of businesses reported that they had raised their prices in December (compared with 21% in December 2022), while 3% lowered them.

As the start‑of‑year price revision period approached, 18% of business leaders in industry were planning to raise their prices in January, compared with 34% in January 2023. Conversely, 9% of business leaders in industry were planning to lower their prices. This proportion climbs to 12% for business leaders in agri‑foods, as the timetable for commercial negotiations was moved up. In construction, 16% of businesses were planning to raise their prices (compared with 42% in January 2023) as were 23% of services businesses (compared with 33% in January 2023).

Business leaders were also asked about their recruitment difficulties, which declined again in December: 41% of the businesses surveyed across all sectors reported difficulties, compared with 45% in November.

4. Our estimates suggest an increase

in activity in the fourth quarter

Based on the results of the Banque de France monthly business survey (MBS), as well as other available data (INSEE production indices and surveys and high‑frequency data), we estimate that real GDP will rise slightly, with growth of up to 0.2% in the fourth quarter, after contracting by 0.1% in the previous quarter. This forecast has been revised upwards slightly on the previous month (forecasted growth of 0.1%), due to the December MBS results being better than business leaders had expected as well as a stronger manufacturing production index in November.

This quarter, activity is expected to be driven by market services, and particularly by information and communication, accommodation and food, and business services. In the manufacturing sector, value added is expected to bounce back after its third‑quarter decline. Indeed, the survey pointed to a good level of activity in this sector in December, in addition to a recovery in the monthly industrial production index in November. Value added is expected to fall in the energy sector, in line with the mild temperatures recorded this autumn. Lastly, value added is expected to decline again in the construction sector, reflecting the downward trend in housing starts.

Note: QoQ = quarterly change.

Download the paper

Updated on the 25th of July 2024