Does the leverage ratio have an adverse impact on client clearing?

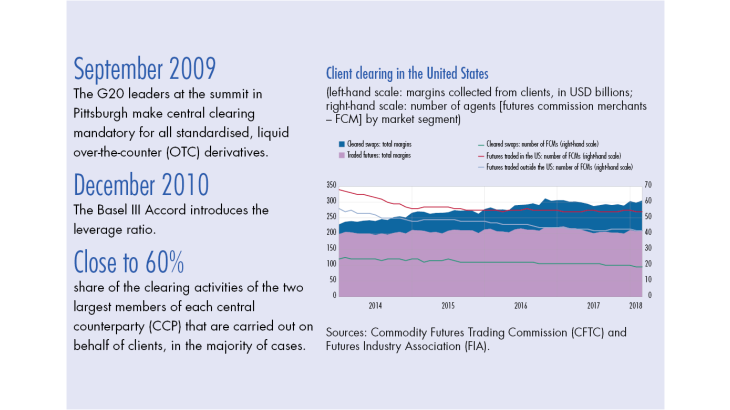

Bulletin n°218, article. In the wake of the 2008 global financial crisis, the members of the G20 agreed to increase incentives for central clearing in order to mitigate counterparty risk in the financial system. In the past few years, however, tensions have started to appear in the client clearing market. One reason often cited for this is the introduction of the leverage ratio, as the measure does not take into account the initial margins collected by clearing members from their clients as part of derivative transactions. While this failure to recognise initial margins is consistent with the objective of the leverage ratio – to provide a non-risk based measure as a backstop to the solvency ratio – penalising client clearing activities poses risks to financial stability that warrant further analysis.