Sources: Mutual Security Program, BIS, US Congress, ECA, FRED, Eurostat, Commission. Authors' calculations.

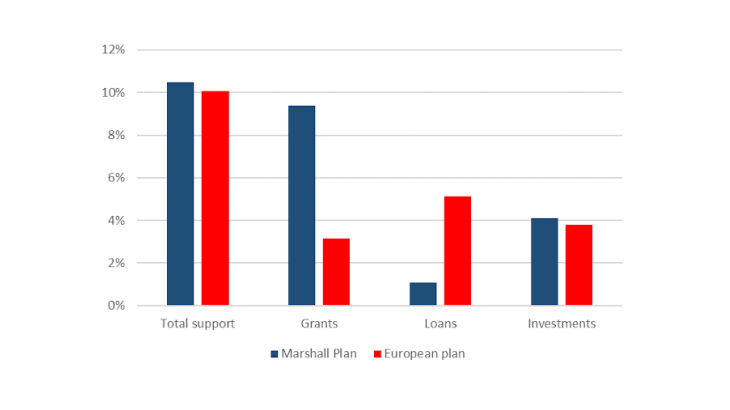

Note: Aid in $1948 and €2020 over GDP in 1948 and 2020, recovery plan investments estimated on the basis of the NRRP. In the case of the European recovery plan, aid consists of available loans and grants.

Two plans of similar magnitude, but different natures

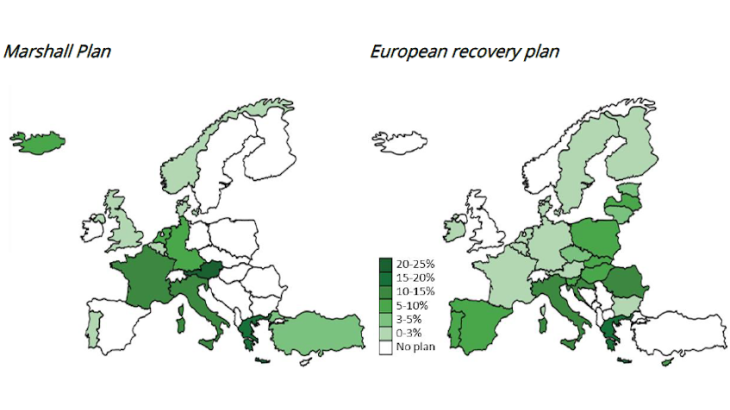

As part of the Marshall Plan, between 1948 and 1952 the United States transferred to 16 European countries – not including Soviet bloc countries – an amount of close to 10.5% of their GDP. Today, the European Union's response to the Covid-19 crisis – including the potential disbursements under the NextGenerationEU (NGEU) recovery plan and the April 2020 support measures (SURE, ESM and EIB) – is of a similar magnitude, amounting to almost 10.1% of its GDP. The levels of long-term investment set out in the Marshall Plan and provided for by NGEU are also very similar (Chart 1), at around 4% of GDP.

However, the composition and origin of financing differ. The Marshall Plan was largely implemented through grants (90%) rather than loans (10%) and was financed externally by the United States. The European plan has a more heterogeneous composition, with potentially 54% loans, 31% grants and 15% of guarantees, financed by the EU.

The contexts in which the two plans were set up are also different. In 1948, the recipients of the plan were emerging from a centrally planned war economy and faced monetary instability, as well as budget and current account deficits (Bossuat, 2008; Crafts, 2011). This macroeconomic background made it particularly difficult to finance the necessary investment for post-war reconstruction (Eichengreen and Uzan, 1992). Additionally, there were significant political and social risks, including the threat of countries shifting towards the Soviet bloc. NGEU, on the other hand, aims to support countries whose public finances have been severely constrained by the Covid-19 crisis in their economic recovery and reform process, as well as in financing their green and digital transitions.

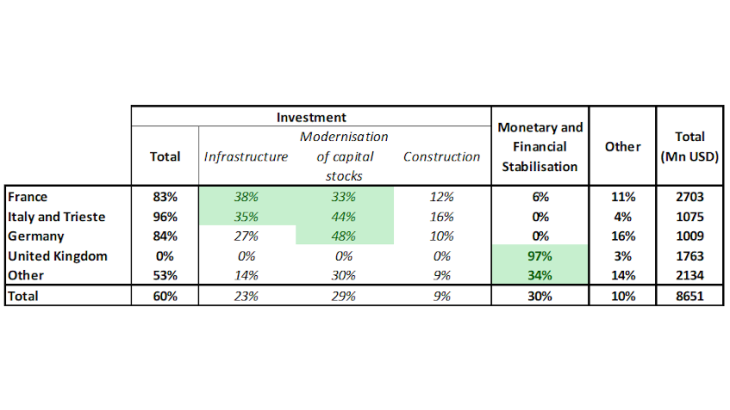

Both plans, however, have a common dual objective of providing macroeconomic stabilisation and supporting the renewal of the capital stock through public investment (Chart 2). We quantify the latter using, respectively, data from the Mutual Security Program for the Marshall Plan and data from the National Recovery and Resilience Plans (NRRP), which define the investment projects (fixed, human and natural capital) to be implemented until 2026.