The anchoring of inflation expectations is fundamental to ensure price stability, and macroeconomic stability more in general. As a result of the lessons from history (such as the costly re-anchoring of inflation expectations at low levels in the 1980s) and modern institutional set-up (inflation-targeting, independent central banks), inflation expectations are closely monitored, in particular medium-term inflation expectations as they are a direct measure of the credibility of the monetary policy of central banks. The post-pandemic recovery triggered renewed discussions on de-anchoring inflation expectations in a context of inflation rates last seen in the 1970s, while at the same time the ECB 2021 strategy review highlighted "the need for a comprehensive framework for assessing (un)anchoring" of inflation expectations.

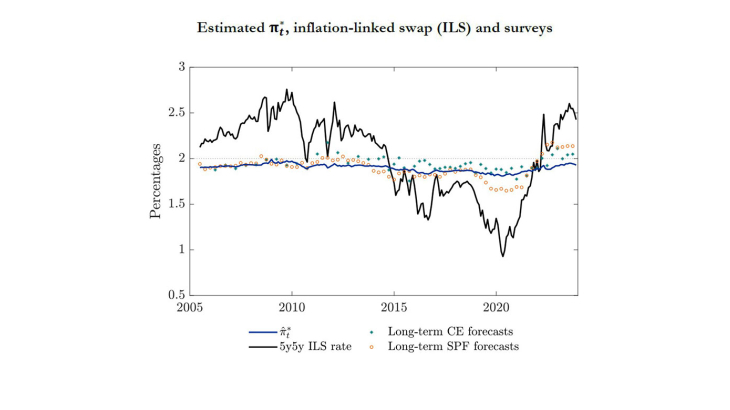

Speaking directly to the question of inflation de-anchoring in the euro area, this article proposes a no-arbitrage affine term structure model for inferring inflation expectations from market-based measures of inflation compensation. The novel feature of the model is that the infinite-horizon expected inflation rate is time varying (πt*). By contrast, standard stationary models feature a fixed endpoint (π*), i.e. forecasts of the inflation rate are assumed to converge at any point in time to the same value.

The model proposed in this article also considers the ECB’s survey of professional forecasters and the Consensus Economics survey when estimating inflation expectations. Jointly, these assumptions impact the decomposition of short-, medium- and longer-term euro area inflation-linked swap (ILS) rates into expectations and inflation risk premia. The baseline dataset of ILS rates used in the estimation spans the period going from June 2005 to December 2023. The question of whether there is evidence of a decrease in the volatility of the inflation trend with the ECB’s establishment in 1998 is analysed with a longer dataset of backcasted ILS rates going back to 1992.

Overall, results show that the estimated long-term measure of inflation expectations has hardly ever been de-anchored in the euro area since 2005. Estimates go down to close to 1.80% in 2016 and reach again a similar trough during COVID-19. Expectations components of short-term ILS rates, such as the one-year rate, are not much affected by πt*, whereas those of longer-term (forward) rates are, including the one-year forward rate four years ahead (1y4y ILS rate) and the five-year forward rate five years ahead (5y5y). At these two horizons, inflation expectations have remained in line with the ECB objective. However, tentative signs of de-anchoring appear in the inflation expectations component of the one-year forward ILS rate two years ahead (1y2y), a relevant horizon as it broadly corresponds to the horizon of the Eurosystem/ECB staff projections.

Summing up, this paper addresses the challenge of reliably estimating medium-term inflation expectations, which is central for the determination of (optimal) monetary policy. With inflation expectations broadly well anchored in the medium term, i.e. with a credible medium-term inflation objective, monetary policy does not need to be particularly restrictive in order to bring inflation back to target. A soft landing of the economy can therefore be envisaged. But if medium-term inflation expectations were to de-anchor, monetary policy might have to be significantly more restrictive to bring inflation expectations back in line with the objective, which could happen at the expense of an economic recession.

Keywords: Inflation-Linked Swap Rates, Surveys, No-Arbitrage, Shifting Endpoint, Inflation Expectations.

JEL classification: E31, E43, E47, E58