- Home

- Publications et statistiques

- Publications

- Macroeconomic projections – December 202...

In order to contribute to the national and European economic debate, the Banque de France periodically publishes macroeconomic forecasts for France, constructed as part of the Eurosystem projection exercise and covering the current and two forthcoming years. Each publication comprises a summary of the projections. Some also include an in-depth analysis of the results, along with focus articles on topics of interest.

Introduction

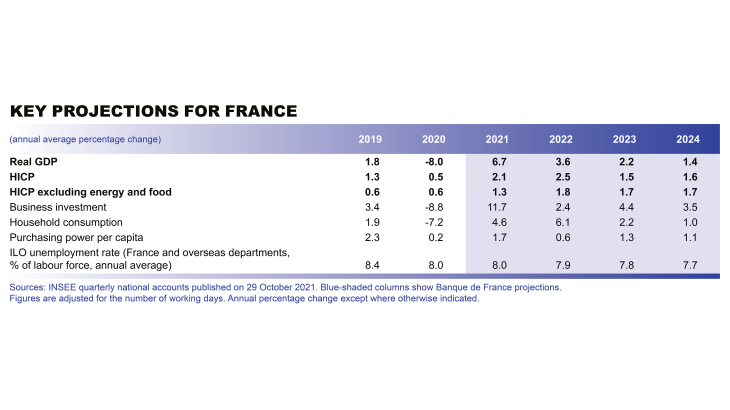

• French economic activity returned to its pre-crisis level as of the third quarter, and the recovery in 2021 remains solid. GDP growth is expected to reach 6.7% in annual average terms in 2021, then to moderate to 3.6% in 2022 and to 2.2% in 2023. It should then return to a much lower pace, closer to potential, at just 1.4% in 2024.

• Over the end of 2021 and start of 2022, two factors are expected to cause some temporary disruption to this trajectory: first, supply bottlenecks, which are notably hitting sectors such as car production; second, the resurgence of the epidemic, with a fifth global wave of virus infections and the emergence of the Omicron variant. The French economy has nonetheless proved its ability to adapt to the pandemic environment. As a result, and as indicated by our business surveys, French GDP is expected to continue rising in the fourth quarter of 2021 and first quarter of 2022, albeit at a slightly lower pace. Given the current uncertainties, however, we also provide an alternative scenario showing a worsening of the public health situation, where activity slows more sharply but very temporarily (see Box 2).

• Between 2021 and 2024, headline inflation should follow a two-phase trajectory.

• With higher oil prices and supply constraints fuelling sharp growth in energy and manufactured goods prices, headline inflation should peak in the fourth quarter of 2021 before easing gradually to below 2% by end-2022. This is what has been referred to as the “inflation hump”.

• In 2023-24, manufactured goods inflation should weaken, as frequently observed in the past. But the strong labour market and decline in economic slack should support robust wage growth over the longer term, leading in turn to higher services inflation. Inflation excluding energy and food is thus expected to average 1.7% in 2023 and 2024, which is well above pre-Covid rates and similar to those seen in 2002-07 (see Box 1 on this subject). However, this price and wage growth is not expected to dampen the rise in household purchasing power or in corporate margins, which are both projected to reach levels similar to those before the Covid crisis.

• There is still a high degree of uncertainty surrounding our inflation projection. In the short term, inflation could remain at its peak for longer if the current pressures on input prices prove more persistent than expected or if energy prices rise again. In the medium term, the path of inflation will also depend on the pass-through of prices to wages and vice versa.

Découvrez nos projections macroéconomiques 🇫🇷 📈 – Décembre 2021 | Banque de France

After an exceptionally strong rebound in the first three quarters of 2021, French economic activity should rise at a more moderate pace over the end of 2021 and start of 2022

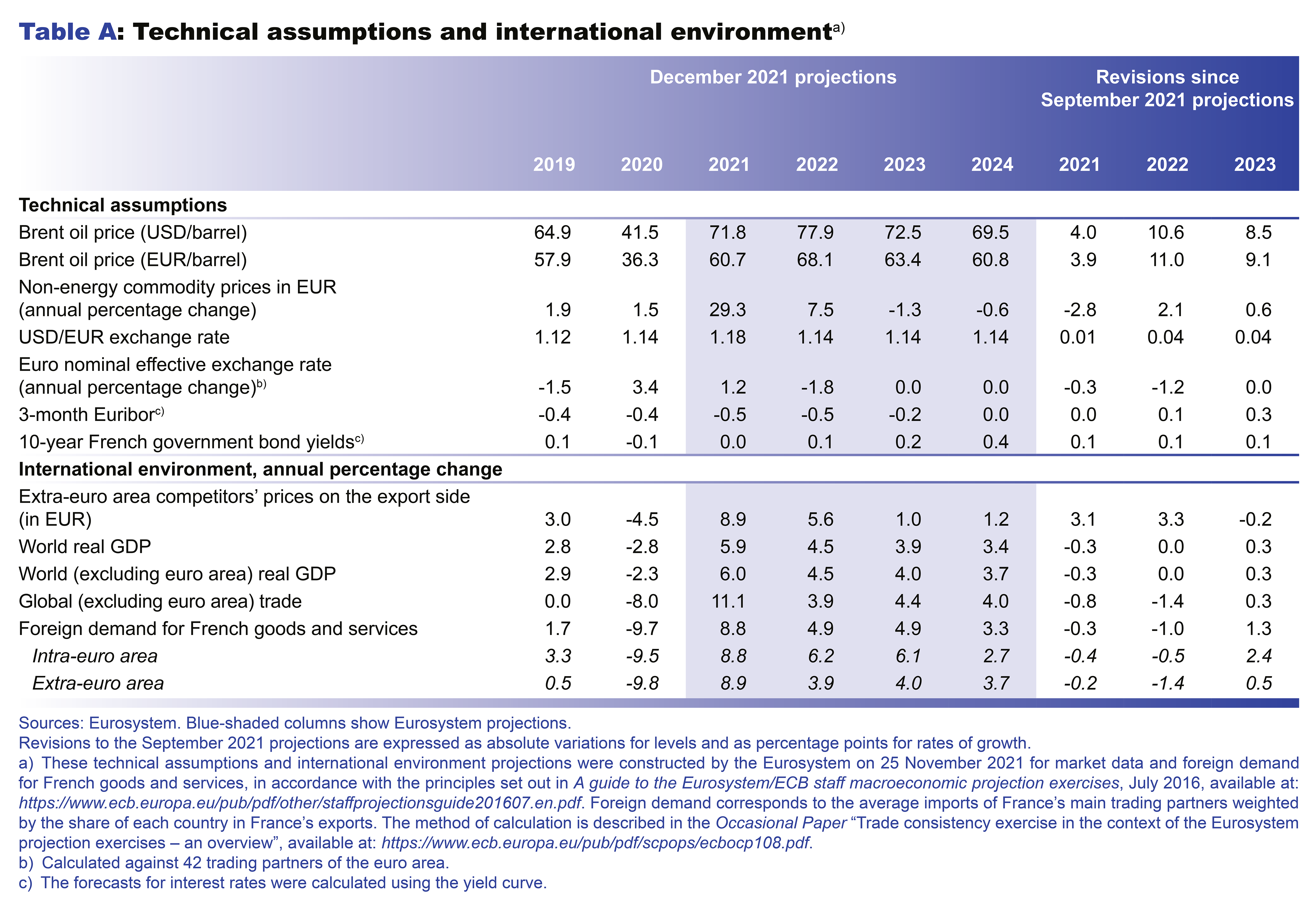

Our economic growth projections for 2021-24 are based on a number of assumptions. They incorporate INSEE’s first estimate of the third quarter 2021 national accounts, published on 29 October 2021. The second estimate of quarterly accounts published at the end of November contained few changes and confirmed the growth figure of 3.0% for the third quarter of 2021. The assumptions concerning the international and financial environment, for which the cut-off date is 25 November (see Table A in the appendix), are those used in the Eurosystem projections for the entire euro area. These assumptions confirm the rebound in foreign demand for French goods and services (growth of 8.8% in 2021 followed by 4.9% in 2022 and 2023 respectively), but revise it downwards for 2022 and upwards for 2023 compared with the assumptions in our September projections. The rise in raw material prices is also considerably larger in these assumptions than in those used in September: the price of oil in dollars has been revised upwards by USD 4 for 2021, by USD 11 for 2022 and by USD 8 for 2023 (the decline in the price of oil since the end of November poses a downward risk to our inflation forecast; see below).

These revisions – to external demand from our trading partners and to import prices – reflect two factors. First, supply chain disruptions have continued to intensify since the summer and are hampering the recovery in many sectors. Second, the economic outlook in all countries remains contingent on the epidemic. The situation has recently deteriorated again, especially in Europe and with the emergence of the Omicron variant at the global level. As a result, several countries have reintroduced measures that will restrict activity in the short term, although economies are increasingly adapting to the new conditions. These factors mean that we now expect the global economy to take slightly longer, until the end of 2022 and in 2023, to recoup all the ground lost since the start of the Covid crisis. By this time, the supply chain disruptions are also expected to have dissipated.

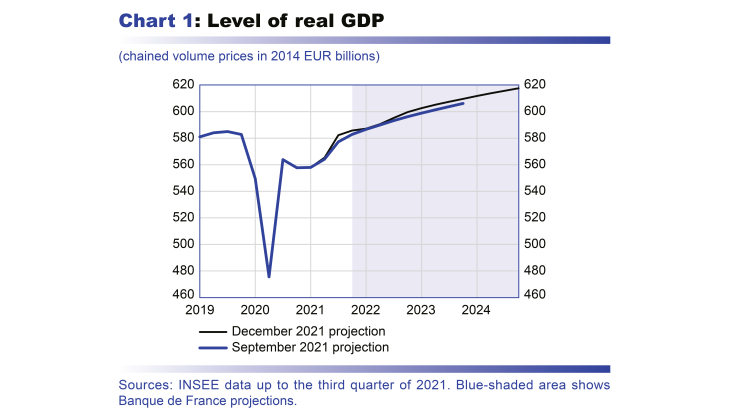

The quarterly path of activity in France is expected to reflect these shocks (see Chart 1). In the third quarter of 2021, the strong roll-out of the vaccination campaign and easing of the containment measures enabled activity to rebound sharply and by far more than we had anticipated. GDP therefore returned to its end-2019 level, although it still has some way to go to get back to where it would have been without the crisis. The rebound is expected to moderate somewhat in the fourth quarter of 2021 and first quarter of 2022 (GDP growth of 0.6% and 0.2% respectively), on account of supply bottlenecks and the resurgence of the epidemic. However, our business surveys show that the economy is adapting to the new conditions, so GDP should remain on an upward path over the coming months. As of spring 2022, activity should rebound more sharply, and should gradually return to near its pre-crisis trajectory in 2024.

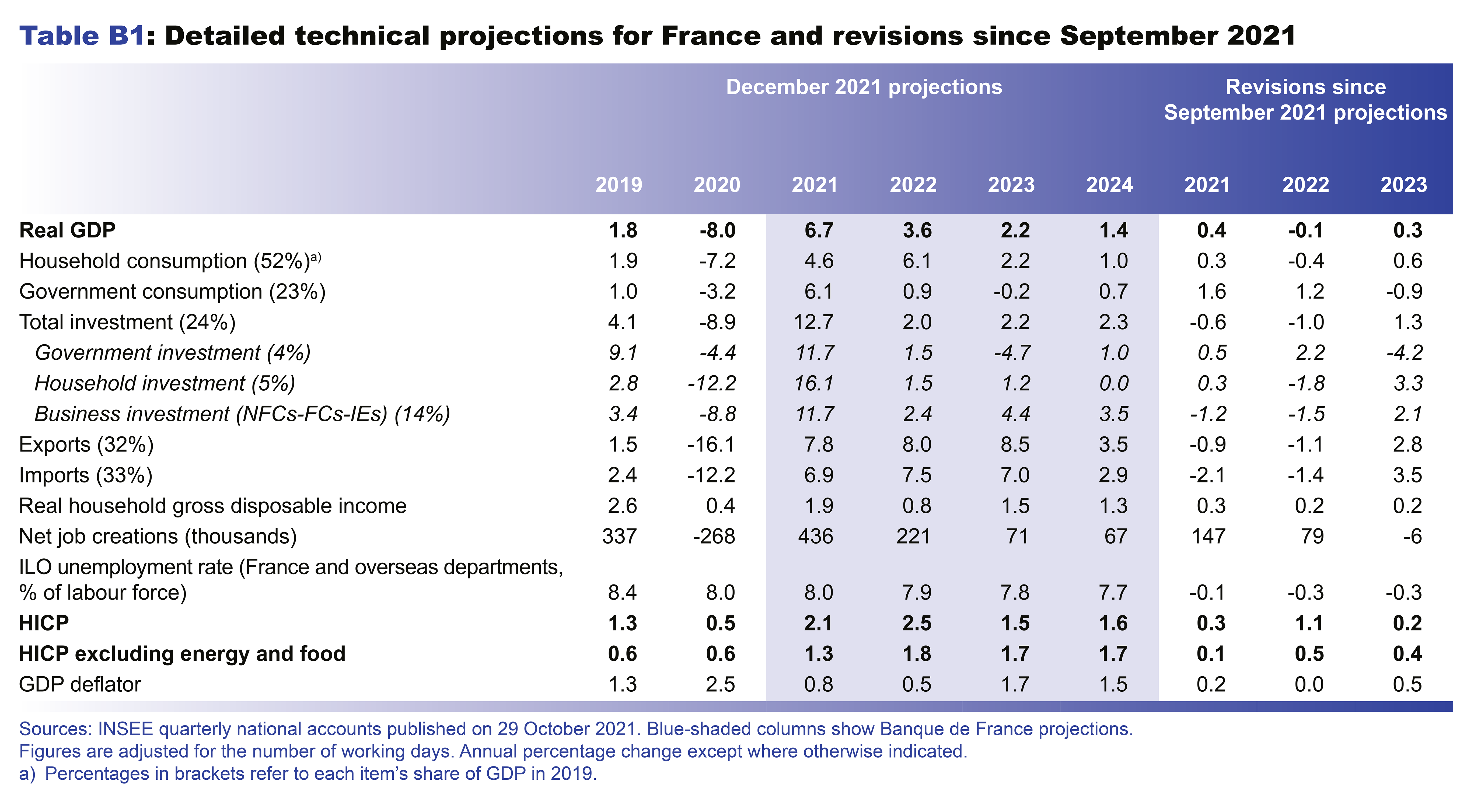

The GDP projection has been revised downwards for 2022 but upwards for 2023

GDP is projected to grow by 6.7% in 2021, 3.6% in 2022, 2.2% in 2023 and 1.4% in 2024. Since our September publication, the forecast for 2021 has been revised upwards (to 6.7% from 6.3%) to reflect the sharp rebound observed in the third quarter of the year. However, growth is now expected to slow more sharply over the end of 2021 and start of 2022, leading to a downward revision to the 2022 forecast (to 3.6% from 3.7%). The upward revision to growth for 2023 (2.2% compared with 1.9%) reflects the fact that the rebound has been pushed back slightly in the current context, and is now expected to last into 2023. In 2024, activity should come back to its more usual rate of growth (1.4%), in line with its long-term trend. By the end of the projection horizon, activity should be close to the level we predicted before the crisis. Indeed, we expect the permanent loss in GDP caused by the crisis to be very limited, thanks notably to a resilient labour market. The projections also take into account the effects of the recovery plan.

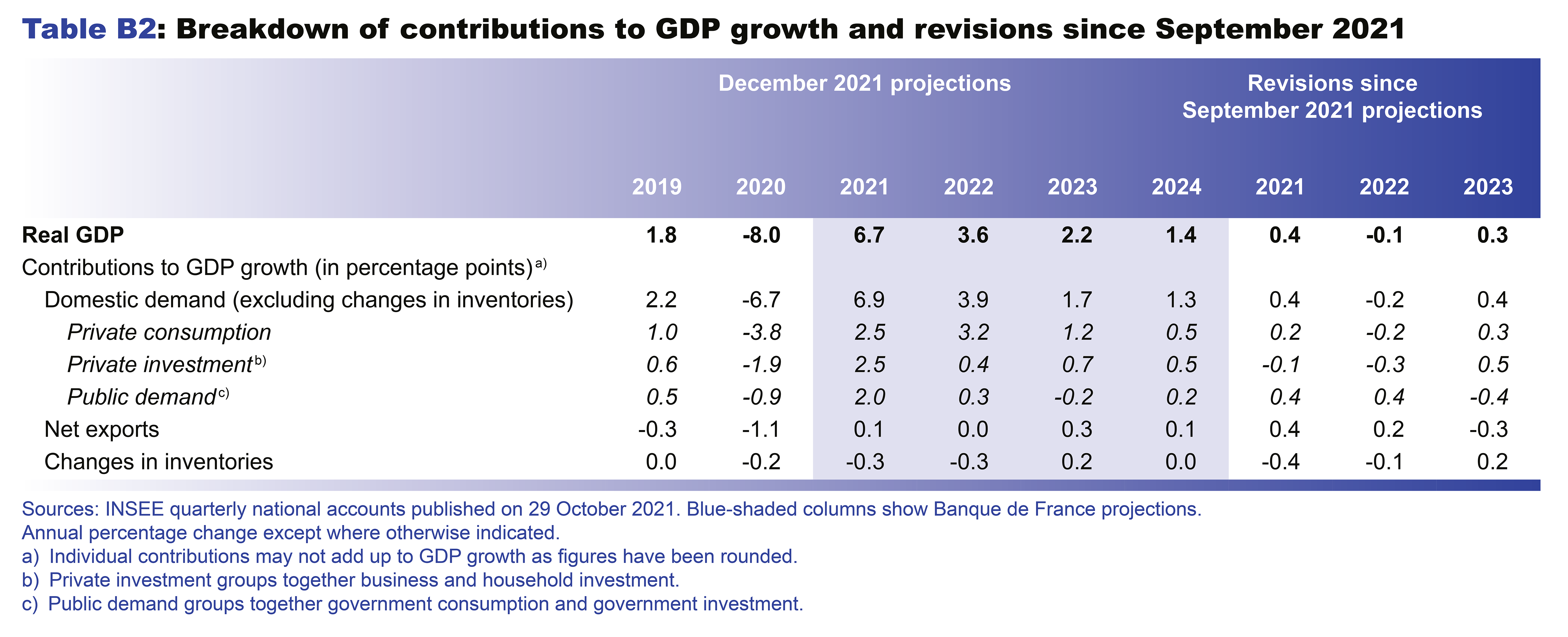

In 2021 and 2022, the strong growth in activity should be driven by a rebound in all components of domestic demand (see Chart 2 above). Business and household investment already recovered sharply in 2021, and household consumption should gain momentum in 2022. By contrast, the contribution of net trade is not expected to recover in 2022 after the steep drop seen in 2020, as exports are only rebounding partially in certain sectors. The contribution of changes in inventories is also expected to remain negative in 2022 due to supply bottlenecks.

In 2023, the international environment is expected to prove more positive; net trade is projected to make a positive contribution and the dissipation of global supply bottlenecks should allow firms to rebuild their inventories. In 2024, all growth contributors should come back to their more usual, long-term levels.

Headline inflation is seen peaking near 3.5% by end-2021, with the energy component making a strong contribution, but should ease to below 2% by end-2022. It is expected to be 1.5-1.6% in 2023 and 2024, buoyed by renewed growth in services prices

Inflation as measured by the Harmonised Index of Consumer Prices (HICP) has continued to increase in recent months, rising from an annual rate of 2.4% in August 2021 to 3.4% in November. National CPI (Consumer Price Index) inflation is 2.8%: the unusually large gap between the two measures stems from the higher weight of energy products in the HICP basket, and should be reabsorbed over the projection horizon as the impact of higher energy prices fades (see below).

The surge in HICP inflation over the past few months reflects the rebound in oil and gas prices from the lows seen in 2020. It also reflects a gradual recovery in HICP inflation excluding energy and food, which went from 1.3% in August 2021 to 2.1% in November. Manufactured goods prices have risen sharply owing to the upward pressures on global input prices. Services prices have also started to gather pace after the slowdown in 2020.

The rise in inflation since August has proved stronger than we predicted in September. The main reason for the surprise is the energy component, due to the increases in oil prices and, until they were frozen in October 2021, gas prices.

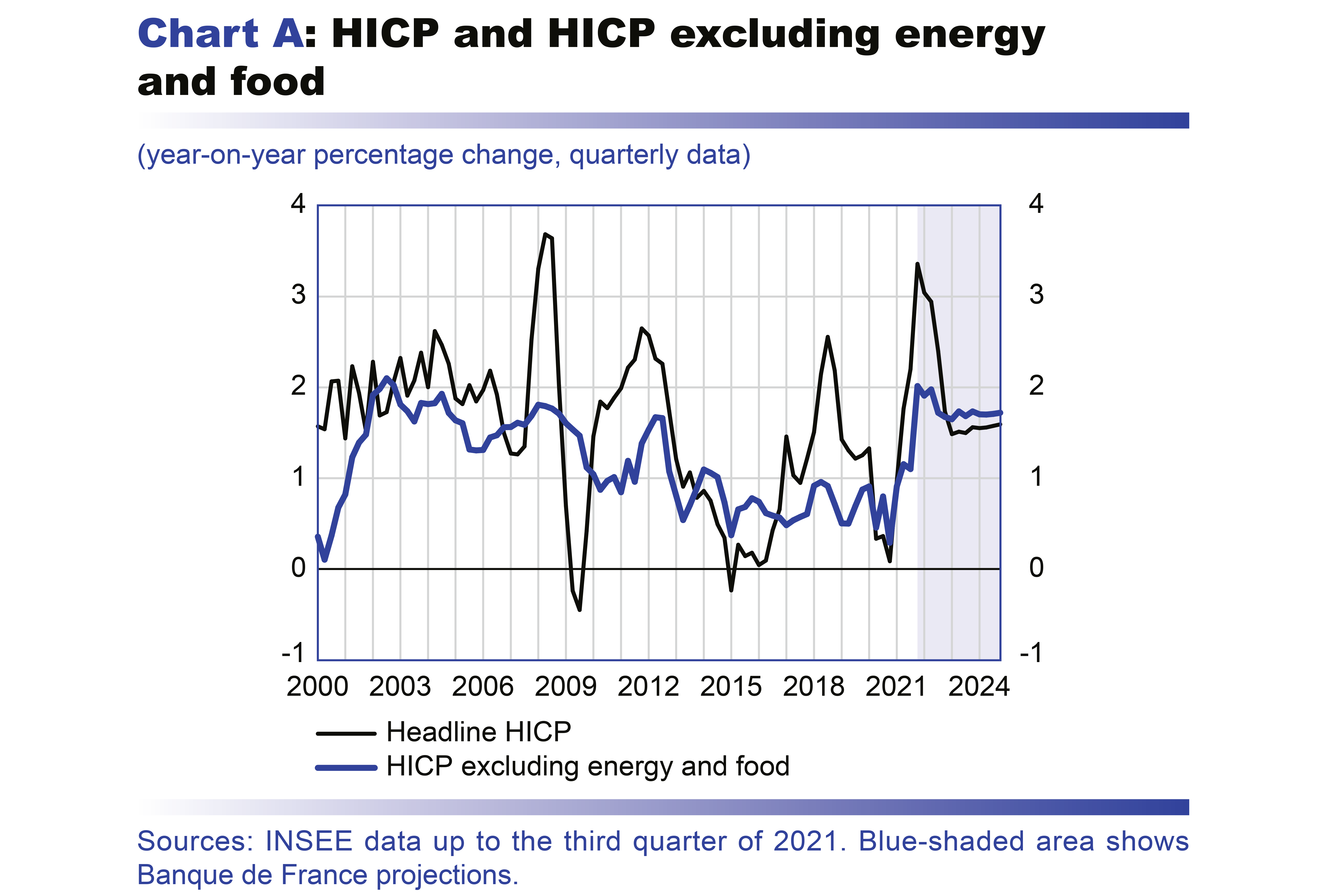

HICP inflation is predicted to peak in December 2021 at a rate close to that seen in November. From the start of 2022, the assumption, based on futures prices, that oil prices will stabilise and then fall implies that energy inflation should weaken fairly rapidly. It should only be slightly above zero by the end of the year compared with 22% in November 2021. This is the main reason why headline inflation is seen falling to under the 2.0% mark in the final quarter of 2022 (see Chart 3).

Inflation excluding energy and food is projected to remain broadly unchanged in 2022 compared with end-2021 (averaging 1.8% over the year), reflecting two opposite trends: as with energy, manufactured goods inflation is expected to fall gradually in the absence of any further spikes in input prices (which are nonetheless expected to remain high). By contrast, services prices are predicted to accelerate gradually amid strong wage growth (see below).

In 2023 and 2024, headline inflation (1.5% in 2023 and 1.6% in 2024) should be driven by inflation excluding energy and food, which is expected to remain stable but robust at an annual average rate of 1.7%. Manufactured goods inflation is projected to decline to near its long-term average; however this should be offset by an acceleration in services prices against the backdrop of a strong labour market, in a scenario similar to that seen in the first half of the 2000s (see Box 1).

This forecast is subject to more uncertainties than usual, in both the short and medium term (see final section of this publication).

Box 1 : At the end of our projection horizon, inflation excluding energy and food could return to its pre-2008 rate and many of its determinants

According to our projections, after the 2021-22 “hump” (see Chart A), headline HICP inflation in France is expected to come back down to 1.5% then 1.6% in 2023-24. It should be driven by the component excluding energy and food, which is projected to rise at an annual average rate of 1.7% in both years. This key component is thus expected to post year-on-year increases close to those reached before the 2008 financial crisis (see Chart A). In particular, we use 2002-07 as the benchmark period, since HICP inflation stood at around 2%, and HICP inflation excluding energy and food was fairly stable at around 1.7%.

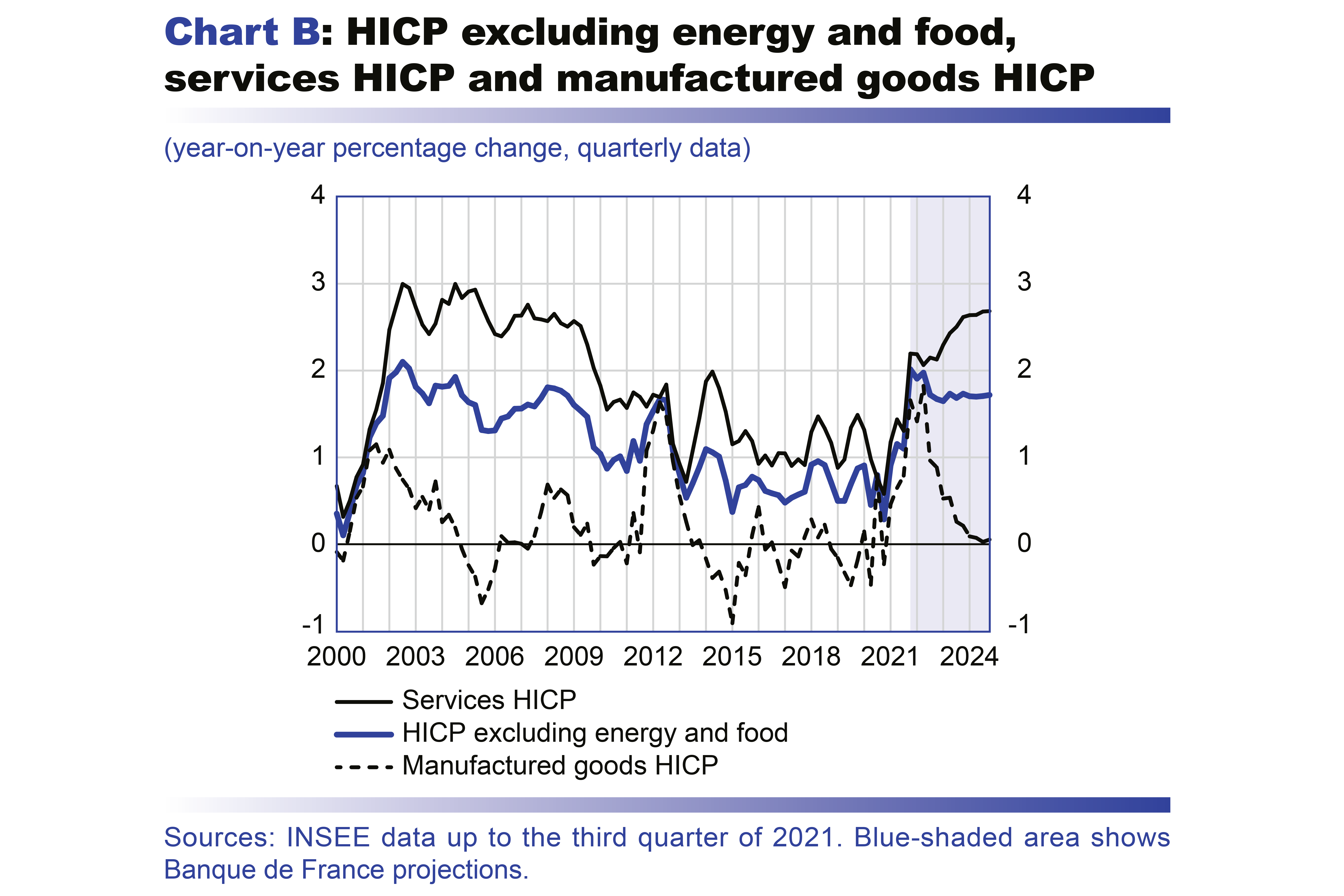

By comparison, between 2013 and 2020, the average year-on-year increase in the HICP excluding energy and food was very different, at only 0.7%. The services component of the HICP was especially sluggish, with the year-on-year increase averaging 1.2%, well below the average of 2.7% between 2002 and 2007. Conversely, the average year-on-year change in the manufactured goods component was less pronounced and only slightly lower than the 2002-07 average (–0.1% compared with 0.2%).

In 2022, HICP inflation excluding energy and food is already expected to be relatively strong due to the peak – which we believe to be temporary – in the manufactured goods component (annual average rise of 1.3%), caused by global supply pressures, while the services component should no longer be as weak as in previous years. After that, the determinants keeping HICP inflation excluding energy and food at 1.7% in 2023-24 should progressively change and become more significant over the medium-term (see Chart B). This is what we detail below.

After peaking in 2022, the rise in manufactured goods prices is expected to gradually return to its long-term average (see Chart B), close to 0%, as supply difficulties ease. In our baseline scenario, the current tensions should have persistent effects on manufactured goods prices, which should not correct downwards as was the case after the 2012 peak. However, in 2023-24, changes in manufactured goods prices should no longer affect the trend in inflation as significantly as in 2002-07.

Meanwhile, in 2023-24, price increases in services are expected to continue to be markedly more dynamic and should thus support HICP inflation excluding energy and food, as in 2002-07. The services component of the HICP is expected to rise by 2.5% in 2023, then by 2.7% in 2024. The private services component should even post a 2.9% increase in 2023, i.e. a rate identical to that observed in the 2002-07 period. This increase should be supported by wage growth, driven up by a lastingly low unemployment rate from a historical perspective, and takes account of the recruitment difficulties reported by companies in our short-term business surveys. This scenario also incorporates the usual pass-though of prices to wages and of wages to prices over the entire projection horizon, but assumes that long-term inflation expectations remain anchored given the credibility of monetary policy, thus avoiding an inflationary spiral.

In this scenario, price increases are expected to be passed on partially to wages, and vice versa, in line with the trends observed since the start of the 2000s. We should then see a convergence towards fairly robust household purchasing power growth, at 1.4% on average over the two years, while the corporate margin rate should remain at a level close to that observed prior to the Covid-19 crisis, thanks to wage increases in line with productivity gains.

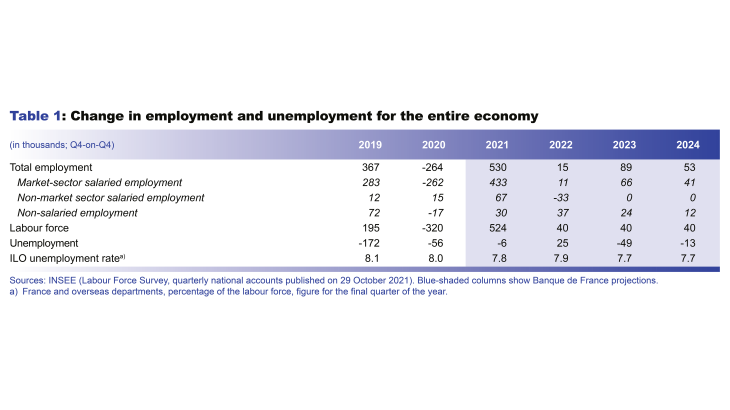

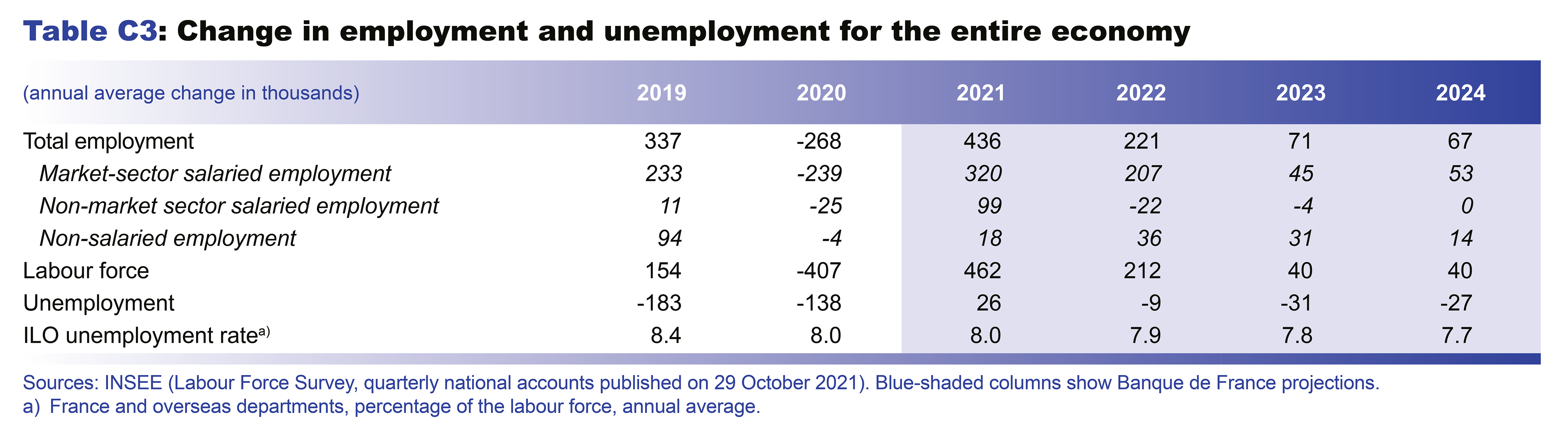

The unemployment rate has already returned to its pre-crisis level and should fall slightly further to reach 7.7% at the end of the projection horizon

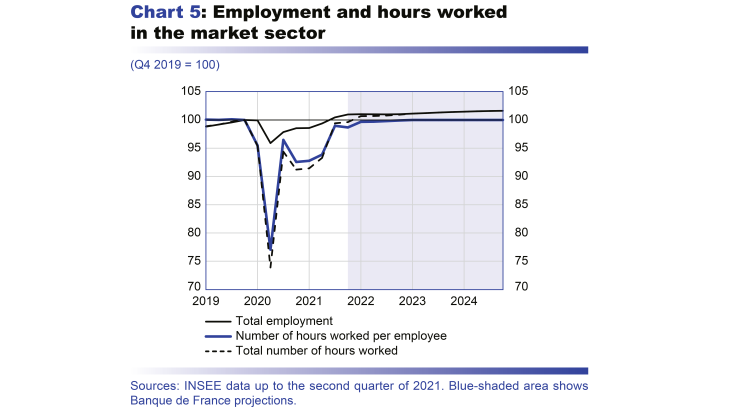

The labour market situation normalised in the third quarter of 2021, returning to pre-crisis conditions. Salaried employment increased sharply after the Covid-related restrictions were lifted in the spring and summer, with 108,000 net jobs created between June and September, on top of the 309,000 already created in the three preceding months. Employment is now slightly above its pre-crisis level (rise of 1.0% in salaried employment, or of 261,000 jobs). The slight uptick in the unemployment rate to 8.1% in the third quarter, according to the latest employment survey, is mainly due to a surge in the labour force, which is now back on its pre-crisis growth trajectory, combined with a record high employment rate (67.5%). In parallel, the number of staff on the short-time work scheme declined sharply over the summer, to 160,000 full-time equivalent employees. This signals that employers have also increased the number of hours worked to more normal levels, along with the number of jobs, in response to the activity recovery. In the market sector, however, the number of hours worked was still 0.6% below its end-2019 level in the third quarter of 2021.

Recent economic data (employment figures for September, new jobless claims) suggest that job creations are likely to remain high in average terms over the final quarter of 2021. This rise in employment, together with the return of the labour force to its trend rate of growth, is expected to lead to a marked drop in the unemployment rate in the fourth quarter compared with the previous quarter (see Chart 4).

Over the start of 2022, however, employment could lose momentum amid a slowdown in activity linked to industrial supply bottlenecks and the threat of a resurgence of the epidemic. Under this scenario, employment is only seen growing moderately over the full year, and the unemployment rate is seen stabilising at 7.9% in 2022. As the number of hours worked per employee normalises, the total volume of hours worked should continue to rise in 2022 and should exceed its pre-crisis level as of the first quarter of 2022.

With the rebound in activity at the end of 2022 and start of 2023, the unemployment rate should start to come down again and reach 7.7% by the end of 2024. Job creations should increase, as should the volume of hours worked; indeed, with the end of the short-time work scheme, working times should already return to pre-crisis levels in 2022 (see Chart 5 below).

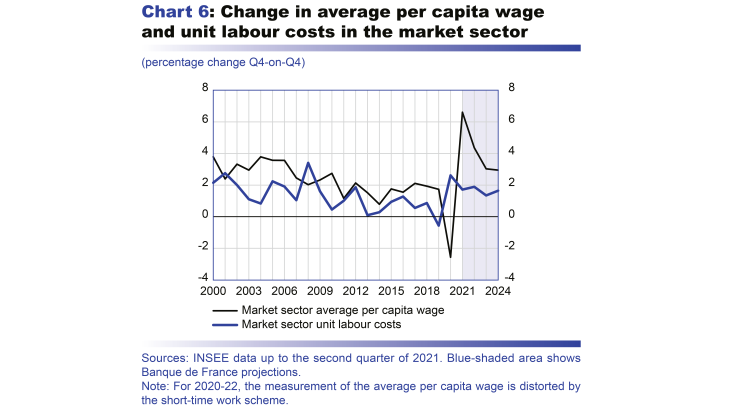

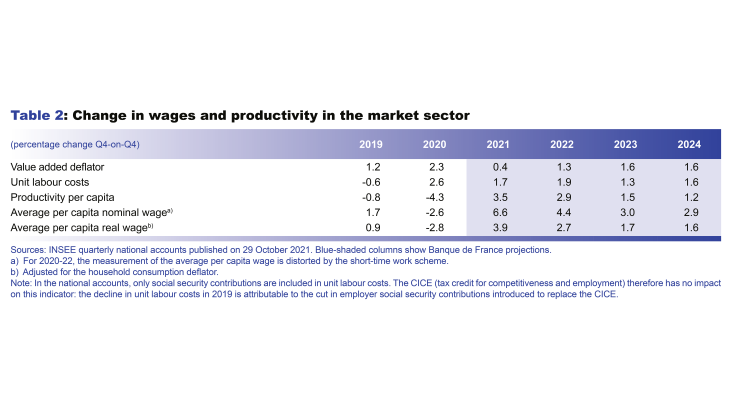

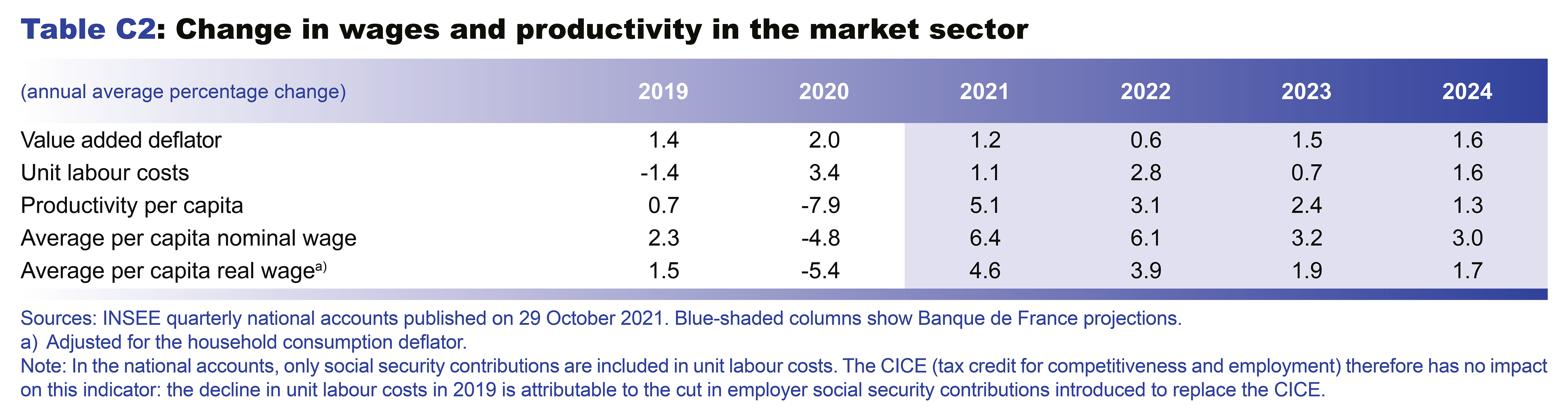

Price rises should be passed on partially to wages, which should also be supported by a strong labour market

Several factors are expected to contribute to stronger per capita wage growth in the market sector. Excluding the impact of the short-time work scheme, per capita wages are projected to rise by close to 4% in 2022. In 2023-24, they should continue to grow at a robust pace of around 3%, which is higher than the wage growth seen in 2012-19 and similar to that observed in the early 2000s (see Chart 6). The wage agreements signed in certain sectors since October 2021 already suggest that negotiated wages are rising, and often by more than observed in the pre-Covid years – although the extent of the increase differs markedly from one sector to another.

The current sharp price rises are first expected to be passed on partially to wages, in line with historical trends. This is already reflected in recent alignments of the minimum wage, which was automatically revised upwards in line with inflation at the start of October (increase of 2.2%) and should be revised again in January 2022. In general, wages do not rise completely in line with inflation in the short term. But they should also benefit over the longer term from the strength of the labour market, and especially from the persistently low level of unemployment compared with the past 25 years (see Chart 4 above).

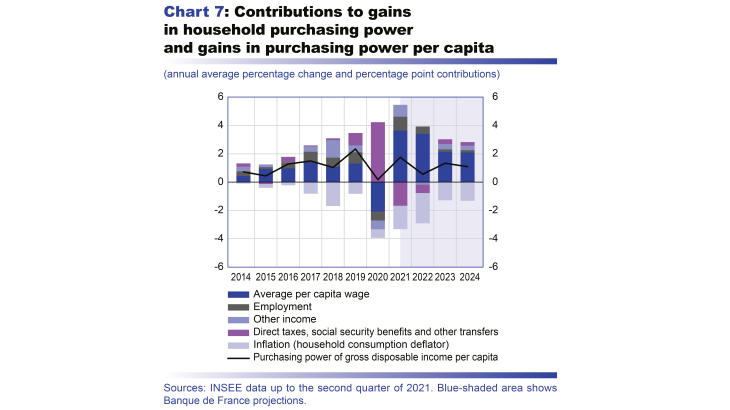

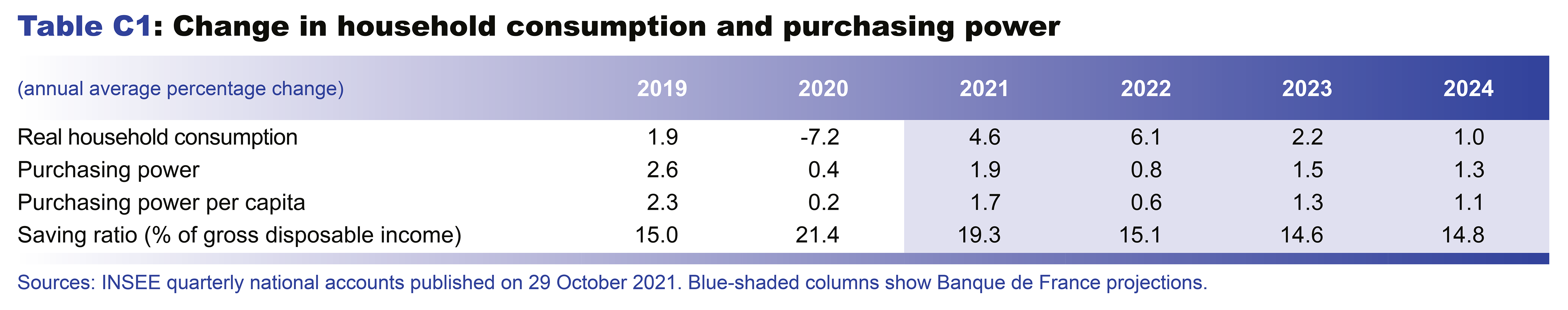

This strong wage growth should support household purchasing power, which is in turn projected to rise at a fairly robust pace, especially in 2023-24 (see Chart 7). In addition, given the strong economic fundamentals, the rise in wages is not expected to erode corporate margins, as productivity gains should limit the rise in unit labour costs. Corporate margins are thus projected to remain close to their pre-crisis levels (see below).

In the short term, household consumption should be dampened by supply difficulties and the epidemic, but should subsequently be supported by robust income growth

In 2020, the government cushioning mechanisms helped to prevent a sharp deterioration in the labour market and preserved household purchasing power at the microeconomic level (see Chart 7), although this aggregate picture may mask more pronounced differences in individual situations. In 2021, the recovery in employment and rise in wages should buoy household income and should start to replace the support provided by fiscal measures. Purchasing power is seen slowing in 2022 amid higher inflation and the winding down of certain emergency measures (short-time work scheme, solidarity fund for the self-employed), but should pick up momentum again in 2023 and 2024, fuelled by labour income.

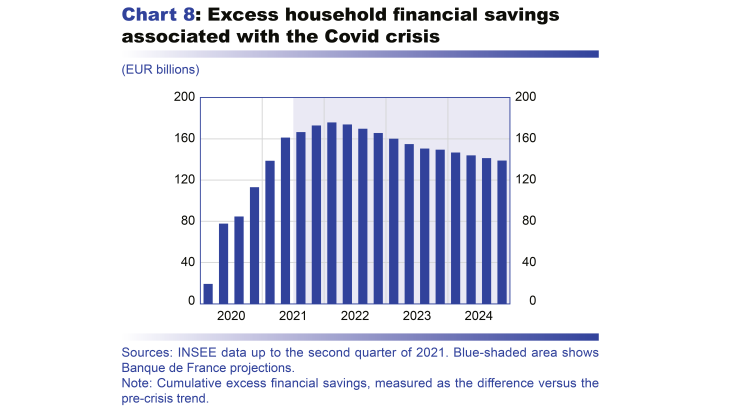

In the third quarter of 2021, household consumption proved particularly strong (growth of 5%), especially in accommodation and food services following the lifting of the containment measures. This sharp growth in consumption was accompanied by a steep drop in the saving ratio, although it is still well above its pre-crisis level. Consumption should remain stable between the end of 2021 and start of 2022, amid supply chain difficulties, especially in the car production sector, and uncertainties over the fifth wave of the epidemic and the new Omicron variant. As of mid-2022, however, and once these obstacles vanish, consumption should rise at a robust pace, supported by continuing strong income growth. Households are also expected to continue spending some of the excess savings accumulated during the health crisis. This savings surplus reached close to EUR 170 billion in the third quarter of 2021. According to our projections, households should spend around a fifth of this stock between now and 2024 (see Chart 8).

Household investment had already exceeded end-2019 levels by the second quarter of 2021. As in our September publication, by the end of the projection horizon, we expect households to have completely made up for their under-investment during the crisis. This new investment will mainly take the form of renovations of existing dwellings or purchases of new dwellings and the related expenses (agency and notary fees, etc.). In the second-hand dwelling market, the excess savings accumulated by households could help to support strong growth in real estate prices and in housing credit.

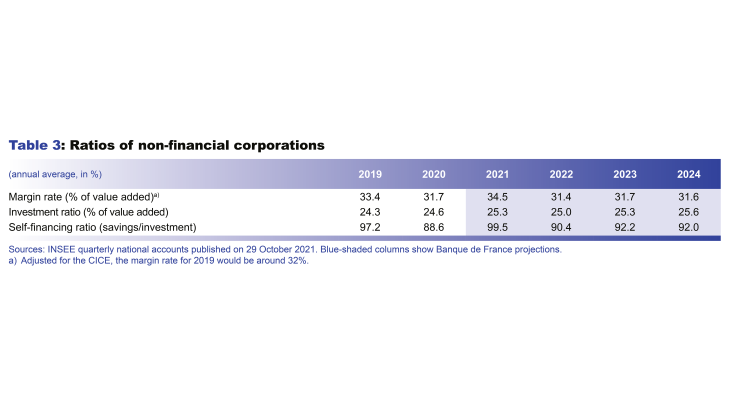

With government measures keeping margin rates stable, corporate investment ratios are expected to remain high

As with households, government support mechanisms such as the short-time work scheme or solidarity fund have helped to preserve corporate income and margin rates. The average corporate margin rate was still very high at the start of 2021, but should decline in the second half as nearly all the emergency measures are withdrawn. It is expected to come back to the levels seen in 2015-18, before the 2019 peak linked to the “double-counting” impact of the conversion of the Tax Credit for Competitiveness and Employment (CICE) into a permanent cut in social security contributions (the corporate margin rate was 31.6% in 2018). The margin rate should then remain stable at around this level for the rest of the projection horizon, thanks in particular to government support (cuts to production taxes, subsidies under the France Relance and France 2030 recovery plans).

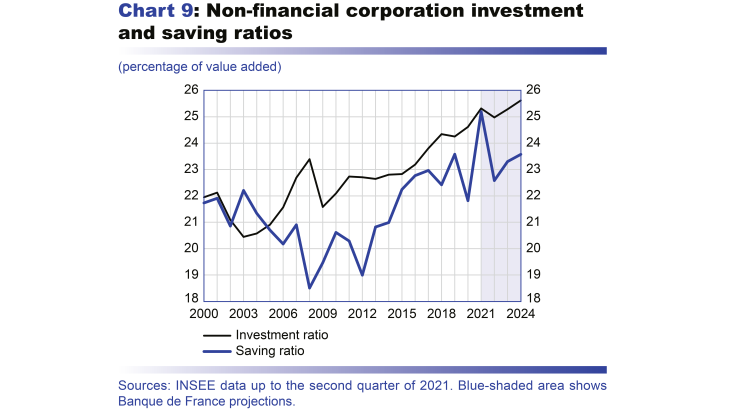

After reaching an all-time high at the start of 2021, the corporate investment ratio should ease back slightly in 2022 owing to supply bottlenecks in equipment goods, although it should still remain very high (see Chart 9 below). It should then start to rise again in 2023 and 2024, buoyed by continuing favourable financing conditions and the subsidies granted under the recovery plan.

Despite this robust investment, the non-financial corporation (NFC) self-financing ratio should remain above 90% while the NFC saving ratio should also remain high (see Chart 9).

Exports are expected to be lifted by the rebound in global trade and by the gradual dissipation of global production constraints

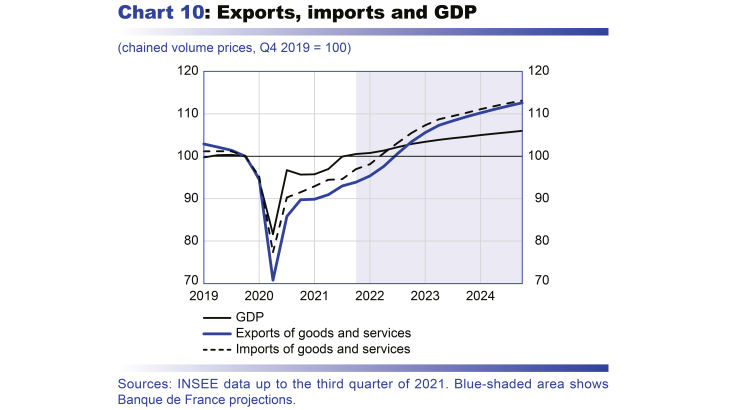

After falling sharply in 2020, French exports benefited from the recovery in global trade in 2021 and from the return of foreign tourists during the summer, notably from neighbouring European countries (Belgium, the Netherlands, Germany). However, exports are still recovering at a slower pace than GDP (see Chart 10), reflecting ongoing difficulties in tourism, in car production – where the situation has been deteriorating since July 2021 amid a semiconductor shortage – and in aeronautics, which is still feeling the effects of the global travel restrictions. In the medium term, exports should accelerate towards the end of 2022 as global supply difficulties fade, and should then return to normal in 2024. By this time, we assume that the difficulties in the aeronautics and tourism sectors will have partially dissipated, although activity is not expected to have returned fully to its pre-crisis trend in these sectors.

In 2024 growth should ease to 1.4%, which is close to its potential rate

Activity is expected to finish recouping all the ground lost since 2020 in 2023. After this, and once the effects of the Covid crisis have faded, economic growth should ease back to 1.4% in 2024, which is close to current assessments of its potential rate. By this time, the drivers of demand should have normalised: growth in demand from our trading partners should be closer to its long-term trend, and export market shares should have stabilised. At the domestic level, the household saving ratio should once again be in line with its pre-crisis levels, and the strong fluctuations linked directly to the Covid crisis should no longer be a determining factor in corporate performances. As a result, higher GDP growth would require lifting potential output; this could be achieved through a number of new structural reforms.

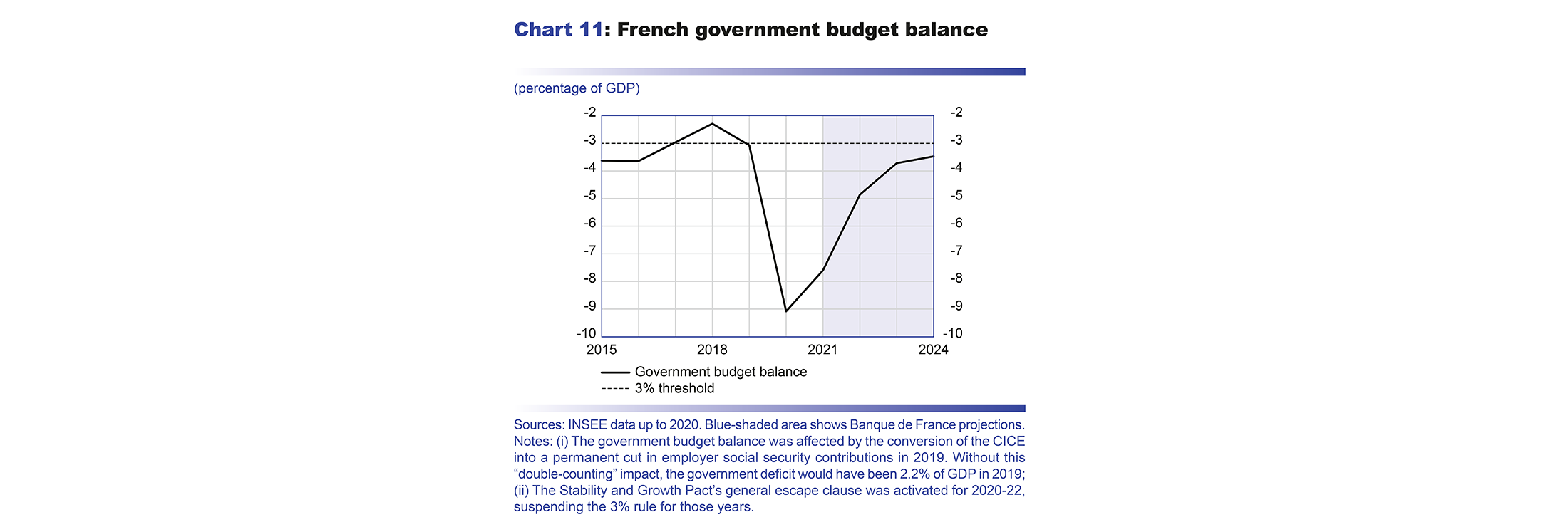

The measures to tackle the health crisis, combined with support for purchasing power and the roll-out of the recovery plan, should weigh on government finances in 2021 and 2022, followed by a limited recovery in 2024

Our forecast for government finances is based on the macroeconomic scenario described above. In 2021, the government budget balance should remain firmly negative (deficit of 7.6% of GDP after 9.1% in 2020), on account of the emergency measures and the roll-out of the recovery plan, and despite the strong economic rebound and the receipt of EUR 5 billion of funds from the European Recovery and Resilience Facility (RRF). After rising temporarily to 44.5% in 2020, the tax-to-GDP ratio is expected to fall to 43.5% in 2021; this reflects the cuts to taxes and social security contributions already voted into law (gradual abolition of the housing tax, lowering of the corporation tax rate, cuts to production taxes under the France Relance plan), and a spontaneous elasticity of tax revenues to GDP of slightly less than unity. Government spending is projected to grow sharply in 2021, fuelled by the emergency measures to tackle the health crisis (solidarity fund, short-time work scheme, exceptional healthcare expenditure, etc.), but also by upward revisions to public sector pay (the Ségur de la Santé and Grenelle de l’Éducation agreements for health care and education), the roll-out of the France Relance plan and, to a lesser extent, the plan for skills development. Added to this will be the measures to support household purchasing power, including the “energy cheque”, the “inflation bonus” and the “price shield” that should gradually come into force at the end of 2021. Government spending (excluding tax credits) should therefore rise vigorously again in 2021, by 4.2% in nominal terms and 2.6% in real terms (adjusted for the CPI excluding tobacco), after already growing sharply in 2020 (growth of 7.1% in nominal terms and 6.9% in real terms). Despite the large government deficit, and thanks to the rebound in GDP and to a negative debt-deficit adjustment (general government units should notably use some of the cash reserves accumulated in 2020), the government debt-to-GDP ratio should fall slightly from 115.0% in 2020 to 113.6% in 2021.

In 2022, the government deficit should narrow to 4.9% of GDP as most of the emergency measures expire and the economy continues to grow vigorously. The ongoing receipt of payouts from the RRF should also help to lower the deficit, and this effect is expected to continue over the rest of the projection horizon. Despite the temporary cut in the TICFE (internal tax on electricity) as part of the “price shield” measure, which is designed to limit the rise in electricity prices to 4.0% in 2022, the tax-to-GDP ratio is expected to rise moderately in 2022. This is because the spontaneous elasticity of tax revenues to GDP should be slightly higher than unity, as the composition of growth is expected to be favourable with consumer spending acting as the main driver. With the withdrawal of most of the emergency measures, government spending excluding tax credits should decline mechanically by 1.5% in nominal terms and by 3.8% in real terms in 2022. However, there should still be significant spending on the recovery measures in 2022, to which will be added the new measures contained in the 2022 budget law, including the France 2030 recovery plan. The exceptional measures to support purchasing power are also expected to be reinforced in 2022, with the continuing payment of an “inflation bonus”, and the payment of subsidies to gas suppliers under the “price shield” in order to keep gas prices stable in 2022. The government debt-to-GDP ratio should fall slightly further to 112.8% in 2022, helped again by a negative debt-deficit adjustment.

At constant legislation, and provided the epidemic remains under control, the government deficit should subsequently continue to narrow progressively to 3½% of GDP by the end of the projection horizon, helped by the expiry of all the emergency mesures over 2022 and the gradual end of most of the France Relance measures. In the absence of any new measures, however, the deficit should remain larger than before the epidemic, due to the permanent impact of certain measures introduced over the course of the health crisis (Ségur de la Santé, Grenelle de l’Éducation, etc.).

These projections remain subject to numerous risks, linked both to the public health situation and to the macroeconomic environment

These projections remain contingent on how the public health situation evolves in France and the rest of the world. We assume that the impact on economic activity will be contained in France, even if we cannot rule out a bigger negative shock to growth in the short term (see Box 2). With respect to inflation, however, the impact of a resurgence of the pandemic is ambiguous: the negative effect on demand could drag on prices, notably via raw material prices; however, the increased disruption to global trade could have an opposite effect. At this stage, the rise in uncertainty since November has translated into a sharp drop in oil prices, which by mid-December were around EUR 7 below the assumptions set on 25 November. This represents a downside risk of around –0.2 percentage points to inflation for 2022.

Aside from the uncertainty related to the epidemic and the associated containment measures, macroeconomic factors could also impact economic activity and inflation in a similar way to that seen in our previous publications.

A faster-than-expected recovery in confidence, thanks to favourable developments in the labour market and once the current epidemic resurgence is over, could mean households consume the savings built up during the crisis at a faster pace than expected, lending support to activity. Over the longer term, post-crisis efficiency gains, including reallocations between economic sectors and internal reorganisations, could gradually increase the pace of future potential growth.

Conversely, the hiring difficulties recently highlighted by firms could dampen growth if staff shortages weigh on output and are not offset by further productivity gains. Current supply constraints could also last beyond mid-2022 and hence continue to weigh on the recovery by limiting firms’ ability to meet demand for longer than in our baseline scenario.

The upward pressures on input prices could be passed on more extensively to consumer prices, pushing up the inflation rate. More persistent wage rises and a stronger pass-through of wages to prices are also an upward risk to our medium-term inflation forecast. Conversely, we cannot rule out a downturn in input prices which would lead to disinflationary pressures on manufactured goods prices, as occurred after the peak of 2011. In addition, the structural factors that weighed on the path of inflation in the years before the crisis may not have completely disappeared.

Box 2 : A severe but temporary worsening of the epidemic situation could weigh heavily on activity in early 2022 but be followed by a marked and rapid rebound

The fifth epidemic wave in France linked to the Delta variant and the fears raised by the Omicron variant are already a factor of uncertainty that could weigh on economic activity in the short term. In a more severe scenario than our baseline scenario, the rise in the number of infections would lead to a new overload of hospital services in the next few weeks and to a new series of health restrictions, which would again more clearly penalise the sectors that are most dependent on face-to-face contact.

In its monthly update on business conditions in France, the Banque de France monitors activity by sector compared to the pre-crisis level. According to the most recent survey, businesses continue to expect a rise in activity in December 2021, despite the current context. We use this as the starting point for our baseline scenario, while remaining cautious for the months to come on account of the latest high-frequency data, such as credit card payments.

In order to construct an alternative scenario in which stronger health-related risks materialise with significant consequences on economic activity, we start from the economic situation expected in December 2021 and project lower activity levels in each sector based on the following assumptions. We assume that it becomes necessary to introduce health restrictions from January to May 2022 that are similar to those implemented from late 2020 to early 2021. We then assume that these restrictions have the same economic impact in the sectors directly concerned (retail trade, accommodation and food services, cultural and recreational activities, transport services, certain non-market services). However, we assume no spillovers to other sectors of the economy, which have demonstrated their ability to adapt and would thus continue to post the same level of activity as in December 2021 (industry, construction, business services, etc.).

Under these assumptions, the level of overall quarterly activity is expected to be a little over 2 GDP points below its pre-crisis level in the first quarter of 2022, and still 1.5 GDP points below that level in the second quarter of 2022, whereas we estimate it to be 0.75 GDP points above that level in December 2021. This loss is nevertheless smaller than the loss of a little over 4 GDP points on average in the fourth quarter of 2020 and the first quarter of 2021 because activity in certain sectors, such as industry, construction and business services, has been growing for a year.

With the gradual lifting of health restrictions, GDP growth is then expected to return to its baseline scenario trajectory in the third quarter of 2022. Annual growth in 2022 is expected to stand at 2.2% (compared with 3.6% in our baseline projection), while the catch-up in the third quarter of 2022 should result in stronger growth in 2023 (3.6% compared with 2.2%).

Appendices

Read the appendices

Eurosystem technical assumptions

Detailed projections, contributions to GDP growth and revisions since September 2021

Additional indicators

Download the PDF version of this document

Updated on the 25th of July 2024