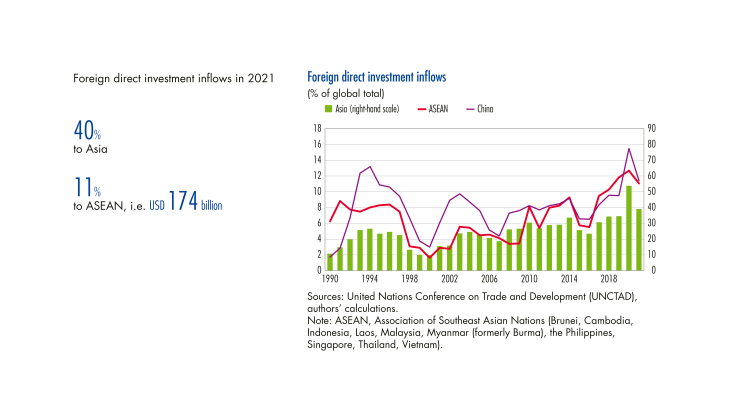

The ASEAN region has benefited enormously from the globalisation of value chains and accounts for over 10% of global foreign direct investment (FDI) since 2018.

This trend reflects the shift in the global economic centre of gravity towards the Asia-Pacific region, underpinned by the rise of China and the region’s own internal momentum which should increase in intensity over the coming years. This is all the more remarkable as the countries of the region differ widely in terms of their economic development, legal systems and political stability.

1 Trade integration among ASEAN countries preceded the boom in FDI

The economic success of ASEAN countries is based around their ability to integrate global production chains and attract direct investment. Back in 1992, the ASEAN countries signed a free trade agreement (AFTA – the ASEAN Free Trade Area) that initially brought together six members (Brunei, Indonesia, Malaysia, the Philippines, Singapore and Thailand), before adding Vietnam (1995), Laos and Myanmar (formerly Burma) (1997), and Cambodia (1999). This free trade agreement between ASEAN members was rounded out by bilateral and multilateral agreements with other partner countries (China, Japan, South Korea, India, Australia, New Zealand and Taiwan), culminating in the creation of the Regional Comprehensive Economic Partnership (RCEP) on 1 January 2022. The agreement promotes direct investment and is largely based around existing arrangements within ASEAN, however it is not as exhaustive as the CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership).

ASEAN has among the highest number of international investment agreements per member country. As of April 2021, ASEAN member states had signed 221 treaties containing investment provisions as part of free trade agreements (FTAs), and 287 bilateral investment treaties with non-ASEAN countries, reflecting the determination of member states to attract FDI and strengthen investment ties with partner economies.

To continue to attract FDI and boost trade integration, ASEAN countries need to work together to maintain an investment-friendly environment for foreign investors. However, these countries differ widely in terms of their political, institutional and regulatory frameworks. Reducing internal political risk is also a prerequisite for more effective integration. Moreover, while it is possible to ease the restrictions on FDI (see below), governments need to act together to make environmental, social and corporate governance standards more effective.

[to read more, please download the article]