- Home

- Publications and statistics

- Publications

- French financial institutions facing the...

French financial institutions facing the climate transition

Post n° 348. As France undergoes the transition to a low-carbon economy, the financial sector must manage the associated risks and contribute to its financing. The sector's exposure to climate transition risk is far from negligible, while securities and loan portfolios are still not adequately aligned with European low-carbon transition targets.

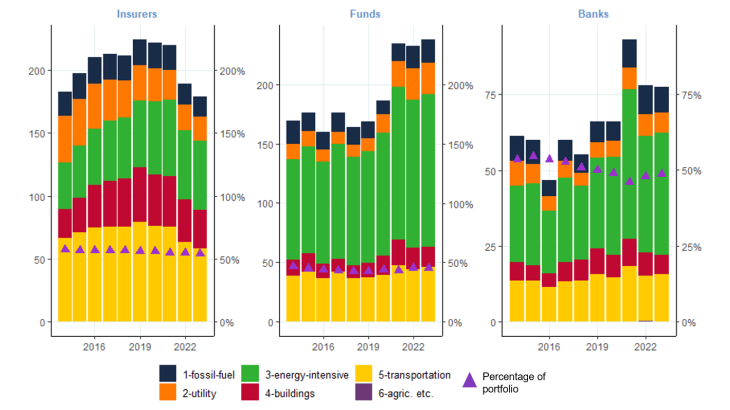

Chart 1: Financial institutions’ exposure (securities portfolios) to climate-policy relevant sectors (CPRS)

Notes: Amounts exposed to climate-policy relevant sectors (CPRS) via securities (debt, equities and other) under direct management, in (i) EUR billions (left-hand scale) and (ii) as a percentage of the portfolio dedicated to non-financial companies (NFCs; triangles, right-hand scale). Key: the exposure of French insurers to CPRS amounted to EUR 180 billion in 2023, or approximately 50% of their securities portfolio dedicated to NFCs.

As France and the European Union undergo the transition to a low-carbon economy, the financial sector (banks, insurers, and investment funds) must manage the associated risks and contribute to its financing. As part of this process, funding for certain sectors, such as fossil fuel extraction, must be halted in favour of low-carbon emission activities, and all businesses must be encouraged to implement coherent transition plans.

France’s National Low-Carbon Strategy estimates that approximately EUR 105 billion in financing will be needed every year to achieve Europe’s goal of reducing emissions by at least 55% by 2030. Although French financial players have pledged to contribute to the efforts (see the Declaration of the Paris Financial Center: A new step for Green and Sustainable Finance), implementing transition policies in line with these objectives could result in substantial losses for insufficiently prepared financial institutions (Jourde and Koné, 2023). Against this backdrop, this blog post puts forward a series of indicators to measure and monitor French financial players’ level of exposure to climate transition risks and their capacity to finance the transition of the economy.

Climate risk exposure and transition financing indicators

The French financial sector’s exposure to transition risk and its support for carbon emission reduction targets can be measured using indicators based on sectoral holdings of security and loan portfolios. Taking the NACE classification of economic activities in the European Community as their starting point, studies by Battiston et al. (2017) and Alessi and Battiston (2022, 2023) identify four indicators based on the share of portfolios invested:

i. in all sectors likely to be affected, positively or negatively, by the transition and that are relevant to its successful implementation, such as fossil fuel, energy intensive, construction, utilities, transport and agricultural sectors – climate-policy relevant sectors (CPRS);

ii. in a subset of economic activities, within the CPRS, that are particularly harmful to the climate and therefore highly exposed to transition risk and subject to a heightened risk of correction in the event of a disorderly transition (e.g. fossil fuels) – transition exposure coefficients (TEC);

iii. in key activities for transition – meeting one of the six environmental objectives defined by the European Union (EU) Taxonomy – that do not necessarily make a substantial contribution for the moment. Electricity production, for example, is taxonomy-eligible but only the share generated by renewable energies is deemed to be taxonomy-aligned (see below) – taxonomy eligible (TEL) activities;

iv. in activities that comply with transition-related technical criteria, such as renewable energies or electrified railway systems – taxonomy alignment coefficients (TAC).

Financial institutions’ exposure to sectors affected by climate policy and climate transition risk

In 2023, around half of the securities portfolios allocated to non-financial corporations (NFCs) by financial institutions resident in France were invested in climate-policy relevant sectors (see Chart 1). The total exposure amounts vary across institutions: EUR 940 billion for banks resident in France (EUR 865 billion through loans – see Chart 3 – and EUR 75 billion through holdings of securities); EUR 250 billion for investment funds; and EUR 175 billion for French-resident insurers. Banks are the main source of funding for the construction, real-estate and agricultural sectors (see Charts 1 and 3), while investment funds and insurers focus to a larger extent on energy-intensive sectors and the transport sector, respectively.

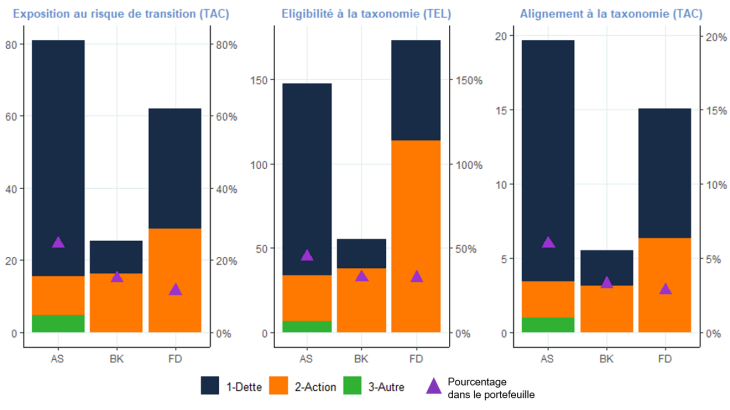

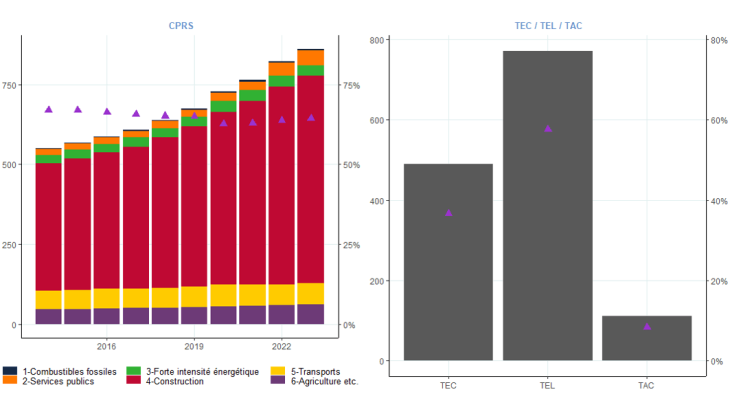

Activities with a high exposure to transition risk account for a fairly significant proportion of the (NFC-dedicated) securities portfolios of insurance companies, banks and investment funds (25%, 15% and 12%, respectively) – see Chart 2, left-hand panel. However, this high risk exposure is far more limited in the overall securities portfolios, including financial and public sector assets (between 2% and 4%). Furthermore, almost 40% of bank loans to NFCs are highly exposed to transition risk (accounting for around EUR 500 billion, or 14% of total loans to non-financial customers and 4% of French banks’ total assets) – see Chart 3. The exposure of the French financial institutions’ portfolios to climate transition risks therefore appears substantial, particularly for banks with their large exposure to NFCs , but looks to be manageable in relation to their total assets.

Chart 2: Exposure to climate transition risk and alignment with the EU Taxonomy (securities portfolio)

Notes: Amounts exposed (i) in EUR billions (left-hand scale) and (ii) as a percentage of the securities portfolio dedicated to non-financial corporations (triangles, right-hand scale) at Q2 2023. INS: Insurers; BK: Banks; FD: Funds. Debt: short and long-term bonds; Equity: listed and unlisted shares; Other: not attributed/not specified. Key: Transition risk exposure (TEC) of French insurers at Q2 2023 amounted to EUR 80 billion, accounting for 25% of their NFC-dedicated securities portfolio.

Transition financing by French financial institutions

In 2023, the financing of activities aligned with the transition objectives by French financial institutions’ securities portfolios was marginal. Between 3% and 6% of their portfolios of NFC-issued securities were aligned with the EU Taxonomy (see Chart 2, right-hand panel), which corresponded to between EUR 5 billion and EUR 20 billion. This result is consistent with the conclusions of Alessi and Battiston (2022) for the euro area as a whole and reflects the fact that various sectors of activity are insufficiently aligned with the EU Taxonomy. However, 30% to 45% of French financial institutions’ NFC-dedicated portfolios are invested in securities issued by companies whose activities are taxonomy-eligible (see Chart 2, central panel). Financial institutions therefore have significant scope of possibility to encourage companies, particularly through influencing strategies, to align their activities with EU transition objectives.

Loans granted by French-resident banks are by far the main potential source of financing for the transition (see Chart 3, right-hand panel). Financing for transition-eligible activities stands at close to EUR 770 billion (or 60% of the portfolio of loans to NFCs, mainly in the construction and real-estate sectors). French banks are also the main source of funding for taxonomy-aligned activities (EUR 100 billion, or around 10% of the portfolio). These observations underline the importance of properly integrating corporate environmental performance issues, so that banks become key players in the climate transition (Carradori et al., 2023).

Chart 3: Exposure of banks, through loans, to climate transition risk and alignment with the EU Taxonomy

Notes: Amounts exposed (i) in EUR billions (left-hand scale) and (ii) as a percentage of the Loans portfolio dedicated to non-financial corporations (triangles, right-hand scale) at Q2 2023. TEC – transition risk exposure; TEL – EU Taxonomy eligibility; TAC – Taxonomy alignment. The construction sector also includes exposures to real-estate activities (NACE code 68), which include French SCI non-trading real-estate companies.

The securities and loan portfolios of French financial institutions are substantially exposed to transition risk, and are still insufficiently aligned with transition objectives. The major priority for financial institutions is twofold: first, to ensure that NFCs are implementing and complying with transition plans consistent with European emission reduction targets; second, to draw up and disclose their own transition plans to align their portfolios with global net-zero trajectories by 2050. Opportunities for investor action depend on the type of assets held: banks have a significant role to play as the main providers of credit, enjoying a particularly close relationship with borrowers. Insurers have substantial bond holdings and can thus play a catalysing role in the development of market instruments associated with green finance. Investment funds, as major shareholders, can influence company decisions on climate policy. It is therefore essential that funds clarify their engagement strategies and step up their scope of influence (Heath et al., 2023). These measures will ultimately reduce the French financial system’s exposure to the risk of a disorderly transition.

Download the PDF version of the publication

Updated on the 25th of July 2024