The Ukrainian central bank's wartime actions have historical precedents

Historically, central banks have had to be called upon in times of war, either to contribute to the solvency of states (Poast, 2015; Pamfili and Chambley, 2017), or later to ensure the liquidity of the banking system (Margairaz, 2019).

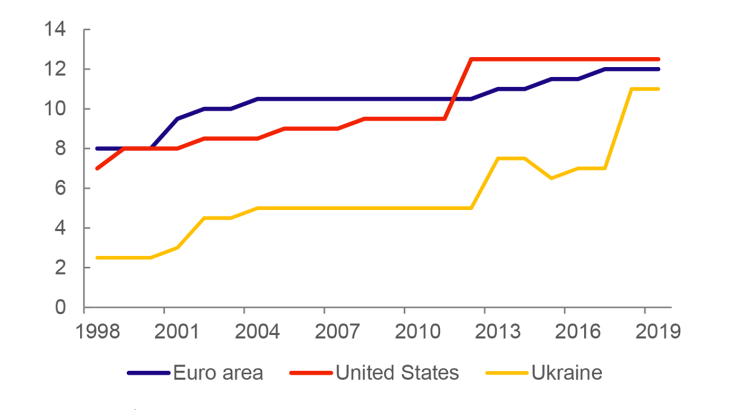

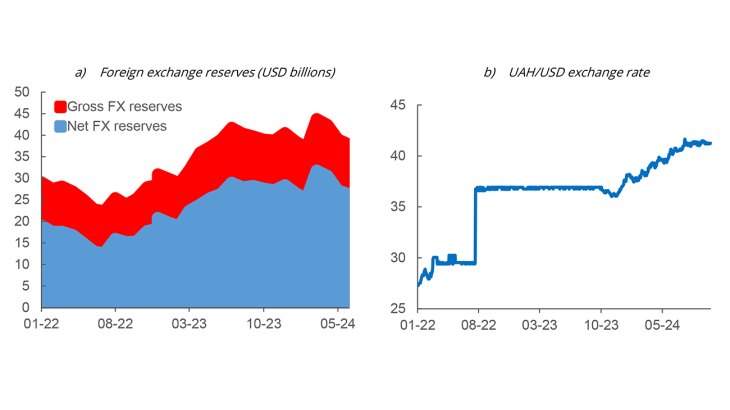

Since the introduction of inflation-targeting regimes in the 1990s and the increasing internationalisation of economies, the actions of central banks in wartime have come to be seen through a new lens, as they must maintain both the internal and the external autonomy of monetary policy (Mundell, 1960). This is the case of the NBU, which, thanks to the reforms undertaken from 2014, has gained this dual autonomy, thereby bringing its monetary policy framework closer to those of advanced economies: adoption of a floating exchange rate regime, inflation targeting, improvement in the degree of independence according to the Romelli index (2022), and greater transparency in the conduct of monetary policy (see Chart 1).

The NBU's actions since the Russian invasion therefore differ from past examples of central banks in wartime. This blog post looks at how the NBU was able to preserve its dual autonomy while supporting the war effort.

Chart 1. The NBU, a modern central bank (transparency index)