- Home

- Publications and statistics

- Publications

- The euro area welcomes its 20th member, ...

Post n°297. Ten years after joining the European Union, Croatia will adopt the euro on 1 January 2023, thus becoming the 20th member of the euro area after Lithuania. The adoption of the euro, which is achieved by complying with the convergence criteria, will reduce the exchange rate risk. Lower transaction and financing costs will strengthen trade and financial integration, thereby promoting real convergence.

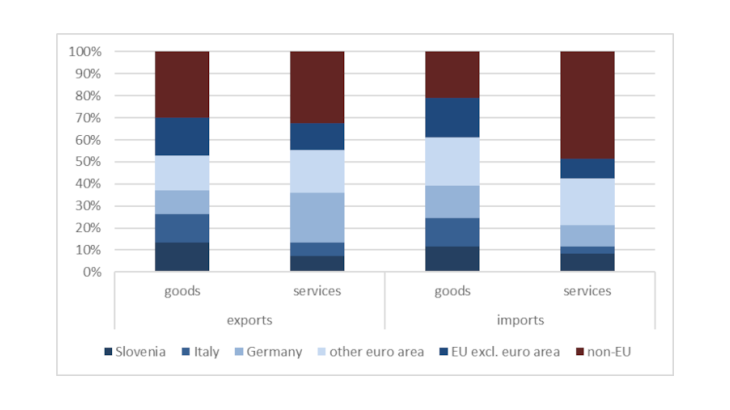

Source: Eurostat, balance of payments.

Note: trade flows broken down by partner country and product. Croatian exports of goods to Germany account for 11% of its total exports of goods.

Croatia is highly integrated commercially with the EU, of which it has been a member since 2013

Croatia conducts more than two-thirds of its foreign trade with the European Union (EU). Since joining the EU, this share has increased in both exports and imports. Thus, in 2021, 69% of Croatia’s exports of goods were to the EU, up from 57% in 2012, and 74% of its imports of goods were from the EU, up from 61% in 2012 (customs data).

The Croatian economy is now more EU-oriented than the rest of the Member States, which on average carry out 61% of both exports and imports of goods and services with the EU. Its situation is comparable to that in the central and eastern European EU Member States (71% and 70% respectively), although these countries joined the EU earlier, between 2004 and 2007.

Croatia's main trading partners are thus Germany (17% of exports of goods and services, Chart 1), Slovenia (11%), and Italy (10%), followed by Bosnia-Herzegovina (9%) and Serbia (5%).

Croatia's external financial transactions are mainly conducted with the euro area. Thus, at the end of 2021, euro area residents held 72% of the stock of foreign direct investment in Croatia and 58% of the stock of Croatian securities liabilities, which represent 45% and 12% of Croatian GDP, respectively. Croatia's holdings in the euro area are smaller (37% of the stock of outward direct investment and 36% of Croatian foreign securities holdings in 2021), but have been rising since 2013.

Adopting the euro is achieved by complying with the nominal convergence criteria

Following the EU Council decision of 12 July 2022, Croatia will join the euro area on 1 January 2023, becoming its twentieth member after Lithuania in 2015. The convergence reports of the European Commission and the ECB attest to Croatia's compliance with the legislative and economic convergence criteria required to adopt the euro.

Croatia has achieved a high degree of price stability, the path of public finances is considered sustainable (in 2021, government deficit and debt stood at 2.6% and 78.4% of GDP, respectively), and the low level of long-term interest rates suggests that convergence is sustainable.

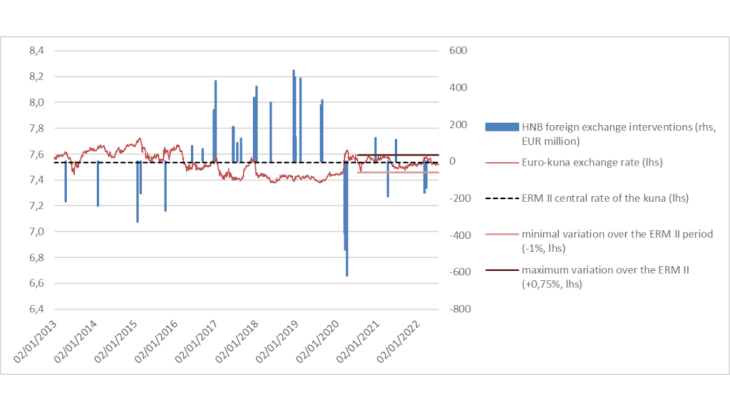

In addition, the exchange rate of the kuna against the euro is relatively stable (Chart 2): since Croatia joined the European Exchange Rate Mechanism (ERM II) in July 2020, the kuna has fluctuated by +/-1% around the central rate, well within the authorised fluctuation band of +/- 15%.

Sources: ECB and HNB.

Note: A positive sign corresponds to a purchase on the foreign exchange market by the HNB in order to trigger an appreciation of the kuna, a negative sign to sales in order to trigger a depreciation.

Croatia also meets the legislative criteria: its central bank is independent and its national legislation is in line with the European treaties and the ESCB and European Commission statutes. In addition, in 2020, Croatia stepped up its cooperation with the ECB in the supervision of its banking institutions.

However, the ECB's 2022 convergence report and Moneyval (the Council of Europe's anti-money laundering body) highlight the progress that needs to be made in the fight against money laundering and the need to improve the quality of institutions and governance.

Adopting the euro will lower transaction and financing costs

The use of the euro is already widespread in economic and financial transactions. In 2018, close to 80% of Croatian goods exports and 75% of imports were denominated in euros (Boz et al., 2020). This will facilitate the adoption of the euro. It will reduce the transaction costs and uncertainty associated with exchange rate fluctuations.

The adoption of the euro will also reduce a factor of vulnerability for the Croatian banking sector, which the ECB and the IMF consider to be well capitalised: the exposure of the public and private sectors to exchange rate risk. According to the European Commission, 45% of household debt and 65% of corporate debt is denominated in foreign currencies, mainly euros. Furthermore, according to the Croatian National Bank (HNB), at the end of 2021, 71% of Croatian public debt was denominated in euros. Eliminating foreign exchange risk on public debt will not only increase the resilience of public finances, but will also benefit the Croatian banking sector, with 20% of its assets exposed to sovereign risk according to the HNB.

Adopting the euro will promote real convergence of the Croatian economy

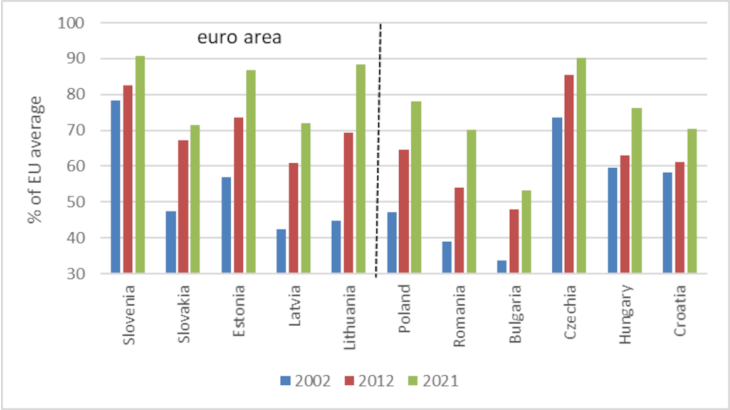

Over the past decade, Croatia has experienced a significant improvement in living standards, both in absolute and relative terms. GDP per capita has grown by an average of 2.5% per year, compared with 1.1% in the EU. Expressed in purchasing power parity terms, Croatia's GDP per capita increased from 61% of the EU average in 2012 to 71% in 2021 (Chart 3).

Sources: World Bank and authors’ calculations.

However, a number of challenges remain in terms of convergence of living standards and economic structures. The tourism sector accounts for close to 20% of Croatian GDP. According to European Commission and IMF estimates, potential growth is low due in part to a pronounced demographic decline, accentuated by the brain drain to the EU, which is also occurring in most other central and eastern European countries since joining the EU. Employment rates and productivity are low.

Transfers of funds between European states are therefore crucial to completing real convergence and raising the growth potential of the new Member States. Over the period 2014-2020, Croatia has benefited from close to EUR 12 billion in European structural and investment funds, i.e. the equivalent of 4% of GDP per year over the period 2014-2020 and 91% of public investment according to the European Commission.

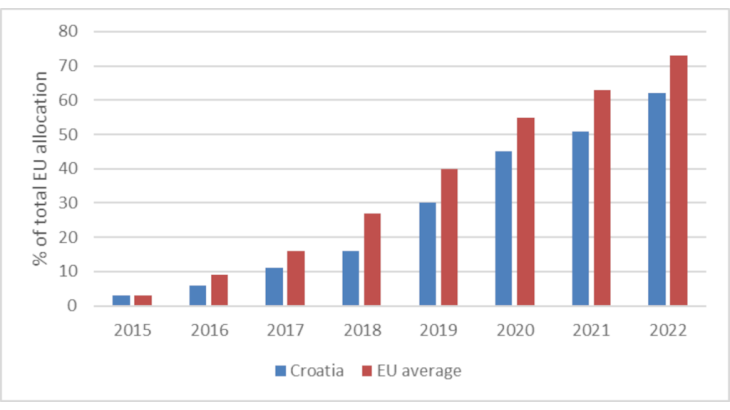

Croatia will also benefit from significant amounts of funding over the next five years. In particular, EU funds and the National Recovery and Resilience Plan are expected to lead to significant reforms in the Croatian economy. The Recovery and Resilience Plan (including EUR 6.3 billion in subsidies until the end of 2026, an amount equivalent to 11% of Croatia's 2021 GDP) and the EU structural and investment funds (EUR 9.1 billion over the period 2021-2027) represent the equivalent of more than 25% of Croatia's GDP in 2021. In this context, the absorption capacity of European funds is crucial. While in the past this was below the EU average (Chart 4), the IMF notes progress and commends the efforts made in the area of public investment management.

Joining the euro area will thus help speed up the convergence of living standards and of the economic structure of the Croatian economy, which is already highly integrated with the economies of the euro area.

Source: European Commission.

Note: Cumulative payments at the end of each year under the European structural and investment funds for the period 2014-2020 as percentages of the total allocation. Data updated on 28 November 2022.

Updated on the 25th of July 2024