The lack of corporate investment has been identified as one of the major weaknesses in the aftermath of the 2008 crisis (Banerjee et al. 2015, Fay et al. 2017). Several explanations have been proposed, ranging from decreased competition (Gutiérrez and Philippon, 2017) to the rise of intangible assets and globalization (Alexander and Eberly, 2018) or financial factors (Acharya and Plantin, 2019). However, we still know too little about how firms put together various financial resources to undertake new investments. And to what extent does the financing mix depends on the nature or size of the investment or firm size?

To tackle those questions, we resort to a methodological framework commonly used in the international trade literature (Eaton et al. 2004, among others) and recently employed in the corporate finance literature (Frank and Goyal 2003, among others). This methodology enables to quantify the contribution of each of these funding sources to the financing of firms’ investment. In practice, we investigate to what extent different funding sources (bank credit, financial debts, equity, retained earnings and cash holdings) contribute to finance both fixed assets and working capital assets accumulation. Our study also examine to what extent these financing patterns are likely to vary with the nature of assets (tangible vs. intangible assets), the size of the firms and the size of the investments undertaken.

This paper provides a comprehensive picture of the funding sources used by firms to undertake new investments and to finance their working capital assets. For this purpose, we use financial statements from a sample of French firms covering 72% of the value added of non-financial corporations in 2018, from very small firms to the largest ones, over the last three decades. Our findings are the following.

First, bank credit appears critical to the financing of investment for the vast majority of firms: we estimate its contribution to the financing of fixed assets accumulation to be around 60%. The remaining funding sources are (i) the other financial debts, (ii) the retained earnings and (iii) the cash holding, each of them contributes to more or less 10% of the financing needs.

We then find that, the contribution of bank credit to fixed assets investment strongly decreases as we consider larger firms: from 60% for the bottom 25% of the distribution of firm size, the contribution of bank credit is estimated to be only 40% for the top 5% largest firms. At the same time, the contribution of other financial debts and equity funding are found to be largely increasing with firm size. In contrast, we find that the contribution of bank credit to fund working capital assets is rather independent on firm size (around 19%).

Third, we show that bank credit strongly contributes to the funding of tangible fixed assets (43% in the weighted-OLS estimation) but to a lower extent to the funding of intangible fixed assets (23%). Indeed, intangible fixed assets rely proportionally more on equity (17% vs 7% for tangible fixed assets) and other financial debts (30% vs 20%). Retained earnings and cash holdings play no significant role in the funding of intangible fixed assets.

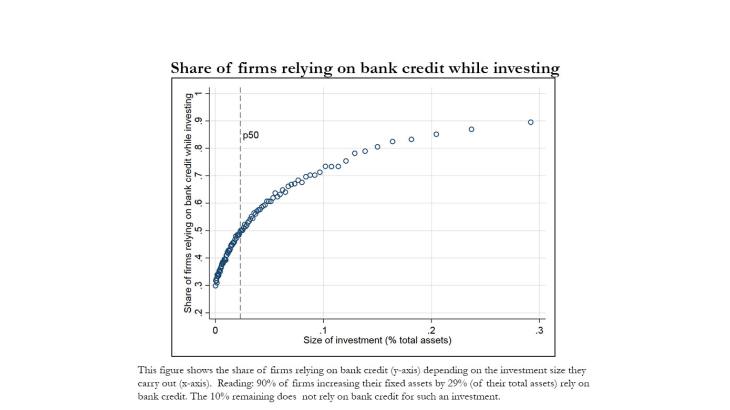

Finally, we show that the funding mix also changes significantly depending on the size of investment. Bank credit strongly contributes to fund large investments (46%) but much less to fund small investments (30%). On the contrary, internal financial resources and most notably retained earnings emerge as an important source to finance small investments.