An extensive empirical literature has investigated the impact of competition on productivity, often using the OECD's anti-competitive Product Market Regulation (PMR) indicators to proxy for the lack of competition (see, for instance, Conway et al., 2006; and Barone and Cingano, 2011). Some papers have also used the OECD's Employment Protection Legislation (EPL) indicators to gauge the productivity impact of the lack of flexibility in labour markets (see, for instance, Bassanini, Nunziata and Venn, 2009). Recently, Cette, Lopez and Mairesse (2018) have proposed new measures of rent creation and rent sharing on cross-country-industry panel data, assessed the relationship of these new measures with the OECD PMR and EPL regulation indicators and estimated the impacts on productivity of these new measures.

What are the original features of our new measures of rent creation and worker’s rent sharing?

While standard measures of competition, such as the Lerner index, assume perfect labour markets, our new measure of rent creation, which is a notional mark-up rate, relaxes this assumption by taking into account that workers may appropriate, through their wages, part of the rent created. The corresponding measure of workers’ share of rent shows that the rent is shared equally between firms and workers on average, but this rent sharing appears very heterogeneous. Therefore, comparisons of these notional mark-up rates, between country, industry and year, differ markedly from comparisons using the Lerner index (and thus based only on the firm’s rent). Moreover, changes in the Lerner index are not necessarily directly associated with changes in workers’ rent, therefore the Lerner index changes are not a good proxy for rent creation changes. Indeed, half of firms’ rent increases (decreases) are achieved through decreases (increases) in workers’ rent and half through total rent increases (decreases).

How do market and employment regulations impact rent creation and rent sharing?

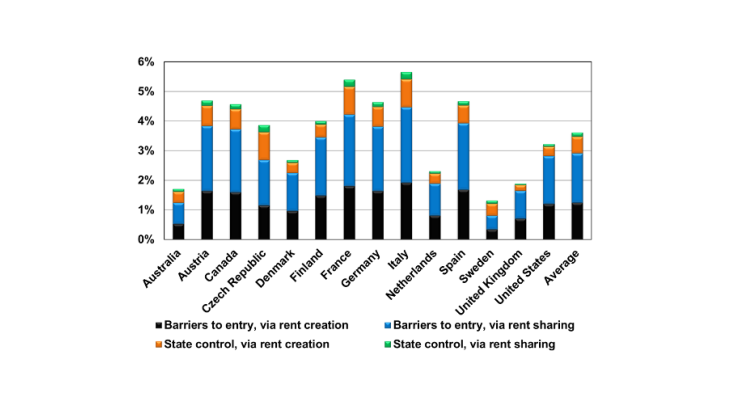

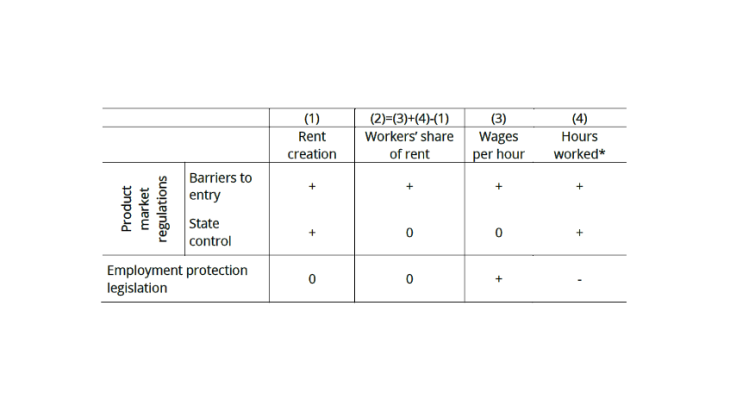

In Blanchard and Giavazzi's (2003) theoretical model, the creation of rents results from product market regulations, whereas workers’ rent sharing is influenced by labour market regulations. This model has received empirical support in Askenazy, Cette and Maarek (2018) who used value added prices and value added labour shares as indicators of rent creation and rent sharing. The new measures proposed by Cette, Lopez and Mairesse (2018) lead to a deeper understanding of the links between market and employment regulations and corroborate these theoretical conclusions overall, but with interesting differences. Table 1 summarizes these links, showing that: (i) PMR has positive effects on rent creation and workers’ share of rents; (ii) these PMR effects are higher for barriers to entry than for State control regulations; (iii) EPL has a positive impact on wages per hour; but (iv) EPL has no significant impact on workers’ share of rents as a negative impact on hours worked offsets the positive impact on wages per hour. Moreover, estimation results by skills find that these two opposite impacts of EPL on wages and hours worked are larger for low- and medium-skilled workers than for high-skilled workers.