- Home

- Publications et statistiques

- Publications

- Including owner-occupied housing costs i...

Post n°253. The harmonised measure of inflation currently published in the euro area does not take into account costs related to owner-occupied housing. There are several ways of capturing these costs, including the “imputed rent” and “net acquisition” approaches. Incorporating these costs into the measure of inflation produces different results depending on the method used, and the size and sign of the impact vary over time.

The HICP does not take account of owner-occupied housing costs

In the euro area, the European Central Bank’s (ECB) target measure of inflation relies on the Harmonised Index of Consumer Prices (HICP). However, this index does not take into account all of the housing costs incurred by households. While it does include rent payments by tenants (around 7.5% of the household consumption basket in the euro area, and 7.8% in France), as well as expenditure on utilities, maintenance, minor repairs etc. (4.4% for the euro area and 3.8% for France), it does not include the cost of owner-occupied housing (OOH). As a result, if the trajectory of OOH-related costs differs from that of other prices, taking them into account could affect the measure of inflation. It could also be a source of heterogeneity between euro area countries: for example, if OOH costs rise by more than the HICP, then the higher a country’s home-ownership rate, the more its HICP will be underestimated. This is why the ECB chose to examine the issue as part of its monetary policy strategy review, which concluded in July 2021.

Different methods exist for measuring owner-occupied housing costs

There are various ways of measuring OOH costs, but two approaches are the focus of particular debate in the euro area, each with its own advantages and drawbacks.

The imputed rent method consists in calculating the rent that home-owners would pay if they were tenants of their property. Imputed rents are already captured in the consumer price deflator in national accounting, and several countries take them into account in their national price indices (United States, Japan, Switzerland, Norway), including some in the euro area (Germany, the Netherlands). Using the imputed rent method would provide data at a monthly frequency, in line with the HICP; however, the approach is not based on actual monetary transactions, which is a requirement for the HICP. Calculating imputed rents can also be complex in countries where the rental market is small or segmented.

An alternative method is the “net acquisition” approach. This consists in measuring the purchase price of owner-occupied houses at the time of the transaction for newly built dwellings or dwellings purchased by households from sectors other than households. It thus excludes all purchases of second-hand dwellings from other households.

The net acquisition approach is used by Australia, New Zealand and Finland for their national consumer price indices. It is based on actual monetary transactions. Eurostat has also used it since 2014 to compile an owner-occupied housing price index (OOHPI). However, this index, which also captures expenditure relating to maintenance, repair and insurance, is only available on a quarterly basis and is published around 95 days after the end of the reporting quarter. Another drawback of the net acquisition approach is that it extends beyond the scope of consumption expenditure by including the price of investment property, which is similar to a financial asset. In the longer term it would be desirable to exclude the financial component from acquisition prices, for example by subtracting land prices, but this currently poses complex measurement challenges.

Characteristics of the OOHPI currently compiled by Eurostat

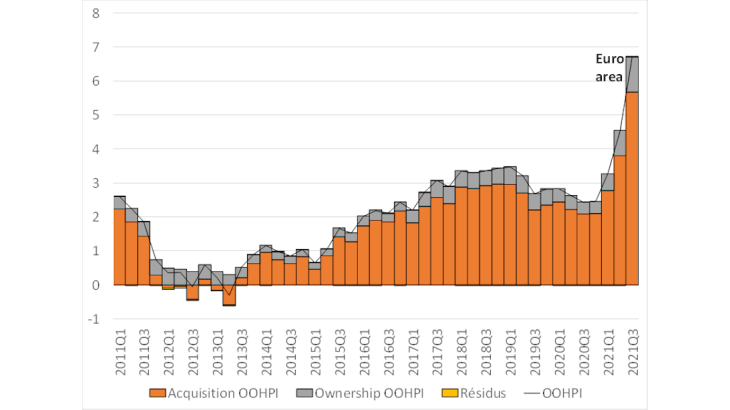

The OOHPI has two main components. The first, linked to the acquisition of housing, essentially reflects purchase or construction costs, and accounts for between 60% and 90% of the total, depending on the country, and around 80% on average for the entire euro area (Table 1). The second, linked to the costs of owning the property, includes expenditure on maintenance and repairs, as well as the cost of home insurance. The acquisition component is responsible for most of the variation in the OOHPI (Chart 2).

Table 1: Weight of the components of the OOHPI in a selection of countries in 2021 (%)

|

COUNTRY |

Acquisition |

Ownership |

|

FRANCE |

67.0 |

33.0 |

|

GERMANY |

89.1 |

10.9 |

|

ITALY |

76.0 |

24.0 |

|

SPAIN |

87.3 |

12.7 |

|

NETHERLANDS |

71.7 |

28.3 |

|

BELGIUM |

86.3 |

13.7 |

|

AUSTRIA |

59.9 |

40.1 |

|

PORTUGAL |

90.1 |

9.9 |

|

EURO AREA (BDF CALCULATION) |

79.0 |

21.0 |

Source: Eurostat (country data), authors’ calculations (euro area, based on country data)

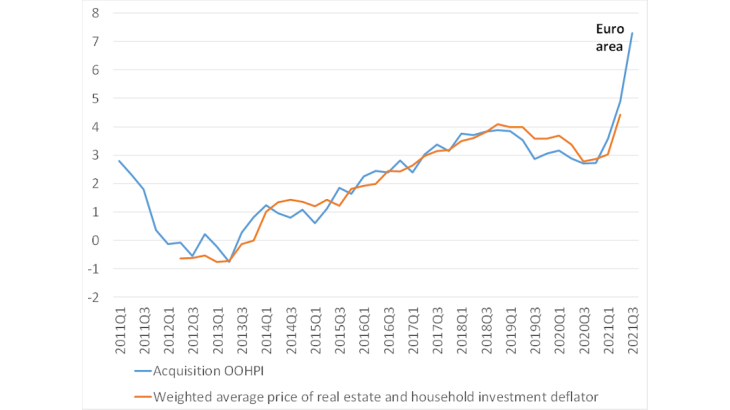

In practice, the acquisition component follows a similar path to a combination of two existing indices, which have different weights depending on the country: real estate prices (new and second-hand) and construction prices (measured in national accounting by the household investment deflator, which excludes land prices). The weight of real estate prices is around 40% on average in the euro area. However, in Spain and the Netherlands it exceeds 90%, with the result that the OOHPI in these countries closely tracks the path of real estate prices (Chart 3). In Germany, Italy and France, its weight is less than 30%, so the OOHPI in these countries more closely follows construction prices.

The effect of OOH-related costs on the inflation measure depends on the method used

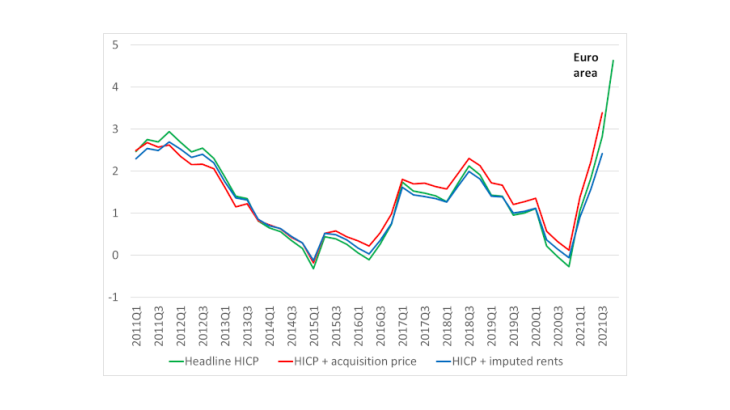

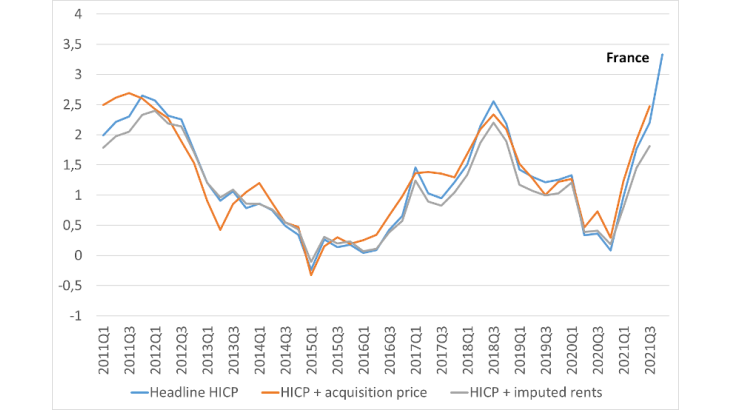

To estimate the impact that OOH inclusion would have on the inflation measure, we construct two alternative indices (Charts 1 and 4). Each index incorporates into the HICP a measure of OOH corresponding to one of the two methods: imputed rents from national accounting and Eurostat’s OOHPI. For the sake of simplicity, the weight of OOH is assumed to be constant and identical for both indices. It is set such that the average relative shares of imputed rents and effective rents over 2010-19 are the same as in the consumption deflator in the national accounts.

Historically, the inclusion of imputed rents has had a limited effect on the measurement of inflation. In the second quarter of 2021, their inclusion would have lowered inflation by 0.3 percentage point in the euro area, but the impact is often even smaller. The inclusion of acquisition prices, which often partially track real estate prices, would have had a bigger and more volatile impact, raising inflation by 0.4 percentage point in the second quarter of 2021, but lowering it by 0.4 percentage point in the third quarter of 2012. The impact would have been larger in those countries with a more pronounced real estate cycle, such as Spain.

The roadmap proposed by the ECB in its strategy review

Following its monetary policy strategy review, which concluded in July 2021, the ECB Governing Council proposed a step-by-step roadmap to integrate OOH into the consumer price index using the net acquisition approach. This roadmap will be submitted to the European Statistical System. If it is approved, by 2023 Eurostat could publish an experimental quarterly index that aggregates the OOHPI with the HICP for the entire euro area. The existing regulations would need to be changed in order to make this index an official publication. These changes would be examined in a second step by the European Commission, and would then have to go through the adoption process set out in the European treaties. This second stage could be completed towards 2026. The last step, which is more uncertain in length, would aim to publish this index on a monthly basis and with a reduced time lag. The ECB is also supporting research projects aimed at isolating the consumption and investment components of the index.

Throughout the transition period, the HICP in its current form will remain the main reference for monetary policy. However, the new quarterly index will play a complementary role in evaluating the impact of housing costs on inflation.

Updated on the 25th of July 2024