1. Organisation of gas and electricity futures markets in Europe

Russia’s invasion of Ukraine led to a sharp rise in gas and electricity prices, and increased their volatility.

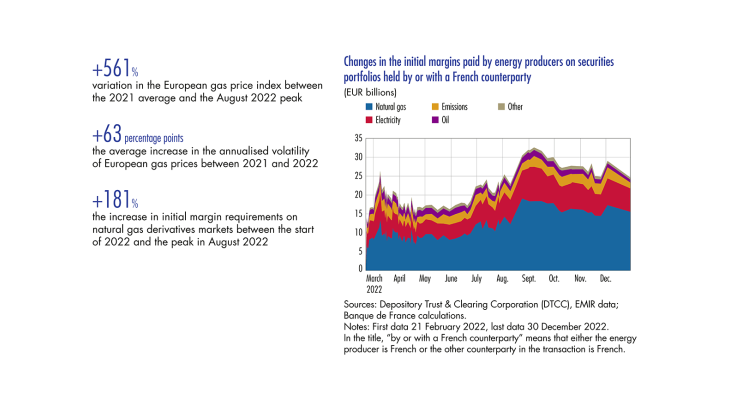

The first disruptions to Russian gas deliveries to Europe at the end of 2021, followed by the invasion of Ukraine in February 2022 (which led to a sharp reduction in gas exports from Russia from May/June onwards) put significant pressure on wholesale prices and on the volatility of natural gas in Europe (see Chart 1a). Due to the organisation of the European electricity market, the inflationary shock on natural gas also spread to electricity prices, and affected their volatility in the same way (see Chart 1b, and further details on the transmission mechanisms of these shocks in the article by Baget et al., 2023). However, after peaking in summer 2022, gas and electricity prices fell sharply.

Electricity/natural gas derivatives markets are intended to transfer risks

For energy market players, derivatives markets enable them to hedge against the risk of future price variations over the production cycle. Their use of financial derivatives (futures, forwards, swaps and options) varies according to their economic activity. Commercial banks act mainly as intermediaries, allowing non financial players and investment funds to participate in the market. Non-financial players, such as energy producers, processors and distributors, generally use derivatives to hedge against the price variations that could affect their business. Energy producers protect themselves against a potential fall in prices throughout the energy transport and processing phases, while consumers protect themselves against a future rise in prices before delivery. Lastly, some investment funds participate in the commodity derivatives market by taking speculative directional positions (i.e. in terms of the expected direction in which the price of the underlying asset will change).

Central counterparties (CCPs) provide secure trading in the derivatives market by acting as intermediaries between buyers and sellers on cleared markets as well as for certain over-the-counter transactions. This central role is designed to limit the risk of loss in the event of a counterparty default, through margin exchanges. These exchanges take the form of initial margins and variation margins.

[To read more, please download the article]