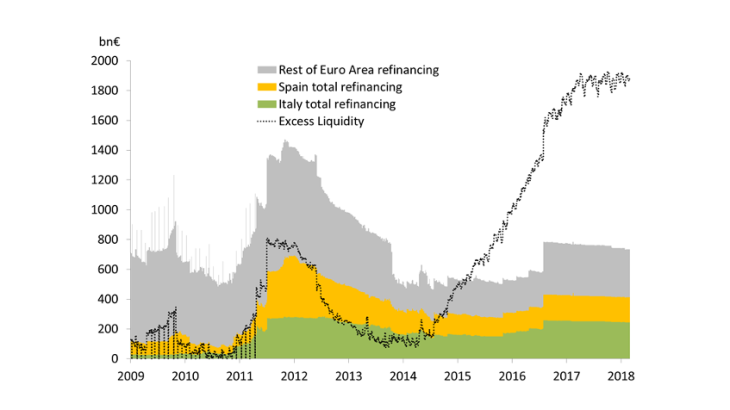

Note: central bank refinancing of Italian and Spanish commercial banks, compared with Eurosystem refinancing as a whole and excess liquidity

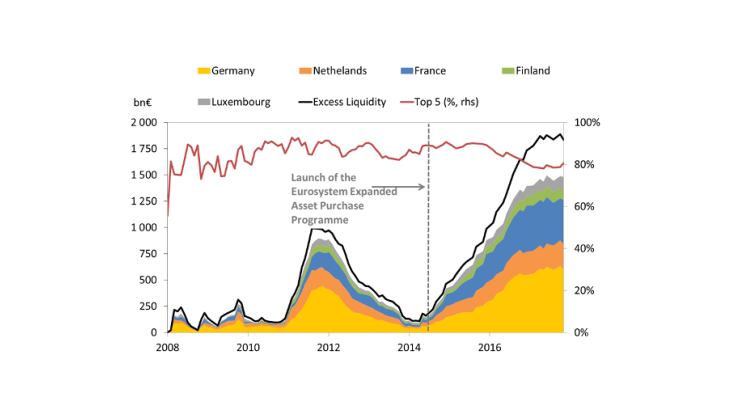

During this period, the bulk of liquidity was provided by the Eurosystem to the banks of the countries most exposed to financial stress (Spain and Italy in particular, see Chart 2). However, in the context of an interbank market freeze (sharp increase in risk perception among banks) and a flight-to-quality phenomenon (investors' preference for the safest assets, particularly in "core” countries), liquidity built up in the banking systems of a few countries only. This was particularly the case in Germany, the Netherlands, France, Finland and Luxembourg, which together accounted for over 80% of the excess liquidity as of 2009.

As of 2015: mainly due to the Eurosystem's asset purchase programme (APP)

While excess liquidity declined sharply after 2012, in line with the easing of financial strains, it started to accumulate again, for very different reasons, as of March 2015 (see Chart 1), following the launch of the expanded APP. In this instance, excess liquidity resulted mechanically from measures taken by the Eurosystem and did not reflect increased financial stress.

The new targeted longer-term refinancing operations (TLTROs), with a maturity of four years, also led to an increase in excess liquidity. Yet, the massive liquidity injection carried out by the ECB under the APP was the main reason why excess liquidity rose as of 2015.

With the decline in financial stress and risk aversion, liquidity should have been distributed in a more homogeneous manner, in line with the ECB capital key, which determines the allocation of the Eurosystem’s asset purchases among issuing countries. However, as shown in Chart 1, this redistribution of liquidity did not take place and it has remained concentrated in five countries.

The first reason is the fact that sovereign yields remained relatively high in countries such as Italy, Spain or Portugal, which may have encouraged banks in these countries to invest in such securities, rather than deposit their liquidity at a lower interest rate with the central bank. As the yields on these countries’ sovereign bonds declined, this opportunity disappeared, leading to a shift in banks' investments towards higher yielding assets, issued largely outside the euro area (hence a trend increase in liquidity flows to the financial centres of the "core" countries - see below).

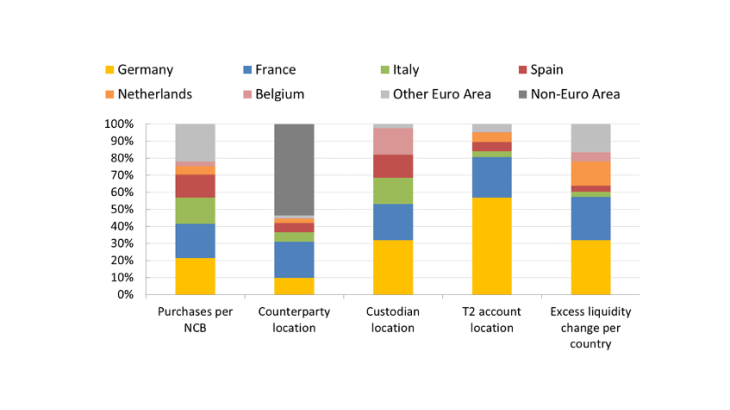

Influence of the geographical location of the accounts of Eurosystem counterparties

The second, more structural reason concerns the liquidity flows generated by Eurosystem purchases conducted with counterparties outside the euro area, whose settlement accounts are largely concentrated in the financial centres of a few euro area countries.

Chart 3 shows that the APP generated significant liquidity flows to accounts in Germany and, to a lesser extent, in France. Liquidity then seems to have been concentrated in a small number of countries, in particular the Netherlands. Luxembourg is, for its part, a major financial centre, home to numerous asset management firms. As regards Finland, it notably hosts the accounts of non-euro area Scandinavian institutions. This confirms that after 2015, the concentration of liquidity flows among a small number of “core” countries was not due to renewed risk aversion but rather to the choices of the main Eurosystem counterparties.