In this paper, we use a unique cross-country micro-based dataset of exporters available for 11 European countries (2001-2011) to investigate how firms’ exports react to real exchange rate movements, and how this reaction may be driven by their productivity level. We then combine the estimated firm-level exchange rate elasticities with information about the microeconomic structure of each country's exports to predict the macroeconomic exchange rate elasticity for each of these countries. While we do not have direct access to firm level data, this dataset reports detailed information about firms' activity related to exports by productivity classes (deciles) defined within each country, sector and year. This information allows us to identify in particular, for each country and sector, the distributions of exporters' productivity as well as their export performance (level or growth).

In our empirical investigations, the exports growth of each firm is explained by real effective exchange rate movements in the exporting country, an indicator of foreign demand, a control for the euro membership, and a set of fixed effects controlling for unobserved heterogeneity. We consider both real effective exchange rate (REER) variations based on relative unit labor costs (ULC) and consumer price index (CPI) changes, as they reveal different but complementary information regarding changes in production costs and prices. Our sample of 11 countries from “Western” Europe (Belgium, France, Italy, Portugal and Finland) and “Eastern” Europe (Estonia, Hungary, Lithuania, Poland, Slovenia, and Slovakia) offers us a wide variety of shocks over recent years and a sufficient variance for identification.

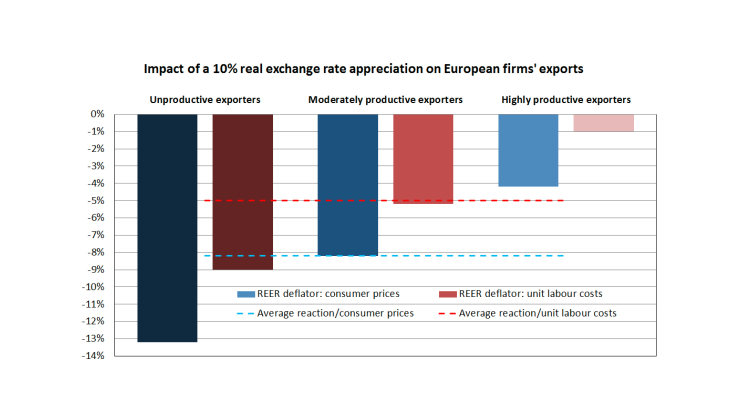

The benchmark average microeconomic elasticity obtained from our estimations ranges from about -0.5 (ULC-based REER) to -0.8 (CPI-based-REER): a 10% appreciation of the real effective exchange rate tends to reduce the exports value in euros of the average firm by 5% to 8%. We find that the reaction of the average firm to REER variations hides substantial heterogeneity within a given sector and country. The elasticity obtained for least productive firms (the bottom 20% of the productivity distribution in each country sector and year) is three times higher than for the most productive firms (the top 20% productive firms) when we consider the CPI-based REER, and eight times higher when we consider the ULC-based REER. We confirm the role played by productivity heterogeneity when firms are ranked based on a European distribution of productivity within each sector rather than on a country-specific productivity distribution: the least productive European exporting firms are on average more responsive to exchange rate movements compared with the most productive ones.

Based on an aggregation exercise using the export shares by firm-productivity class, we find that real effective exchange rate variations have a large impact on aggregate exports in countries populated with a high density of low productive firms, and a weak impact in countries populated with a small density of low productive firms. This result suggests that relative price changes may have only a weak effect on exports in mature European economies.

A short version of this work is available in our blog.