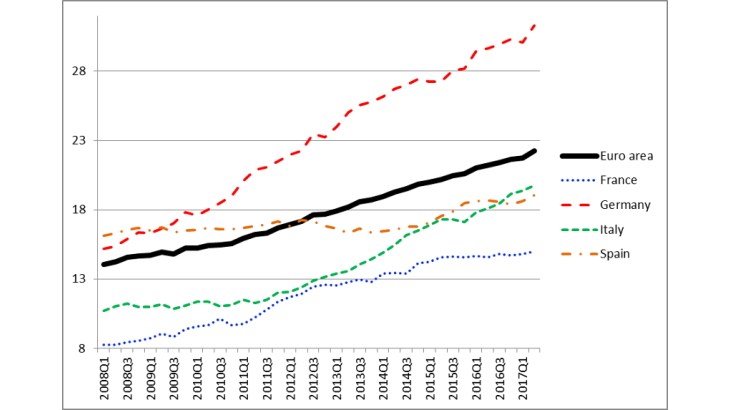

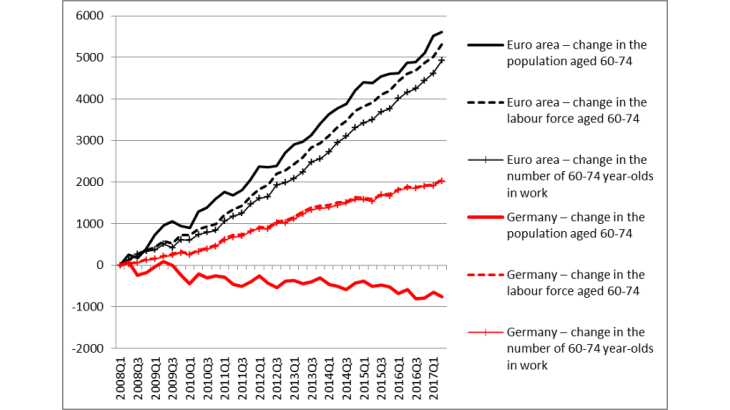

Throughout the euro area, and especially in the three largest economies (Germany, France and Italy), the rise in the number of seniors in employment between 2008 and 2017 broadly matches the labour force growth for these age categories. This essentially reflects the increase in the effective pension age, coupled with the entry of the baby boomers into the 60-74 age bracket. For 50-59 year-olds, the number of people in employment has increased to the same extent as the labour force.

Over the period under consideration, the number of people aged 50-59 in work jumped by close to 8 million, while the total labour force in this age bracket rose by just under 9 million. The trend is even more visible for the oldest category of workers (60-74 year-olds). In Germany, growth in the over-60 labour force exactly matches the rise in the number of jobs in this age group, while in the euro area as a whole, as well as in France and Italy, it is only slightly higher, indicating that seniors have made a very small contribution to the rise in unemployment.

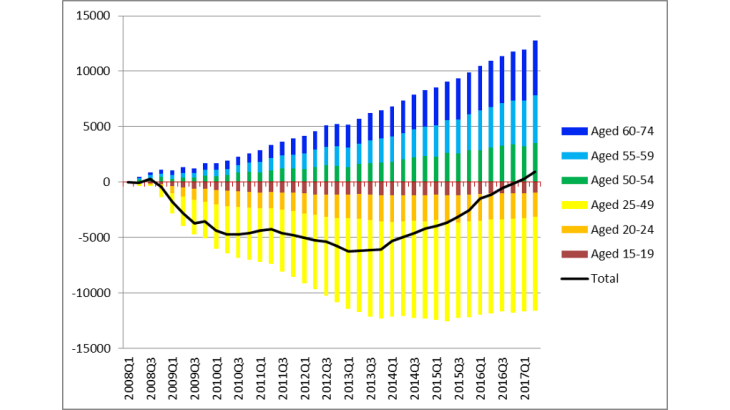

In the euro area, the unemployment rate for seniors has inched up only slightly since 2008 (up 1.4 percentage point for 60-74 year-olds), contrasting with the trend for younger categories (growth of 4.8 percentage points for 15-24 year-olds, and 2.8 percentage points for 25-49 year-olds).

Moderation of average wages for seniors

Changes in the age composition of the labour force can have knock-on effects on growth in average compensation per employee (see ECB 2018). Mojon and Ragot (2018) study the link between wage inflation and the participation rate for seniors and find that the latter has a negative impact on aggregate wage growth. The four-yearly Eurostat survey on the structure of euro area earnings shows that gross hourly wages tend to be higher on average for older workers, but only increase to a minimal extent. In contrast, younger workers generally have lower hourly wages, but see strong wage growth in the early and middle stages of their careers.

A comparison of survey vintages reveals that gross hourly wages increased for all age groups over the period 2010 to 2014, except for the over-60s. The average hourly wage in the euro area for a worker aged over 60 declined by 0.8% between the 2010 and 2014 surveys, compared with growth of 4.9% for workers aged 50-59, and 7.1% for all workers combined. With the exception of France, this fall in hourly wages for the over-60s can be observed in all main euro area countries, particularly in Spain (drop of 9.8% between the two dates) and, to a lesser extent, Germany (fall of 3.1%). None of the previous survey vintages show a similar decline: the average hourly wage for over-60s rose moderately between the surveys for 2002, 2006 and 2010.

The decline in hourly wages for the over-60s between the 2010 and 2014 surveys could thus be the result of two phenomena: the over-60s surveyed in 2014 may have had a lower level of education or been working in lower-paid sectors than their predecessors, especially if pension reforms or the crisis forced less-qualified workers to remain in or re-enter the labour market. It is also possible that a growing share of pensioners are supplementing their pensions with low-paid jobs to make up for the decline in the replacement rate.

With regard to aggregate wages, the higher participation rate for seniors could have two contrasting impacts. First, the rising share of higher-paid seniors in employment could lead to stronger growth in the average wage for the overall population. In the longer term, however, once the share of senior workers has stabilised it can have the opposite effect: although generally higher, wages for senior workers tend to remain more stable than those of younger workers, and can therefore be expected to contribute negatively to average wage growth.