Home lending standards have returned to 2007-08 levels

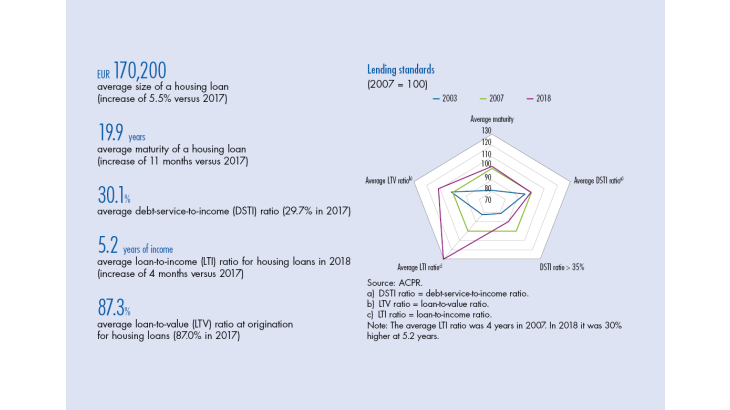

Bulletin n°223, article 3. Against a backdrop of persistently low interest rates, the French residential real estate market proved extremely dynamic in 2018. Total outstanding housing loans exceeded the EUR 1,000 billion mark at the end of the year. Due to the structural features of the French market (preponderance of fixed-rate and guaranteed loans), credit risk remains limited. Nonetheless, lending standards have gradually been eased and in some cases are back in line with the levels observed in 2007-08. This is contributing to the rise in borrowing, and helping to push prices up faster than household income. The easing of lending standards concerns all categories of borrower. However, given that a high share of new loans are to borrowers who already own property and who have higher earnings and financial resources, the risks appear to be contained, as demonstrated by the low rate of loan delinquencies. The easing of lending standards and trajectory of household indebtedness raise concerns as to the sustainability of recent developments. As a result, the Autorité de contrôle prudentiel et de resolution (ACPR – Prudential Supervision and Resolution Authority) and Banque de France are keeping a close eye on the risks linked to the financing of the residential real estate market.