1st prize in the 2024 Eco Notepad competition

Post No.377. The reconfiguration of value chains in an increasingly fragmented global economy is being characterised by the emergence of “connector countries” that serve as bridges between the Chinese and American blocs. By strengthening its ties with these countries and positioning itself as a “connector area” via a more integrated internal market, Europe can play a pivotal role in this new landscape.

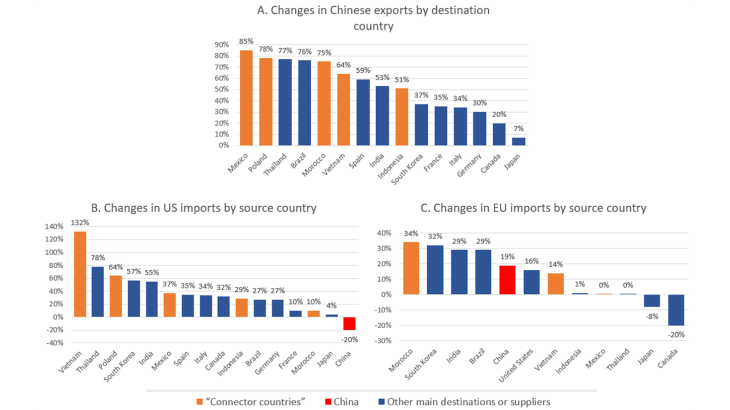

Chart 1: Change in value of exports (China) and imports (US and EU) between 2018 and 2023

Note: China’s exports to Vietnam increased by 64% between 2018 and 2023, whereas US and EU imports from Vietnam increased by 132% and 14% respectively. The connector countries are identified in Bloomberg, 2023.

“Connector countries” highlight growing economic fragmentation that could weaken Europe

The fragmentation of the global economy is in part the result of renewed geopolitical tensions. The trade war between the United States and China undoubtedly contributed to the 20% contraction in US imports from China between 2018 and 2023 (Chart 1B). But although direct trade is falling, flows could be increasing via other routes. Indeed, mirroring this inter-bloc logic, global value chains (GVCs) are also lengthening, pointing to a rise in the role of “connector countries” (Gopinath et al., 2024), which act as intermediaries for increasingly indirect trade flows. Accordingly, those countries that have seen the biggest rise in their import share in the US market have also seen the biggest rise in their inflows of Chinese exports (Chart 1A and Alfaro and Chor, 2023).

Vietnam, Poland, Mexico, Morocco and Indonesia (Bloomberg, 2023) are emerging as “connector countries”, capable of locking in trade gains despite global fragmentation. Thanks to their strategic geographical position and to price competitiveness of their production factors, they are also benefiting from the new investment priorities of foreign firms, which include reshoring, nearshoring and friend-shoring (Yellen, 2022). As a result, Mexico overtook China in 2023 as the United States’ largest trading partner, and has become a major player in the so-called “China Plus One” strategy (María de la Mora, 2024), aimed at diversifying supply chains by directing investment towards countries other than China.

The United States and China are thus developing partnerships with “connector countries”. Vietnam has become an alternative manufacturing base to China for US chipmakers. Moreover, the US CHIPS and Science Act of 2022 provides for partnerships with Mexico and Indonesia to develop the semiconductor ecosystem, while Morocco – theoretically the EU’s primary “connector country” – was the first Maghreb country to join the New Silk Road project in 2017.

Contrasting with this, Europe saw no significant increase in its trade flows with the five “connector countries” between 2018 and 2023, with the exception of Morocco (see Chart 1C). Europe has failed to embrace this trend of supply chain reshuffling, leaving it potentially vulnerable.

This fragmentation weakens Europe, which also has a poorly diversified supply of critical materials

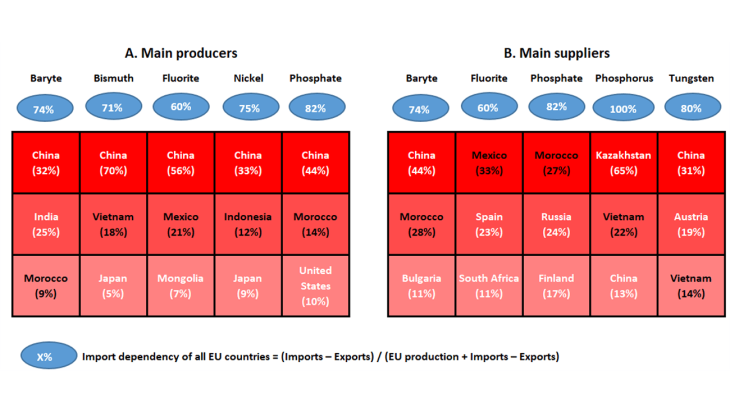

The EU enjoys a higher level of intra-community trade than other free trade associations, however, it also has fewer critical raw materials (CRM) than other regions. This shortage of geographically concentrated materials, which are notably essential for the green transition, means that the EU is highly reliant on its suppliers, including the “connector countries” (Chart 2).

Chart 2: Three largest global producers and three largest EU suppliers of CRM, average over 2016-22

Note: Mexico produces 21% of the world’s fluorite (2nd largest producer) and provides 33% of the EU’s fluorite imports (leading supplier).

To secure its supplies of CRM, Europe introduced the Critical Raw Materials Act on 11 April 2024. The text states that the EU cannot rely on a non-EU country for more than 65% of its imports of each CRM (Chart 2 shows that it has already reached this limit with Kazakhstan). Despite this, the geographical concentration of supplies makes the EU particularly vulnerable to trade restrictions, such as the ban on nickel exports in Indonesia, the world’s second-largest producer. This constraint has forced European firms to offshore the raw material processing locally, depriving it of full sovereignty over its industrial strategy.

Europe is increasing its bilateral ties with “connector countries” as a potential “third way”

In response to the vulnerability caused by growing economic fragmentation, the EU is trying to strengthen its trade links with “connector countries”, even though they remain weaker than those of its competitors. For example, China and the United States are Indonesia’s two largest trade partners, accounting for goods flows of USD 139.4 billion and USD 38.0 billion respectively in 2023, compared with USD 31.6 billion for the EU (UN Comtrade).

However, Europe has been working on free trade agreements with “connector countries” and, since 2021, has been rolling out its Global Gateway strategy, to avoid being left on the sidelines by the Chinese and US blocs. Talks on a free trade agreement with Indonesia began in July 2016. In addition, the EU is trying to strengthen this agreement by supporting the Indonesia Just Energy Transition Partnership, signed at the November 2022 G20 to help the country transition away from coal. The European Investment Bank has committed to providing some one billion euro in loans to the partnership. In the case of Vietnam, the EU’s leading ASEAN partner for goods trade (USD 63.6 billion in 2023, UN Comtrade), the EU-Vietnam Free-Trade Agreement and EU-Vietnam Investment Protection Agreement were signed in 2019. However, the latter still needs to be ratified by the national parliaments, which could highlight political fragmentation within the EU.

Europe relies on its comparative advantages to become a “connector area”

In addition to the development of relationships with connector countries, growing trade fragmentation also opens up the possibility of Europe playing a pivotal interconnecting role between the United States and China.

Like the “connector countries”, it can position itself as a “connector area” in its own right, by overcoming its own internal barriers and ensuring closer intra-community cooperation. In this regard, Europe benefits from a mix of innovation and manufacturing that provides an ecosystem quite different from both the United States, which is comparatively more specialised in innovation, and from China, which is more focused on manufacturing.

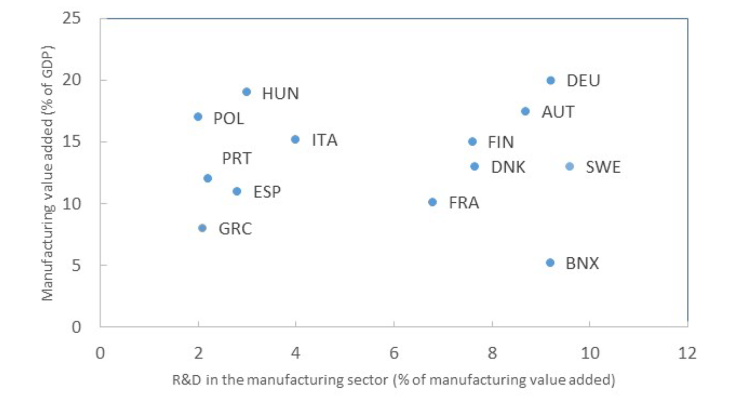

Chart 3: The EU, a mix of countries specialising in innovation and manufacturing

Note: Positioning of countries according to their performance in terms of manufacturing value added (% of GDP) and industrial R&D (% of manufacturing value added).

Chart 3 shows that the EU includes countries such as the Nordic countries, Benelux, Germany and France, which inject 7-10% of their manufacturing value added back into R&D. Meanwhile, Poland benefits from a good cost-competitiveness of a highly quality workforce, and has emerged as a “connector country” capable of attracting substantial foreign investment. In 2022 it notably became the second biggest global producer of batteries after China (on batteries, see Sayagh and Wessim, 2024 billet 378).

European countries can therefore respond to economic fragmentation by specialising in either innovation or manufacturing, depending on their comparative advantages. By reducing the cost of cross-border trade, the deepening of the single market, and especially financial integration (see The Savings and Investments Union), could improve the interconnection of European countries and offer a third avenue without fostering fragmentation. Europe would be independent in its interdependency, and could play a linking role in the “new global map” (Lagarde, 2022).

Download the PDF version of the publication

Updated on the 6th of December 2024