The extent to which the international environment influences monetary policy decisions in industrialised economies depends on each country’s degree of trade openness and its exposure to the international financial system. In the case of the United States, which is the archetypal large and relatively closed economy, the Federal Open Market Committee’s (FOMC’s) monetary policy is designed to meet purely domestic objectives – principally full employment and price stability. Occasionally, however, the FOMC does appear to pay close attention to events beyond US borders, especially if those events are liable to have repercussions for the dollar, trade or the global financial system. This was notably the case in the summer of 2015, which was marked by concerns over the rebalancing of China’s growth model and the possible manipulation of the renminbi. Observers who had been expecting a first hike in interest rates in September 2015, after several years at the zero lower bound, were surprised to hear FOMC members refer in their speeches to developments in China and the risks these posed to other economies (see Stanley Fischer, Jackson Hole, 29 August 2015). In this context, the decision to delay the US rate hike until December 2015 was seen by some as reflecting Fed concerns over the international environment.

These analyses are nonetheless subjective and at times anecdotal. Our aim here is to quantify the role played by the international environment in shaping monetary policy decisions. To achieve this, we construct an indicator that measures the number of occurrences of words referring to the international environment in the minutes published after each FOMC meeting.

An international environment indicator based on Fed minutes

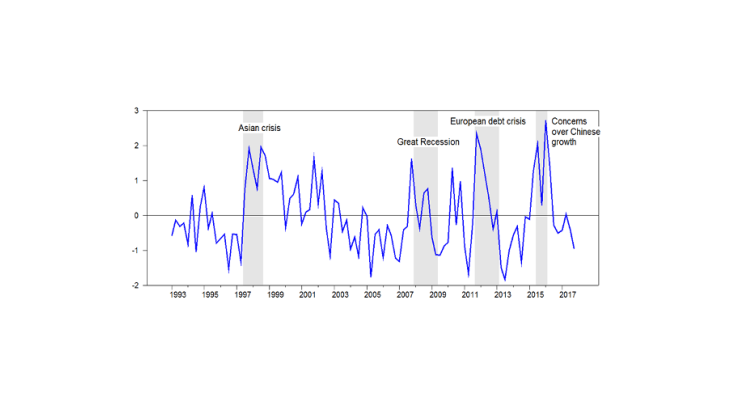

To construct the indicator shown above (see chart), we use the so-called “dictionary” method to analyse 200 Fed minutes published between 1993 and 2017. Each point in the series corresponds to the sum of occurrences in each document of words relating to the international environment, relative to the total number of words in that document. The chosen words are: “China”, “foreign”, “emerging”, “European”, “depreciation”, “global”, “euro”, “exchange”, “international”, “export” and “dollar”. We also conduct a stemming analysis in order to include words derived from those in our selected dictionary (e.g. the word “Chinese” is also counted). The choice of dictionary is crucial to the exercise, but our results are robust to different selections of words.

Over the chosen period, eight minutes were published per year, or two per quarter. The chart describes a quarterly international environment indicator with a mean of 0 and a standard deviation of 1. The periods where Fed minutes refer to the international environment are indeed found to coincide with the major economic events of the past two decades. In particular, the indicator can be seen to rise during the Asian crisis, the Great Recession of 2008-09 which affected the global economy, the 2011-13 European sovereign debt crisis and the aforementioned period of concerns over the Chinese economy. There is also a degree of asymmetry in the indicator, in that discussions over the international environment only appear to take place when news regarding economic activity or the markets is bad.

Rises in the indicator correspond to periods of more accommodative monetary policy

We then test whether our international environment indicator played a role in shaping central bank monetary policy from 1993 to 2017. We assume that interest rates remain the principal tool of monetary policy throughout the period, even though policy makers now have access to a broader range of tools (forward guidance, securities purchases, etc.).

A standard model used to describe interest rate setting by central banks is the Taylor rule (1993). Under this model, policy rates are determined by (i) divergence between actual and potential domestic output (the output gap), and (ii) the divergence between actual inflation and the central bank’s target. Several versions of the Taylor rule have been developed over the past few decades, some of which include a smoothing variable that accounts for the observed stickiness in the US interest rate series.

We use a standard Taylor rule similar to that proposed by the Atlanta Fed on its website. We also use the same variable calibrations as the Atlanta Fed, which are fairly standard in the literature. The weight of the output gap is therefore set at 1, that of the inflation gap at 1.5 and that of the interest rate smoothing variable at 0.85. Following the example of enhanced Taylor rules which include other explanatory variables, such as asset prices or financial stability (Cecchetti et al, 2000), we introduce a complementary explanatory variable: our international environment indicator. According to the model results, the weight of the international environment is significantly different to zero and its estimated value is negative (-0.4). Thus, when our indicator is equal to 1, the FOMC tends, all things being equal, to lower its policy rate by an average of 40 basis points, which has a non-negligible economic impact. The significance of the international indicator is confirmed when all the parameters of the Taylor equation are estimated, or when the evolution of the natural rate of interest calculated by Laubach and Williams (2003) is taken into account.

Thus, when references to the international environment increase in FOMC discussions, it turns out that monetary policy tends to become more accommodative. This is consistent with the idea that the Fed reacts to international surprises that are not yet captured in domestic GDP and inflation data, but that could have a negative future impact on the US economy.