The US dollar is widely recognized as the major vehicle currency for invoicing international transactions. According to Gopinath and Itskhoki (2021), the US dollar represents more than half of global export invoicing. For European countries, the US dollar represents about 40% of their aggregate exports and imports extra-EU, while this share tends to be quite stable over time (Boz et al., 2022).

The dominant role of the US dollar in international transactions invoicing is, however, increasingly debated, in the context of the emergence of large economic powers potentially offering alternatives in terms of invoicing and reserve currencies. The increased use of international sanctions in the foreign policy toolbox of the United States and its Western allies has also reignited the debate on the dominant role of the US dollar in the international financial system. As direct and secondary sanctions implemented by the US administration increase the risks of holding assets or invoice transactions in US dollars, this generates an incentive by targeted countries and third parties to diversify away from the US dollar for international payments.

This paper investigates whether international sanctions may reduce the dominance of US dollar invoicing in international transactions. In the analysis, we explore this question in the context of the first Russian invasion of Ukraine, using firm-level information about the export activity of French firms during the period 2011-2020. The analysis mainly relies on firm-level information about the currency denomination of individual transactions by French exporters to Russia and other destinations outside the European Union.

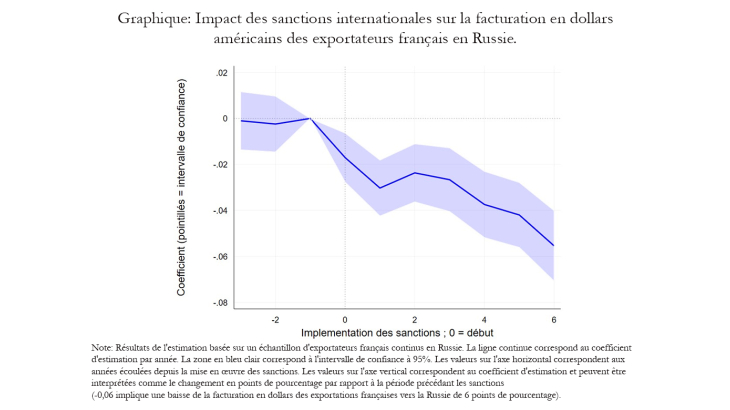

Estimation results confirm that consecutive to the implementation of sanctions in 2014, the propensity to invoice exports in US dollars by French firms to Russia declined. In quantitative terms, we find that the shock due to the sanctions decreased the propensity to invoice in US dollars by about 4 percentage points six years after the start of the sanctions.

We find evidence for different transmission channels. The reduction of US dollar invoicing by French exporters in Russia is partly explained by the reduction in the market share of US exporters in Russia, in particular during the period starting in 2016 when US sanctions were strengthened. The role played by the market share of competitors in a destination market highlights the role played by strategic interactions between firms, which contributes to promote the dominance of the vehicle currency (the US dollar) as large firms have an incentive to set their prices in the same currency.

We then find evidence that changes in the composition of international reserves by the central bank of Russia reduced the incentive for private firms in Russia to hold US dollars and contributed to the decline of the importance of USD invoicing in our estimations.

Finally, we provide evidence of the importance of the US secondary sanctions in driving our results. The decline in the propensity by French exporters to invoice their exports to Russia in USD is indeed stronger in dual-use goods (i.e., goods that can be used for both civilian and military applications) that were particularly targeted by US sanctions. We also find evidence that French banks contributed to the decline of USD invoicing by their clients as they sought to avoid being targeted by US secondary sanctions.