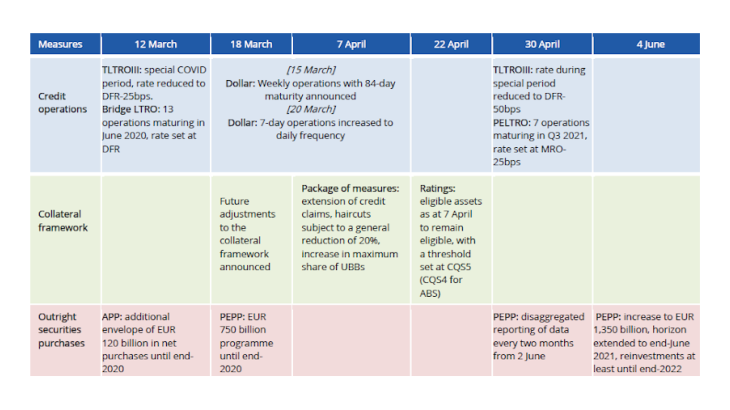

DFR: deposit facility rate; MRO: main refinancing operations; CQS: credit quality step; UBB: unsecured bank bond; TLTROIII, PELTRO, bridge LTRO, APP, PEPP: cf. definitions below.

While health and fiscal policies make up the front-line in the public response to COVID-19, monetary policy is also playing a key role, in particular by maintaining financial sector liquidity whilst ensuring that the real sector, i.e. households, companies and general government, continues to benefit from favourable financing conditions during this period. Beginning in early March, the Eurosystem, which comprises the ECB and euro area national central banks, thus took steps to safeguard the efficient transmission of monetary policy and ward off the risks of financial market fragmentation in the euro area (Table). Other major central banks have done likewise.

Measures to extend and adjust Eurosystem credit operations

The conditions for targeted longer-term refinancing operations (TLTROs) were significantly eased to support lending to the economy. TLTROs, which have been implemented through three series of operations since 2014, are referred to as “targeted” because the amounts that may be borrowed and the applicable rates are tied to the volume of loans to non-financial corporations and households (except for house purchases), so creating an incentive for banks to lend.

On 12 March 2020 (and then again on 30 April 2020), the ECB announced that it was further easing the conditions for the third TLTRO series, which was launched in 2019 (TLTROIII), notably by introducing a special period, running from June 2020 to June 2021, during which the rate on the operations will be reduced to 50 bps below the DFR (i.e. at present -1%). It will also be easier for borrowing banks to obtain the most favourable rates, owing to a reduction in lending targets (Cf. ECB and Banque de France websites for more details).

The Eurosystem also launched a number of new operations:

- Bridge LTROs: on 12 March 2020, the Eurosystem announced a series of 13 additional longer-term refinancing operations (LTROs), conducted as weekly fixed rate tender procedures with full allotment. The rate used is the DFR. All of these operations will mature on 24 June 2020, which is the settlement date of the June TLTROIII. The purpose of these operations is to provide liquidity support and bridge the period until the new TLTROIII operations with relaxed requirements.

- Dollar operations: on 15 March 2020, the Eurosystem announced, as part of coordinated action by six major central banks, a series of weekly operations to provide dollar liquidity on a longer-term basis (84 days) at a rate of OIS+25 bps. The frequency of the 7-day operations was later increased to daily (20 March 2020).

- PELTROs: on 30 April 2020, the Eurosystem announced a new series of Pandemic Emergency Longer-Term Refinancing Operations (PELTROs). The 7 PELTROs will be conducted starting at the end of May 2020 as fixed rate tender procedures with full allotment. The interest rate will be MRO-25 bps. Maturing between July and September 2021, they will provide a liquidity backstop, especially for banks that are unable to take part in TLTROIII operations.

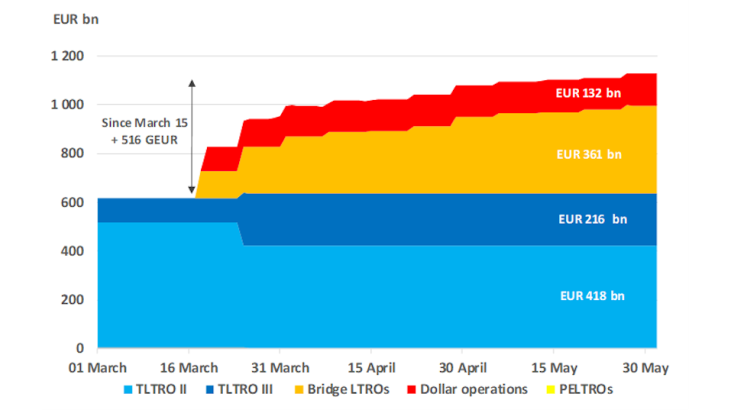

Following these measures, the outstanding amount of refinancing provided by the Eurosystem in EUR and USD to euro area banks increased significantly, climbing by over EUR 500 billion between mid-March and the end of May to exceed EUR 1,000 billion (Chart) even before the June TLTROIII.