Exporting to some destinations entails an exposure of the exporter to foreign exchange risk. For instance, when selling goods to the United States, European firms overwhelmingly receive payments in US dollars instead of euros. Setting the price of its exports in the currency of the importer exposes the firm to a currency mismatch, when the export revenues are denominated in US dollars while the debt raised to fund working capital is denominated in euros. This problem is exacerbated by the long payment delays typical of international trade transactions. A common hedging practice in such a case is for the exporter to borrow today the value of its future export revenues in the importer's currency (or to purchase hedging derivative contracts) from a bank. The success of such a strategy then crucially depends on the capacity of the exporter's bank to grant foreign currency funding at a reasonable price. In times of stress in the foreign exchange market, the ability of exporting firms to find foreign currency financing may therefore be constrained, which adds a financial trade cost to other trade costs such as foreign tariffs or transportation. Accordingly, the ability of the domestic financial system to smoothly provide exporters with the foreign currency they need to fund their activity may prove an important contribution to the country's competitiveness.

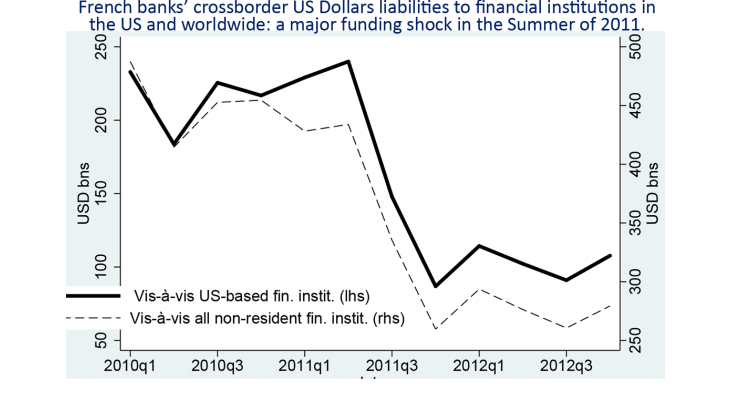

In this paper, we show that shocks increasing exporters' cost of foreign currency funding negatively affect their export performance. Our analysis exploits a large exogenous shock to the cost of US dollar funding faced by French banks and their domestic customers in the second half of 2011. As the euro crisis escalated in 2011, US money market funds started to worry about the creditworthiness of European banking groups. As a consequence, they cut their dollar-denominated exposure to European banks across the board. Meanwhile, heightened tensions in the euro-dollar foreign exchange market materialized in sharp deviations from the covered interest parity. Overall, this resulted in an increased cost of dollar funding for European banks and their customers.

We investigate whether this dollar-specific funding shock affected the export performance of French firms to the United States, a market where most imports are priced in US dollars. In order to identify the effects of this shock, we construct an ex ante measure of French exporters' exposure to the 2011 US dollar funding shock using a unique dataset that merges disaggregated information on French banks' cross-border dollar liabilities with exhaustive data on bank-firm credit relationships and firms' exports. We find that more exposed firms reduced their exports to the United States in the twelve months that followed the shock. In the baseline specification, the point estimate shows that an increase in firm-level ex ante exposure to dollar funding by one standard deviation (2.52 percentage points) is associated with a reduction in exports to the United States by 3.6 percent relative to other destinations. The effect of the dollar funding shock proves to be strongly non-linear, as firms in the top 33% of the exposure distribution react about 9 times more than firms in the bottom third. Furthermore, we show that the US dollar funding shock reduced the survival probability of French exporters in the US market. Note that this impact is economically non-negligible: according to our computations, the average impact of this heightened, destination-specific, financial trade cost on French exports to the US is indeed akin to the effect of a counterfactual rise in US tariffs by 2 to 5 percentage points.