The Covid-19 crisis triggered a “dash for cash” phenomenon that revealed vulnerabilities on short-term debt markets, and required the intervention of various central banks. The Eurosystem, the Federal Reserve and the Bank of England decided to conduct asset purchases of corporate commercial papers that correspond to unsecured short-term debt securities issued by non-financial firms to meet their cash needs, such as payrolls and inventories. This paper studies the impact of the first asset purchases conducted by the Eurosystem as part of the Pandemic Emergency Purchase Programme on the French market.

In March 2020, market tensions on the corporate commercial paper market started to materialize: issuance volumes plummeted coupled with a deterioration of issuance terms (maturity and financing conditions). Firms able to issue such securities were doing so with shorter maturities, possibly increasing their vulnerabilities in the short run (rollover risk), and at higher rates. These market disruptions were closely related to the ones observed among money market funds as these financial intermediaries have a significant footprint on the commercial paper market. In the Covid-19 context, the demand for these securities was also severely impaired. Indeed, money market funds (MMFs), typically held by institutional investors for cash management, were facing significant outflows from investors withdrawing their shares. To face these redemptions, money market funds first used their cash buffers. However, they were also forced to sell some assets, including commercial papers at prices lower than the ones that would have prevailed if the secondary market for commercial papers were not both small and illiquid and if the universe of alternative investors to buy their CP were not so limited. These tensions ultimately required the intervention of the Eurosystem on this market to restore confidence and boost trading activity.

The Eurosystem was able to buy commercial papers issued by investment grades firms, in euros, with a maturity higher than 28 days, and a minimum issuance amount of 10 million €, both on the primary and secondary market. This intervention was slightly different from the other past ones, especially asset purchases of corporate bonds within the Corporate Securities Purchase Programme (CSPP). First, the intervention was fast and short-lived, since a significant share of the purchases conducted in 2020 were made three months after the start of the purchases. Second, the goal of the PEPP was to restore trading volume to keep a reference rate for these unsecured securities, ultimately allowing for a smoother monetary policy transmission in the short run.

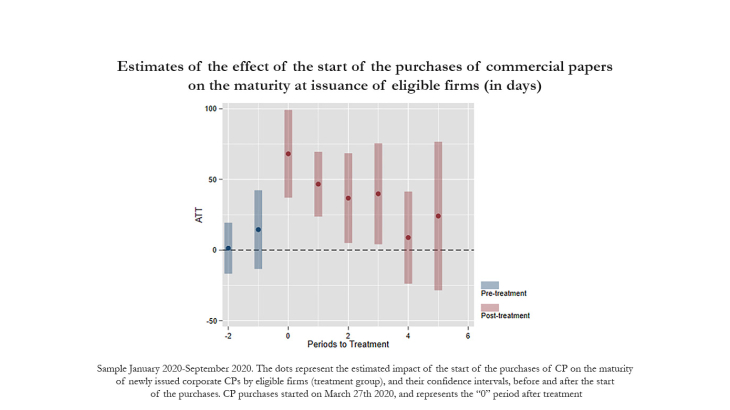

The primary objective of this paper is to understand the effects of the PEPP on corporate commercial paper market in terms of volumes and issuance terms (interest rates and maturity). We found a shift in the debt composition of eligible firms towards eligible debt, without an economically significant effect on the aggregate volume. We discovered that the PEPP led to an easing of financing conditions for eligible firms by 12 bps on average and 18 bps for longer maturity buckets. While the PEPP was not targeting maturity at first, we found a significant increase in maturity by 42 days on average for eligible firms, with potential positive effect on rollover risk of these corporations. On the demand side, as the investor base matters regarding the terms of the short-debt securities that firms issue, we split our sample of eligible firms between those primarily hold by MMFs before the crisis, e.g. in December 2019, and the others. We uncover that the effect on maturity was smaller when MMF were significant holders of debt, indicating their role into maturity debt structure.

Keywords: Commercial Paper, Pandemic Emergency Purchase Programme, Eurosystem, Debt Structure, Money Market Funds

JEL classification: E52, E58, G01, G12, G20, G23