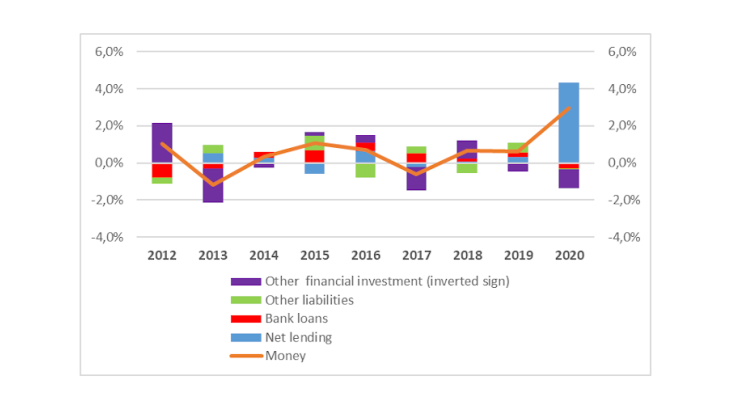

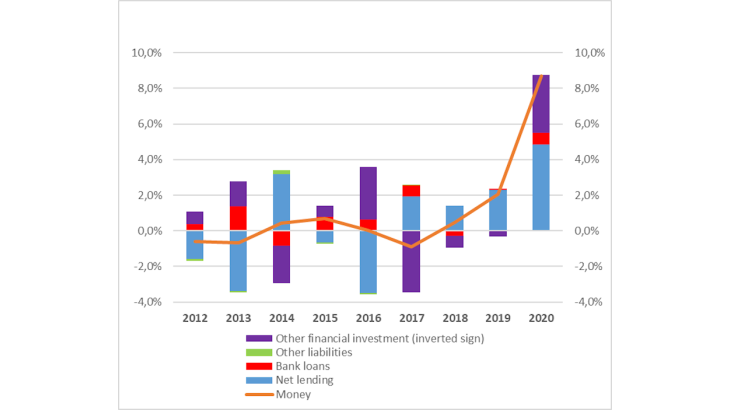

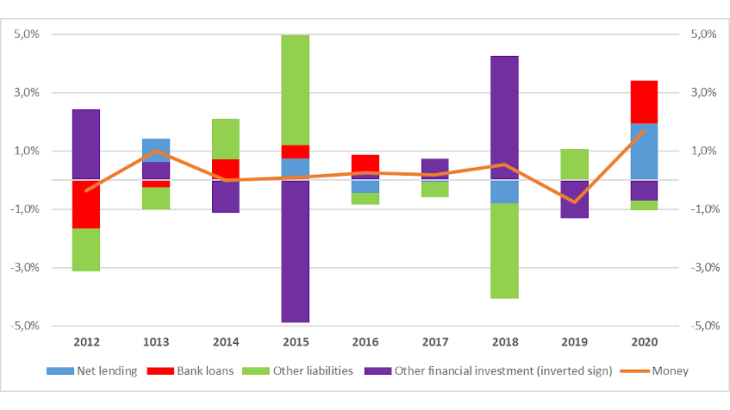

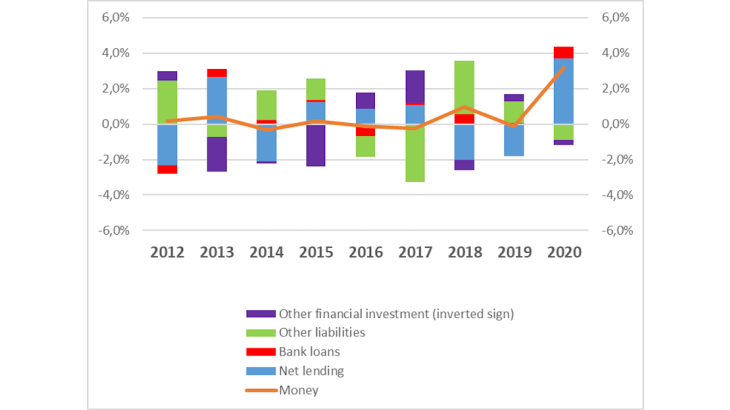

Note: The chart shows the change in money holdings (orange line) resulting from the changes in net lending, financial investment and liabilities (bars). Other liabilities includes other accounts payable. Other financial investment includes long-term deposits and debt securities, equities, investment fund shares excluding money-market funds, insurance reserves, other accounts receivable.

The pandemic had a very large impact on the economy, economic agent’s earnings and financial behaviour. Households experienced a very strong increase in their net lending (also referred to in this blog as “financial savings”), together with a surge in money holdings. Money held by households rose by around 9% of GDP in the United States, compared with 3% in the euro area. The articulation between money holdings, net lending, liability issuance and portfolio shifts in the euro area and the United States can be formalized by the following identity:

Money = Net lending + bank loans + other liabilities – other financial investments.

The money stock held by one sector is raised through financial savings (net lending), by incurring loans or by issuing other liabilities (for instance equities and debt securities). It is lowered through financial investments other than money (long-term debt securities, equities, non-money market fund shares and insurance reserves).

The rise in households’ financial savings was due to the combination of very large public transfers and a fall in consumption as a result of general lockdown. It was the main driver of the growth in money holdings in the euro area and the United States. This surge in money holdings reflects the massive issuance of public debt purchased by monetary financial institutions (MFIs) and channeled into the money holding sectors through public transfers (see Bulletin no 239-2). However, portfolio shifts also played a role, which differed across both regions. In the euro area, the monetary dynamics were attenuated by the increased purchases of higher risk assets: equities, non-money market fund shares and life-insurance reserves. Conversely, in the United States, portfolio shifts into money, i.e. out of debt securities and non-money market fund shares, enhanced the build-up of monetary assets (see purple bar in Chart 2). Bank loans did not play an important role in either area. In the United States, the Fed Survey of Consumer Expectations (March 2021) suggests that one third of households' stimulus checks has been used to pay off their debt.