Why is it important to anchor inflation expectations?

Many important economic decisions depend on inflation expectations. These expectations play a role, for example, in setting the prices of goods and services, in wage negotiations, in deciding whether or not to take out a bank loan, etc. The anchoring of these expectations, i.e. their stability over time, is therefore a necessary condition for macroeconomic stability.

Inflation expectations are also a measure of the central bank's credibility. Since most central banks aim to stabilise inflation around a given target level, if economic agents believe that the central bank will fulfil its mandate, then they naturally expect that long-term inflation will stand at this target level.

For these two reasons, central bankers closely monitor changes in inflation expectations, for example, through private sector surveys, and in some cases respond by changing their monetary policy stance.

The use of monetary policy rules to anchor inflation expectations

But to what extent can a central bank actually influence inflation expectations to anchor them at a given level?

The answer in the economic literature is simple: the central bank must follow a monetary policy rule in order to anchor expectations permanently at the desired level. The rule defines the level of an instrument (e.g. key interest rates) based on observable economic variables (inflation, growth in economic activity, etc.), for example the "Taylor rule". This rule states that central banks set short-term interest rates in response to changes in the values of inflation and the output gap. Thanks to these types of rules, the private sector knows how the central bank will react to their inflation expectations. If the rule is correctly chosen, it is assumed to anchor expectations at the level desired by the central bank.

The academic debate on the anchoring of inflation expectations therefore focuses on identifying the right instrument and the right monetary policy rule to anchor inflation. Some even suggest that central banks should officially follow a monetary policy rule, as in one of the proposals in the Financial Choice Act of 2017 in the United States, which was intended to force the Fed to follow a Taylor rule.

But can we really rely on monetary policy rules to anchor expectations?

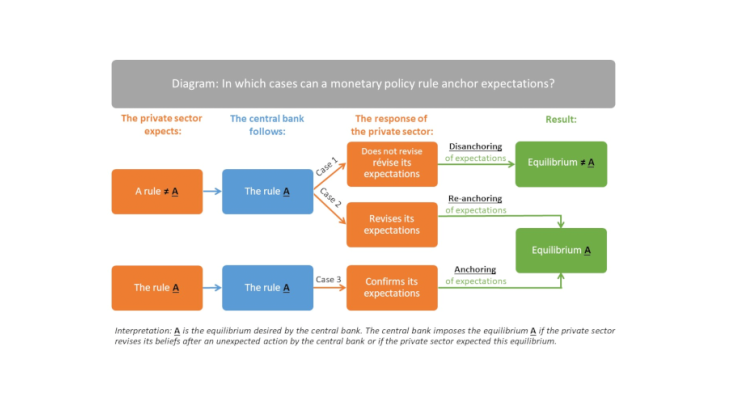

Economists say that a monetary policy rule anchors expectations if and only if only one level of inflation is possible when the private sector expects this rule and the central bank actually follows it (case 3 in the diagram above).

But what happens if the private sector does not believe in the rule and expects that the central bank will act in a way that is incompatible with it (cases 1 and 2 in the diagram)? This type of expectation is only possible if (i) private sector expectations are not rational or (ii) the central bank cannot commit itself to following the rule regardless of its ultimate desirability. To consider this second case, Barthélemy and Mengus (2019) use a concept of equilibrium from game theory known as subgame perfect equilibrium. This concept of equilibrium makes it possible to place a limit on the central bank's commitment capacity: it only follows a rule if it is the best decision to take at any given date vis-à-vis its objective.

If the central bank's commitment capacity is limited, i.e. if it is not prepared to pursue its policy at any cost, we show that no rule is sufficient to anchor inflation expectations. The reason for this is: if private agents do not expect the central bank to follow its rule but rather another one, the central bank will not follow its own rule but instead that expected by the private sector.

What is the mechanism? The central bank will only choose to deviate from what is expected by private agents if the long-term gain from the re-alignment of private agents with the equilibrium desired by the central bank is greater than the short-term cost of deviating from expectations. If private agents are so confident that they never revise their expectations, then the central bank will not perceive any long-term gains and will therefore choose not to deviate. Thus, it is the private sector that ultimately selects the equilibrium, and not the central bank.

It would therefore be futile to seek at any cost a rule that would ensure that expectations are permanently anchored. Unless we consider that the central bank can commit to a policy even if it means possibly deviating very significantly from its objective, such a rule does not exist.

What can we therefore expect from a monetary policy rule?

This result could suggest that the central bank's use of a monetary policy rule is totally unnecessary and that the central bank can do nothing to anchor inflation expectations. However, we show that this is not the case.

If the private sector is uncertain about the central bank's future action but is willing to be convinced, then the central bank can change agents' expectations by acting according to a rule. Economic agents who were sceptical, but uncertain, then revise their expectations and the central bank's decision to follow its rule then has the effect of re-anchoring inflation expectations (case 2 in the diagram).

However, two main conditions are necessary for such a re-anchoring to occur: (i) that agents revise their expectations fairly quickly and (ii) that the central bank is sufficiently forward-looking - as re-anchoring can be costly in the short term. Point (i) suggests that it is important for the central bank to communicate its intentions clearly and as widely as possible so that agents can revise their expectations rapidly. Lastly, point (ii) shows why it is necessary to guarantee the independence of central banks: this independence ensures that it can pursue a long-term objective and therefore does not focus on short-term costs to the detriment of long-term gains.