We analyze the redistribution channel of a money-financed (MFFS) versus debt-financed fiscal stimulus (DFFS) in a model where a fraction of agents is borrowing constrained. We find that a money-fonanced fiscal stimulus is able to redistribute from savers to borrowers around the double of what a debt-financed fiscal stimulus does. The redistribution channel of the stimuli can be decomposed in what Auclert (2019) calls the Fisher effect and the interest rate exposure effect. The unexpected increase in the price level due to the injection of liquidity of a money financed fiscal stimulus revalues nominal balance sheets with nominal

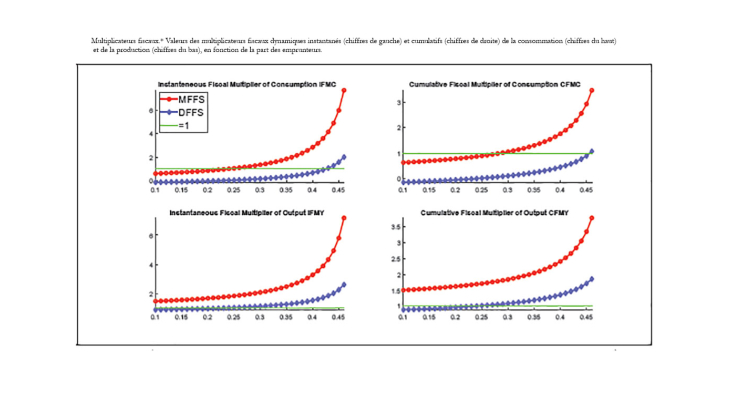

creditors losing and nominal debtors gaining (Fisher effect). In addition, the real interest rate fall redistributes away from savers to borrowers (interest rate exposure effect). However, a money-financed fiscal stimulus generates larger fluctuations than a DFFS in the output gap, inflation gap and consumption gap. Consequently a MFFS generates larger welfare losses than a DFFS. The consumption equivalent welfare losses are particularly large in a borrower-saver framework due to the presence of the consumption gap that characterizes the welfare function, which is instead absent in a representative agent model. To sum up, the redistributive effects are welfare detrimental. But, the larger the redistributive effects, the higher the impact and cumulative fiscal multipliers are and more effective the stimulus is (see Figure). Finally, differently from Galì (2020), we show a liquidity trap scenario amplifies the differences between money-financed and debt-financed fiscal stimuli.