A potential source of information for credit institutions are credit ratings, which are opinions on borrowers' creditworthiness produced by third-party agencies. Whether banks rely on third-party ratings for their lending decisions is not obvious: Given their superior screening and monitoring technologies, credit institutions may prefer to produce the assessment of borrowers’ credit quality on their own. The existing literature typically focuses on the use of credit ratings by capital market investors. Little evidence exists on the use of credit ratings by banks, and their implications for small- and medium-sized firms, which mainly obtain funding through bank debt.

This paper studies whether, and how, rating information influences firms’ access to bank financing and corporate policies. To do so, we consider a unique setting in which a large number of small- and medium-sized firms have a credit rating, issued by the Banque de France, and such ratings are primarily available to banks. We then exploit a reform of 2004 that increases the number of notches of the rating scale, making a more stringent and precise classification of firms. The consequence is that within the same rating class some firms receive a positive rating surprise, which implies an increase in their credit rating level, albeit not due to changes in the firms’ fundamentals.

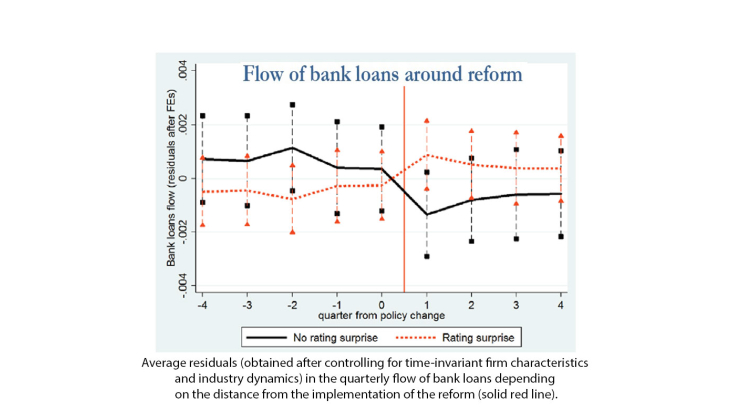

Our first hypothesis is that if credit institutions rely on ratings for their lending decisions, such exogenous change in the rating information influences firms’ credit availability. To address this question, we exploit firm level information on quarterly bank debt exposure for a panel of firms for which Banque de France’s analysts do not report any change in their judgement in the four quarters preceding the reform. When the reform is implemented, some firms receive the rating surprise while others do not. We test our hypothesis using a difference-in-differences methodology, and compare the trajectories of firms that receive the surprise and firms that do not, before and after the reform. We remove any constant firm characteristic, industry-specific business cycle, and rating class-specific dynamics. We find that, exactly when they receive the rating surprise, affected firms experience a greater supply of credit (see the figure below), equivalent to an expansion in the annual flow of bank loans of about 1.2 % of total assets. This finding is consistent with the idea that banks use the third-party certification in their lending decisions.