The green transition will come at a cost with likely consequences on inflation (Dees et al. 2023, Ferrari et al. 2022). At the same time, inflation can impact firms unevenly, particularly in terms of their input prices (Chava et al. 2022). Analyzing the impact of monetary policy on green and brown firms, Havrylchyk and Pourabbasvafa (2023) show significant differences between firms that have good environmental performances and firms that don’t. This post suggests that the same differences can influence the channels through which inflation impacts firms, and in turn, create an uneven impact of inflation on green and brown firms. However, determining the aggregate direction of this impact is challenging.

Labor-intensity of green and brown firms exposes them unevenly to inflationary pressures

Green firms tend to be more labor-intensive while brown firms are (tangible) capital-intensive. Chart 1 [left] shows the negative correlation between firms’ emission intensities and their labor-to-capital ratio (the ratio of firms’ full-time employee to its PPI-adjusted (real) net property, plant, and equipment). The firms at the bottom 25% of emission intensity (green firms) have on median 35 employees per 1$ million of tangible capital in form of property, plant, and equipment (henceforth NPPE), while the firms in the top 25% (brown firms) have only 7. The higher labor-intensity of green firms corresponds with their higher intangible capital investment (discussed in section 2) and the sectors at which they operate, which are usually service and/or technology.

This gap in labor-intensity of green and brown firms coupled with differences in stickiness of inflation rates for wages and investment goods Chart 1 [right] could result in an uneven impact of inflation on green firms and brown firms. In inflationary episodes, the input prices of green firms, which mostly comprises of wages, is under weaker upward pressure compared to input prices of brown firms, which mostly comprises of tangible products. However, in times of low inflation, green firms face higher input inflations compared to brown firms due to stickiness of wage growth and they cannot pass this cost onto their output.

Inflation's wealth and credit effects are more favorable to brown firms

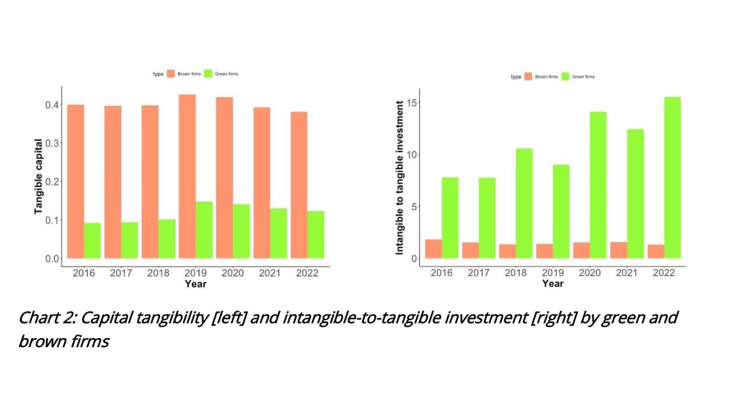

Brown firms tend to own significantly more tangible capital in form of NPPE, and less intangible capital (patents and goodwill and, in addition, organizational capital and employees’ training), while green firms own more intangible capital and less tangible capital. This distinction is also evident in their investment where brown firms have higher capital expenditure and green firms have larger R&D expenses and organizational capital investment (Chart 2).

This difference can alter the impact of inflation on green and brown firms in two ways. First, inflation corresponds to an increase in the prices of assets such as tangible capital, without impacting the prices of intangible capital. This is because intangible capital is much harder to price (Falato et al. 2022). For example, intangible capital in form of employees’ training or organizational capital is very firm-specific and cannot be traded. This translates into a wealth effect of inflation for brown firms with tangible capital while no such effect impacts green firms.

Second, tangible capital can be used as collateral to secure bank loans, while intangible capital offers no collateral because it is firm-specific, hard to redeploy, and difficult to price (Falato et al. 2022). Consequently, brown firms’ borrowing ability strengthens when inflation increases tangible capital prices, while green firms are not affected in the same way. Both these channels operate to disproportionately benefit brown firms in times of high inflation.

![Source: Fred Economic Data, Trucost, Capital IQ Note: Figure [left] reports 2016–2021 averaged metrics for 790 Euro Area publicly traded firms. Figure [right] shows the inflation rates in PPI of investment goods and hourly labor compensations in private sector, and their differences for Euro Area](/system/files/styles/image_media_mobile_730x410_/private/2024-01/Billet_343_EN_1.png?itok=HE-qxgkF)